Last updated on: September 19, 2025

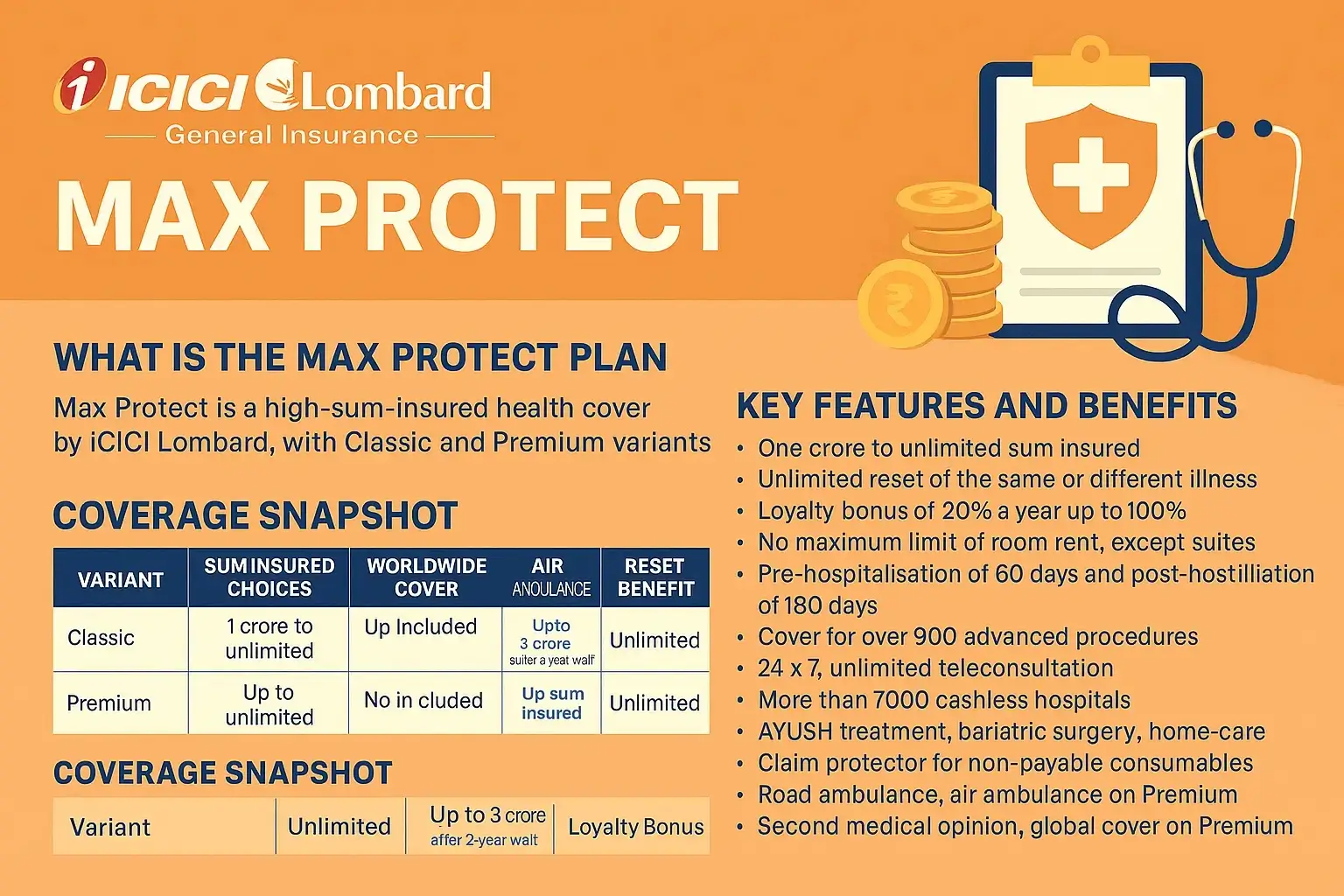

ICICI Lombard Max Protect is a high-value health insurance plan offering coverage from ₹1 crore up to unlimited. Available in Classic and Premium variants, it includes unlimited reset benefits, no room rent cap (except suites), and a wide cashless network of over 7000 hospitals. The Premium plan adds global treatment and air ambulance benefits after a 2-year waiting period. It covers advanced procedures like robotic surgery and chemotherapy, offers annual health check-ups, teleconsultations, and a loyalty bonus that increases your sum insured annually. Waiting periods apply for pre-existing conditions and certain treatments, but a PED waiver add-on is available

