Last updated on: September 19, 2025

As the financial heart of India, Mumbai is popular for its busy lifestyle, successful businesses, and first-rate hospitals. Among its most famous hospitals are Tata Memorial Hospital, Kokilaben Dhirubhai Ambani Hospital, Breach Candy Hospital, and Lilavati Hospital. Being in Mumbai, the cost of healthcare is extremely high, making it important to get health insurance. Having health insurance is important for everyone, since it gives you coverage in case of unexpected medical expenses and allows you to focus on treatment.

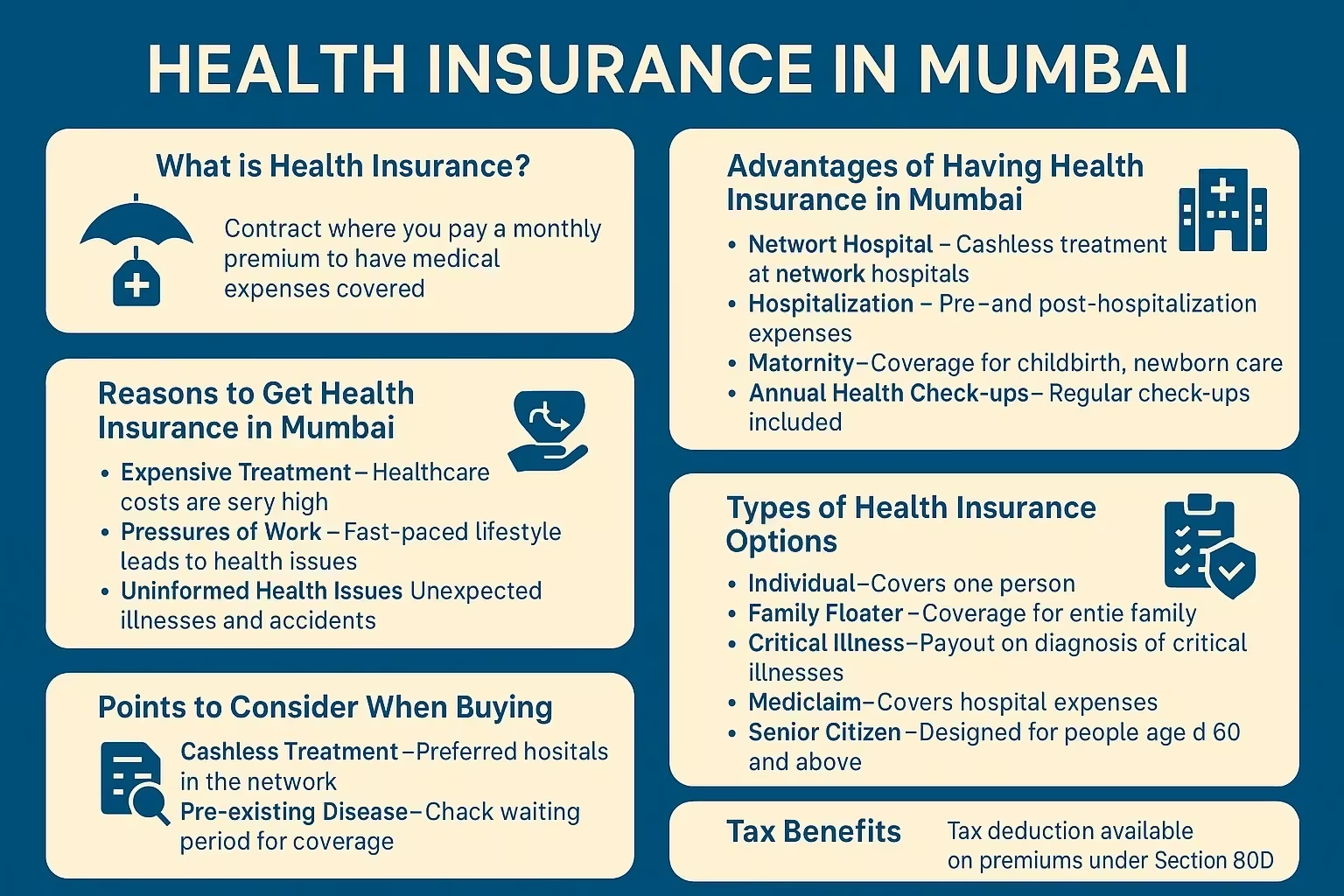

A health insurance contract is when you pay a monthly premium to get medical bills covered. Hospital bills, medical procedures, costs for seeing a doctor, tests, and sometimes health screenings are usually included in the plan. With health insurance, you can access medical services without worrying about the cost to you.

Expensive Treatment - While Mumbai’s health care is excellent, it can be very expensive. Treatment for a critical illness in the hospital can cost up to lakhs, so having health insurance is a good idea.

Pressures of Work – Mumbai’s fast work life, hectic commutes, and high stress make many people prone to lifestyle diseases. It helps pay for the treatment that might be needed for a long time.

