IndusInd Bank Credit Cards 2024 & Get Instant Approval

Unlock rewards & experiences with IndusInd Bank Credit Cards! Explore Lifestyle, Rewards, Co-Branded & Fuel cards. Find the perfect fit for your needs. Apply online instantly!

- Lifetime Free Cards

- Compare Best Offers

- Completely Digital Process

BESTSELLING IndusInd Bank Credit Cards

IndusInd Bank Platinum RuPay Credit Card

Benefits

- UPI payments: Link your card to your UPI account for convenient and rewarding transactions

- Lifetime free card (NO ANNUAL & NO JOINING fee)

- 2X reward points on every ₹100 spent through UPI: This is the card’s most significant benefit, making it attractive for frequent UPI users

- Fuel surcharge waiver: Get 1% discount on fuel surcharge across all petrol pumps in India for transactions between ₹400 and ₹4,000

- Air accident insurance cover of up to INR 25 lakh

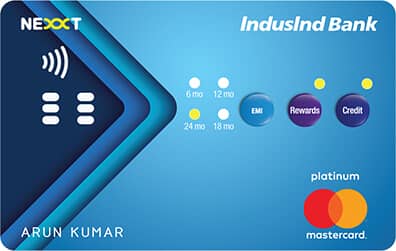

IndusInd bank Nexxt Credit Card

Benefits

- Get 1 reward point for every ₹ 150 spent on your IndusInd Bank Nexxt Credit Card. The value of 1 reward point is Rs. 1. Aside from this, the rewards can be converted into airmiles in 1:1 ratio

- Enjoy a leisurely stay at one of the best Oberoi Hotels, Choose from exquisite collection of Montblac watches, Access to premium brands with Luxe Gift Card, Discounts from multiple brands like amazon, Flipkart, Zee5, Uber, and Ola

- IndusInd has tied up with ICICI Lombard to provide travel insurance to the Nexxt Credit Card holders

IndusInd Platinum Aura Edge credit card

Benefits

- Upto 4x Reward Points on every Rs. 100 Spent

- Discount vouchers from multiple brands like Amazon, Flipkart, Big Bazaar, Zee5, Apollo Pharmacy, Uber, Ola etc

- Travel insurance from ICICI Lombard that covers baggage loss upto Rs. 1 Lakh

- 1%* waiver on all petrol pumps across India.

- Total Protect plan to ensure complete safety, coverage against unauthorized transactions in the card

- complimentary personal air accident insurance cover of up to Rs. 25 lakhs

IndusInd bank Legend Credit Card

Benefits

- Complimentary stay at Oberoi Hotel

- Waiver on Foreign currency markup

- Access to 600+ lounges all over the world

- Buy one get one offer on BookMy Show. Avail upto three tickets per month

- Concierge services during a trip like pre-trip assistance, hotel reservation, flight booking, exclusive booking

- Insurance covers up to 48 hours before reporting the loss of your card

- Get discount vouchers from multiple brands like Amazon, ALDO, Benetton, Flipkart, Zee5

IndusInd Platinum Visa Credit Card

Benefits

- Welcome Benefits from Montblac, a luxury accessories brand, Luxe Gift Card, Complimentary stay in the PostCard Hotel

- Discount vouchers from Amazon, Flipkart, Zee5, Uber, Ola, Pantaloons, Bata, Raymond, etc

- Travel Insurance from ICICI Lombard

- waiver* of 1% on fuel surcharge at any petrol station within India

- Total Protect cover to prevent fraudulent usage of your credit card

- complimentary personal air accident insurance cover of up to Rs. 25 lakhs

IndusInd Platinum Master Credit Card

Benefits

- Upto 4x Reward Points on every Rs. 100 Spent

- Discount vouchers from multiple brands like Amazon, Flipkart, Big Bazaar, Zee5, Apollo Pharmacy, Uber, Ola etc

- Travel insurance from ICICI Lombard that covers baggage loss upto Rs. 1 Lakh

- 1%* waiver on all petrol pumps across India.

- Total Protect plan to ensure complete safety, coverage against unauthorized transactions in the card

- complimentary personal air accident insurance cover of up to Rs. 25 lakhs

EazyDiner Indusind Credit Card

Benefits

- 25% OFF upto ₹1000 everytime you eat out and order on app via PayEasy.