ICICI Lombard Max Protect is crafted to ensure that one does not have to worry about a hospital bill ever again. It combines totally unlimited coverage, benefits include infinite reset, incentives, global care and no-hassle visits to any hospital. Have you ever seen health expenses and imagined yourself saying, I just hope my basic coverage is not going to be insufficient? Max Protect was created especially with you in mind.

Max Protect is a high-sum-insured health cover by ICICI Lombard. It has two versions Classic and Premium. They both begin at one crore and extend till unlimited cover. The Premium tier adds global coverages of medically transporting and flying air-ambulance, whereas Classic stays domestic and bony on the features. In any case, the plan gives priority to caps removal, expansion of access, and payment of healthy behaviour.

Pro tip Couples or young families tend to use their employer program on an everyday basis and add on

As a safety net without limits, Max Protect. The overall price remains well short of the price of purchasing an equally large base policy.

| Variant | Sum Insured Choices | Worldwide Cover | Air Ambulance | Reset Benefit | Loyalty Bonus |

|---|---|---|---|---|---|

| Classic | 1 crore to unlimited | Not included | Not included | Unlimited | 20 percent a year up to 100 percent |

| Premium | 1 crore to unlimited | Up to 3 crore after 2-year wait | Up to sum insured | Unlimited | 20 percent a year up to 100 percent |

Reset activates every time the cover is exhausted, restoring full amount so you no longer run short of protection throughout the year.

Adults aged between 21 years and 65 years, children aged between 91 days and 21 years under a family floater

Relationships included: spouse, children, parents, siblings, in-laws, grandparents and grandchildren

One, two or three year policy term options with ten and fifteen percent multi-year premium discounts

You can cancel, with a seven days written notice. In case there is no claim but there is coverage, a specified percentage of the unutilized premium is refunded by ICICI Lombard. Policies with periods exceeding one year are only refunded on complete future years in which risk coverage is not yet in effect. Refunds are made to your account in the course of ten business days.

Given the health and fitness awareness of Max Protect, purchasing this product via Fincover is a solid investment.

Real story Priya is a 40-year-old entrepreneur who had a simple five-lakh corporate plan, which she beefed up with a one-crore cover on Fincover and called it Max Protect Classic. Her premium cost her less than a family dinner a month. Six months later her father required a bypass surgery worth eight lakh. The corporate plan covered five lakh and Max Protect divided the rest of it, one lakh at that, and not a rupee came out of Priya wallet.

What is the greatest benefit of Max Protect to a normal policy

It gives you unlimited reset and very high sum insured so that you cannot run out of cover during a policy year, even after a series of costly treatments.

Is Premium usually much more expensive than Classic

The gap reduces with the increase in the sum insured. Premium covers global care and air ambulance, which is useful to individuals who live or travel outside of the country some of the time.

Is it possible to later upgrade to Premium?

Yes, you are able to change variants or increase your sum insured when you renew, but will be subject to underwriting and waiting periods on any new cover such as worldwide cover.

Is there a limit to room rent?

There is no capping of room rent on either variant except that you are not allowed to select a suite room as a default. This implies that you have the freedom to choose the private rooms at no additional charge.

What is the interaction between loyalty bonus and reset?

Loyalty bonus increases your base cover on being claim-free and reset replenishes used cover following a large claim. When claiming a bonus, then you keep the bonus you already got and the reset still recharges the base amount.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).