Uninformed health issues - Unexpected sickness, accidents, and operations can cause major financial pressure. If you have health insurance, you can receive medical attention without fear of costs.

Daycare - Mumbai is known for having top-notch hospitals offering quality procedures that can be very expensive. Health insurance can pay for surgery, chemotherapy, and transplantation, which are the main high-price treatments.

Tax deduction - You may claim a tax deduction for health insurance premiums under Section 80D of the Income Tax Act.

Did You Know : Wellness benefits, such as gym memberships and counseling for diet and mental health, are offered by many insurers to keep you in good shape.

Network Hospital - You can be admitted and treated without money at any network hospital in Mumbai.

Pre-and Post Hospitalization - Many policies cover medical expenses that occur 30-60 days before and 60-90 days after hospitalization.

Daycare - Today, medical procedures such as cataract surgery, chemotherapy, and dialysis are covered, and patients don’t have to be admitted to the hospital afterwards.

Maternity - Some policies pay for childbirth, newborn care, and vaccination treatments.

No-Claim Bonus - Earn extra coverage or a lower premium by not filing a claim in a policy period

Annual Health Check-ups - Having your health checked regularly is often a feature in many policies.

Pro Tip: Be sure to find hospital insurance without sub-limits on room rent so you do not have to pay extra from your own pocket if you’re hospitalized.

You should get a health insurance plan that is at least half of your yearly income. That means if you earn an annual income of 15 lakhs, you should have minimum health insurance coverage of 7.5 lakhs. Considering the cost of healthcare in Mumbai, it’s best to buy more insurance coverage, especially if you have a family or currently have critical illnesses.

Expert Insight: Alternatively, you might want to look into add-ons such as critical illness cover or restoration benefits that will help you get more cover if your claim has used up the initial sum insured.

Individual Health Insurance - Covers just one person, best for people who are working or don’t have a family.

Family Floater Plans – Enables the entire family to be covered by a single sum insured.

Critical Illness Insurance – Gives you a lump sum payment when you are diagnosed with a serious, possibly fatal, illness like cancer or stroke.

Mediclaim - These are regular plans that only provide coverage for hospital expenses, up to an agreed limit.

Senior Citizen Health Insurance - Designed for people 60 and above with better protection and benefits related to age.

Top-Up and Super Top-Up Plans - These help you by providing extra coverage if your main insurance amount is used up

Did You Know : You can get better health insurance coverage at lower costs by adding top-up plans to your plan.

Cashless Treatment - Make sure the hospitals included in your insurer’s cashless network are ones you prefer.

Pre-existing disease - Learn about the condition for pre-existing diseases, which often takes 2-4 years before coverage kicks in.

Room Rent Charges - Depending on the plan, you may see limit on your room rent.

Co-payment - Some plans list Co-Payment Clauses that require you to cover some of the cost yourself.

Lifetime Renewability - Go for plans that ensure lifetime renewability so you can continue having coverage in your later years.

Claim Settlement - Select insurance companies that have a good history of settling claims.

Add-ons - Look into maternity cover, personal accident cover, or OPD benefits to get more protection.

Pro Tip : Look at the details in your policy to see what is included and what isn’t.

Network Hospital - Verify that your hospital belongs to your network for hassle-free treatment.

Bring Your Health Card - Put your insurance card on the desk at the hospital insurance office

Pre-approval - Prior to your visit, the hospital will submit a request for pre-approval to your insurer.

Receive Care - If you are accepted, you can get care without covering the costs yourself

Bill Payment - The insurer makes payment to the hospital for your claim, as per your insurance policy

Expert Insight : It’s useful to have both a digital and physical version of your health and insurance cards in case something unexpected happens.

Review - Take your age, family members, health records, and lifestyle into account when picking a health plan.

Compare - Visit websites like Fincover to look at different plans and compare them.

Read Reviews - See what others have said about how claims are handled, how helpful customer service is, and the overall service provided

Get Guidance - Contact insurance advisors for guidance on which policy suits you best

Review your policy Yearly - Make it a habit to review and modify your health insurance policy each year

How does critical illness insurance differ from regular health insurance in Mumbai?

Critical illness insurance pays you a large amount if you are diagnosed with a particular critical illness, while regular health insurance helps cover your day-to-day medical costs.

Can my parents be covered by my family health insurance plan in Mumbai?

Yes, most family floater plans let you cover your parents, but make sure their age and health are taken into account for strong coverage.

Is day care covered by health insurance plans in Mumbai?

Most current health plans pay for many types of day care that do not involve staying in the hospital.

Is it possible to get maternity benefits after waiting a period in Mumbai’s health insurance plans?

Usually, people have to wait 2 to 4 years before they can use their maternity plan, so planning ahead is necessary.

Is it possible to get cashless health treatment in places outside Mumbai using my insurance policy?

Yes, most insurance plans let policyholders receive treatments at network hospitals on a cashless basis in India.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).