Last updated on: June 17, 2025

The town of Madurai has a rich legacy in Tamil Nadu being both established as a religious landmarks and being a harbinger of ancient traditions. The healthcare center in Madurai is gaining traction because of its state-of-the-art medical facilities together with their modern infrastructure. Madurai’s medical reputation has surged due to the establishment of hospitals such as Meenakshi Mission and Velammal Medical College and Apollo Speciality. Medical expenses continue to rise along with unforeseen health emergencies so health insurance in Madurai functions as a necessity instead of being perceived as a luxury

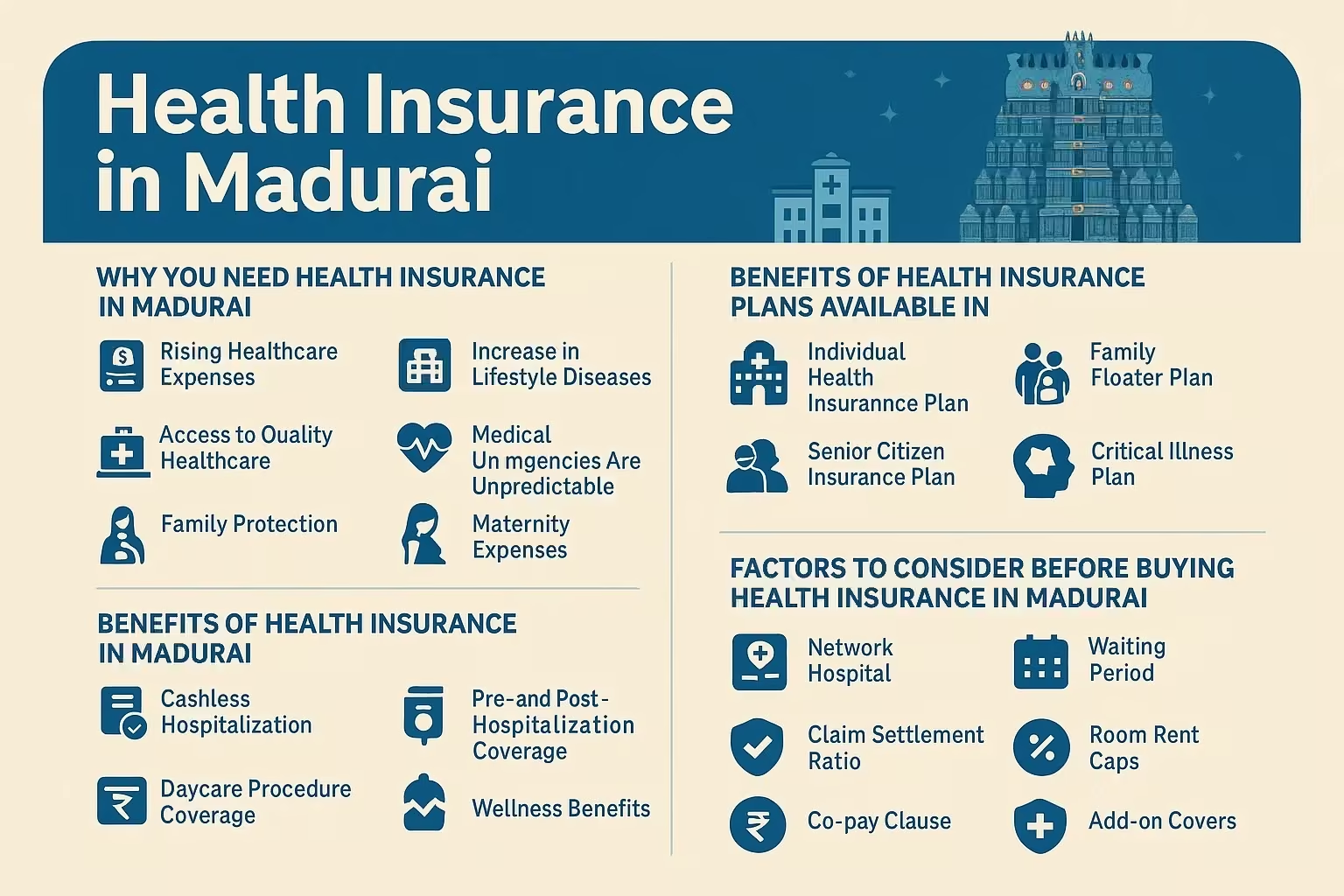

1. Rising Healthcare Expenses: Medical costs have surged to such heights that even basic medical treatments are now expensive to access. Your hospital stay to cure a viral fever may require you to spend thousands of rupees. Medical operations and long-term illness maintenance can reach amounts exceeding one lakh rupees. When you do not have health insurance coverage hospital expenses can destroy your savings.

2. Increase in Lifestyle Diseases: With urbanization comes sedentary living. People tend to develop diabetes alongside hypertension and heart conditions alongside obesity-related medical conditions that are becoming increasingly prevalent. One of the main benefits of health insurance is that it helps families cover expenses for extended medical treatments.

3. Access to Quality Healthcare: Hospital and diagnostic facilities operating at the highest levels provide sophisticated treatment to individuals in Madurai. Medical protection through insurance empowers you to reject subpar medical services because of monetary hardships.

4. Medical Emergencies Are Unpredictable: Health emergencies including diseases and accidents occur without notice. Health insurance comes as a saviour during such circumstances

5. Family Protection: Health insurance provides coverage to every family member from children to senior adults and spouses along with protecting you financially

6. Maternity expenses: There are plans that cover delivery expenses and prenatal and postnatal medical care as well as the newborn baby’s first medical costs.