- Two complimentary domestic airport lounge stay with gourmet meals

- Complimentary movie tickets worth Rs. 200 every month on BookMyShow

- 1% fuel surcharge waiver* across all fuel stations

- Total Protect feature that covers you for an amount equal to the credit limit of your card

IndusInd Bank Pinnacle World Credit Card

Benefits

- 5 points for every 100 spent for e-comm transactions and 1.5 points for E-commerce travel and airline transactions

- 4 Complimentary golf lessons once a month at prestigious clubs

- Buy one get one free on movie tickets

- Insurance cover up to 48 hours for theft of cards

- Air Accident cover of up to Rs. 25 Lakhs

- 24×7 concierge service offers like flight booking, hotel reservation, flowers and gifts

IndusInd Bank Avois Visa Infinite Credit Card

Benefits

- 5X Avios on every INR 200 spent and enjoy discounted forex mark-up of 1.5%

- Two complimentary meet-and-greet services

- Earn milestone benefits of up to 50,000 bonus Avios in a year

- Redeem your Avios for flight tickets, hotel stays, and car rentals

- 25% on retail rates on Airport Fast Track immigration (Visa)

Indusind Bank, established in 1994, has emerged as a leading financial institution in India, offering diverse financial products and services. Among these, their credit cards have gained significant popularity, catering to various customer segments and lifestyles. This comprehensive guide delves into the world of IndusInd credit cards, providing valuable information to aid your decision-making.

Benefits of IndusInd Credit Card

Beyond card types, Indusind credit cards come packed with enticing benefits:

- Reward Programs: Earn cashback, points, miles, or air miles depending on your chosen card, redeemable for various rewards.

- Travel Benefits: Enjoy airport lounge access, travel insurance, and partner airline offers with travel-focused cards.

- Lifestyle Privileges: Get discounts and exclusive offers on dining, entertainment, and shopping with partner merchants.

- Fuel Surcharge Waivers: Save on fuel expenses with specific cards offering waivers on fuel surcharges.

- Emergency Assistance: Access emergency cash advances, card replacement services, and lost card reporting assistance.

Types of IndusInd Credit Card

Indusind boasts a diverse range of credit cards covering diverse spending habits and aspirations. Here’s a glimpse into their key offerings:

- Lifestyle Cards: Indulge in premium experiences with cards like Legend, Club Vistara, and Platinum Travel, offering rewards on dining, travel, and entertainment.

- Rewards Cards: Maximize your purchases with cashback or points-based cards like NexWave, Pulse, and Easy Miles, ideal for everyday spending.

- Co-Branded Cards: Enjoy exclusive benefits through partnerships with airlines, hotels, and retail brands like Jet Airways IndusInd Premier, Yatra IndusInd Signature, and Flipkart IndusInd Credit Card.

- Fuel Credit Cards: Drive on savings with cards like IndusInd Zomato Petro Card and IndusInd Amex Axis Cards, offering fuel surcharge waivers and cashback on fuel purchases.

IndusInd Credit Card Interest Rates and Charges

| Card Type | Annual Fee (₹) | Interest Rate (% per month) | Cash Advance Fee (%) | Late Payment Fee (₹) |

|---|---|---|---|---|

| Lifestyle Cards | 3,999 – 12,500 | 3.83 – 4.00 | 2.99 – 3.50 | 500 – 1,000 |

| Rewards Cards | 0 – 3,999 | 3.83 – 4.00 | 2.99 – 3.50 | 500 – 1,000 |

| Co-Branded Cards | 0 – 5,000 | 3.83 – 4.00 | 2.99 – 3.50 | 500 – 1,000 |

| Fuel Cards | 0 – 2,499 | 3.83 – 4.00 | 2.99 – 3.50 | 500 – 1,000 |

IndusInd bank Credit Card Eligibility

| Card Type | Minimum Age | Minimum Income | Minimum Credit Score |

|---|---|---|---|

| Lifestyle Cards | 18 years | ₹25,000/month | 750+ |

| Rewards Cards | 21 years | ₹20,000/month | 650+ |

| Co-Branded Cards | 18/21 years (varies) | Varies based on partner | 700+ |

| Fuel Cards | 18 years | ₹20,000/month | 700+ |

Documents Required for IndusInd Credit Cards

| Card Type | Mandatory Documents | Optional Documents |

|---|---|---|

| All Cards | - Photo ID (Passport, Aadhaar Card, PAN Card) - Address Proof (Utility Bills, Bank Statements) - Income Proof (Salary Slips, ITR) | - Employer Details (for salaried) - Business Proof (for self-employed) |

| Lifestyle Cards | - High income proof (typically above ₹10 lakhs annually) | - Investment proofs (Mutual funds, stocks) |

| Rewards Cards | - Consistent income flow | - Past credit card statements (if any) |

| Co-Branded Cards | - May require additional documents specific to the partner (e.g., Jet Airways membership) | - None |

| Fuel Cards | - Regular fuel consumption history (optional) | - None |

How to Apply for IndusInd Bank Credit Cards at Fincover?

Follow these simple steps to apply for an IndusInd Bank credit card through Fincover:

- Log onto Fincover.com

- Navigate to the “Loans & Deposits” tab and click on “Banking Products” to select “Credit Cards”

- Enter the required information such as income, employment, and credit score details

- View personalized credit card options from IndusInd Bank and other leading banks

- Compare and analyze features like rewards, interest rates, and annual fees

- Apply for the card that best suits your financial needs

- Upload the necessary documents – your application will be forwarded to the bank, and a representative will contact you for verification and further steps