1. Cashless Hospitalization: Leading hospitals from Madurai have working partnership with many insurance providers. You don’t have to pay upfront for treatments; Insurance payments go directly from your provider to the hospital during your admission without requiring any instalments.

2. Pre and Post-Hospitalization Coverage: The plans support pre-hospitalization charges and post hospitalization charges upto 90 days

3. Daycare Procedure Coverage: Insurance covers daycare procedures such as cataract surgery and chemotherapy that do not require need hospital admission overnight.

4. Tax Benefits: You can get both benefits of tax savings and healthcare protection through Section 80D of the Income Tax Act.

5. Wellness Benefits: The Top-Up & Super Top-Up plans let your existing coverage continue beyond the base policy limit. This supplements your standard health plan at reasonable costs.

Select an ideal sum insured that matches half of your current annual income. Individuals who bring home Rs. 15 lakhs as annual income need health insurance coverage starting at Rs. 7.5 lakhs. A room rent limit could lead you to share or select a lower-room category option. So, it is advised to plan accordingly. A family policy starting at Rs. 10 to Rs. 15 lakhs provides the best coverage for families with children or elderly dependents. The treatment costs for senior citizens are higher so a Rs. 5–10 lakh cover may be the most suitable option.

1. Individual Health Insurance Plan: The individual health insurance plan serves working professionals who are unmarried. It covers only one person. Each insured individual gets their own policy under this product selection.

2. Family Floater Plan: Under Family Floater Insurance Plans, policyholders pay one premium to receive one sum insured that protects multiple members. This insurance type serves young households along with their children and parents who need financial support.

3. Senior Citizen Insurance Plan: The insurance plans designed specifically for senior citizens who meet the age requirement of 60 and above. Review all details in the paperwork because hidden expenses can occur without warning.

4. Critical Illness Plan: Critical Illness Plans pay a complete lump sum to policyholders after diagnosed with serious conditions involving cancer, stroke, or organ failure. The assistance offered by these plans functions to help individuals throughout their recovery phases when they face medical costs and loss of income.Decide on insurance by evaluating your specific needs that stem from your age and lifestyle as well as family situation.

5. Maternity Cover: A healthcare insurance specifically designed for expectant mothers features as the ideal solution for new couples. Dedicate your time to identify your needs properly before evaluating options to create an informed decision. Normally, group health insurance for employees covers maternity expenses. If not, you would need to buy it separately.

1. Network Hospital: You should select health insurance from a provider that maintains solid hospital partnerships in Madurai. Hospitals having wider network coverage allow easier access to cashless services.

2. Claim settlement ratio: You should buy insurance from companies that have demonstrated a track record of effectively handling claims. You gain confidence knowing your claims will be processed without complications.

3. Waiting Period: You should understand the waiting duration for health coverage if you want to benefit from diabetes or asthma coverage or other medical conditions. Review insurance options which offer brief waiting periods when claiming benefits.

4. Room Rent Caps: Room rent caps exist in some plans to restrict your accommodation options. Your insurance coverage might force you to move into less expensive accommodation or have unwanted roommates.

5. Co-pay clause: Medical insurance plans impose Sub-Limits and Co-payments that restrict coverage of various medical expenses such as surgeries and diagnostic tests and visits to doctors. Reading through the policy specifics will help you avoid unexpected extra fees that you may have to pay.

6. Add-on covers: Cheapest premiums may not mean you are getting maximum benefits. Your policy selection should consist of reading coverages alongside exclusions together with evaluation of add-on riders.

7. Portability: Policy portability through other insurance providers should enable you to maintain all accumulated benefits when switching insurers.

1. Select a medical facility that exists in the insurer’s approved network of healthcare organizations.

2. You must show your insurance health card together with your valid identification documents when being admitted.

3. Your insurer will collaborate with the hospital for pre-authorization procedures.

4. The insurer will make direct payments to the hospital after obtaining approval.

5. Upon hospital discharge verify that your insurance policy included coverage for everything provided in your bill.

Non-network hospital treatment requires upfront payment followed by reimbursement through the submission of hospital bills and reports.

Real-Life Scenario: A 38-year-old school teacher named Janaki purchased an individual policy through Fincover which provided coverage worth Rs. 3 lakhs. The medical insurance provided only reimbursed 60% of the hospitalization expenses when his husband needed treatment for his liver issue. She then secured coverage under a family floater policy which provided Rs. 10 lakhs worth of protection. Make decisions by learning from cases like Janaki’s and plan your insurance strategies early on.

What’s the ideal health insurance amount in Madurai?

To achieve minimal coverage protection, persons should obtain a medical plan for at least Rs. 5 lakhs. A family should consider purchasing health insurance in the range of Rs. 10-15 lakhs.

Can I include my elderly parents in the same plan?

Separate senior citizen plans offer better insurance benefits than including them under your family floater coverage because family premiums normally increase when you add them.

Are pre-existing diseases covered from day one?

No. Polices typically require 2-4 years of waiting time before covering pre-existing diseases.

Do health plans cover COVID-19 and future pandemics?

Yes. Current health policies offer COVID-19 protection alongside future epidemic coverage with specific conditions.

Can I pay monthly premiums instead of annually?

Numerous insurance providers currently provide payment flexibility through monthly and quarterly arrangements for their policyholders.

Can NRIs buy insurance for their parents in Madurai?

Absolutely. Indian residents outside the country can use online facilities provided by insurance providers to buy and renew health coverage for their parents who live in India.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).