Last updated on: September 19, 2025

Health insurance for paralysis patients in India is crucial given the significant medical expenses associated with treatment and rehabilitation. Many Indian insurers offer policies that specifically cover critical illnesses, including paralysis, ensuring patients receive necessary medical attention without facing financial burdens. These policies often include inpatient care, hospitalization, and coverage for therapies and rehabilitation. However, coverage specifics, such as the waiting period, exclusions, and premium costs, can vary significantly between insurers. It’s vital for patients and their families to carefully assess different policies, considering the extent of coverage, claim procedures, and network hospitals. Government initiatives, such as the Ayushman Bharat scheme, also aim to provide financial assistance to those who cannot afford private insurance, enhancing accessibility to essential healthcare services for paralysis patients across the country.

Paralysis is a medical condition characterized by the loss of muscle function in part of your body and is often accompanied by a loss of feeling. In India, patients with paralysis face unique challenges, particularly when it comes to affording medical care and rehabilitation. Understanding health insurance options for paralysis patients is crucial for those affected and their families. This guide provides an in-depth look into the available insurance plans, coverage, eligibility, and more.

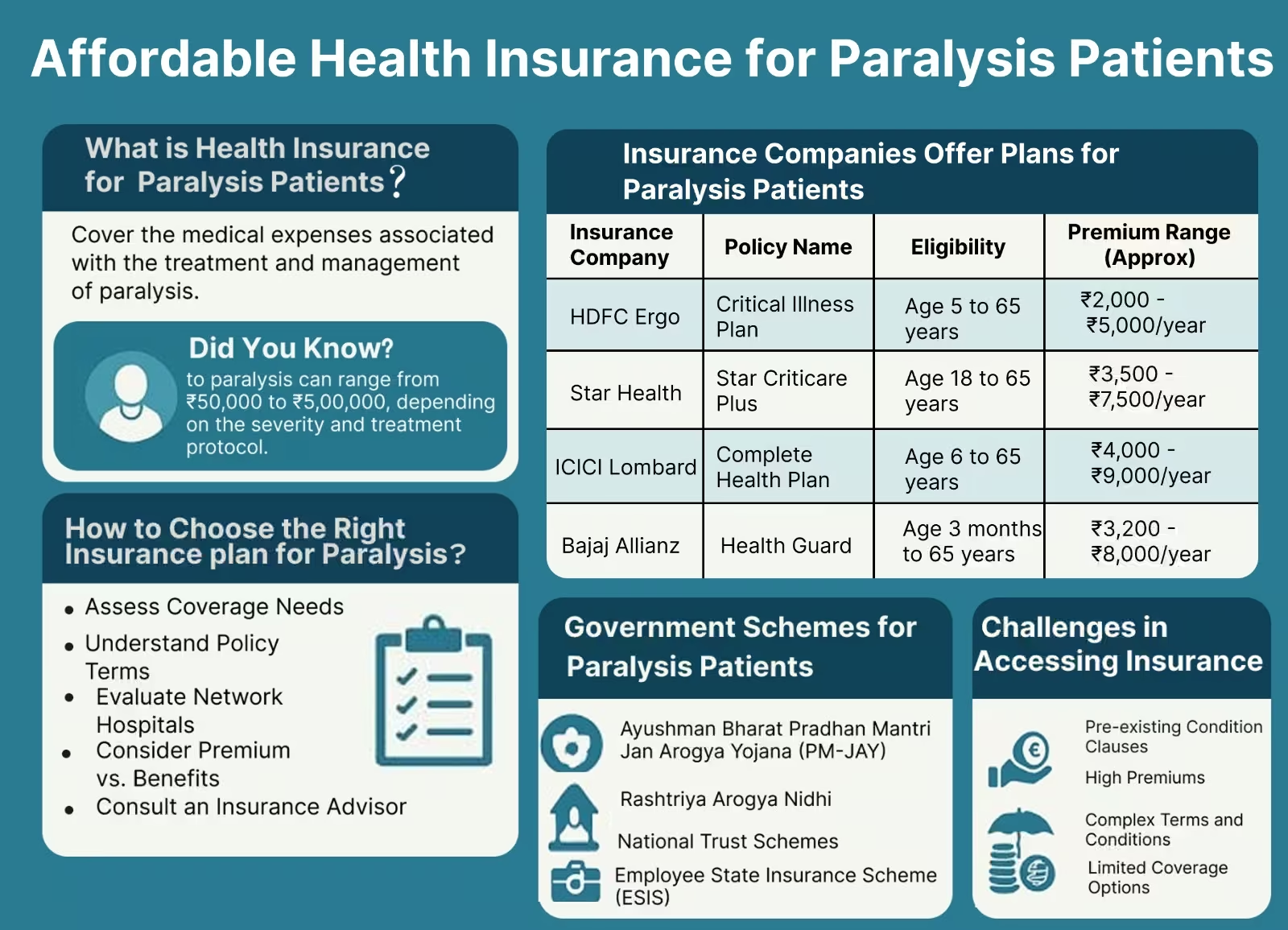

Health insurance for paralysis patients in India is designed to cover the medical expenses associated with the treatment and management of paralysis. This includes hospitalization, therapy, medication, and sometimes rehabilitation. Given the lifelong nature of paralysis, having appropriate insurance coverage can significantly reduce financial burdens on families.

Paralysis can result from various medical conditions, including stroke, spinal cord injury, and multiple sclerosis. The expenses for treatment can be overwhelming, with costs for surgeries, ongoing therapy, and assistive devices. Therefore, selecting the right insurance plan is vital for managing these costs effectively.

Did You Know?

According to the Indian Spinal Injuries Centre, nearly 20,000 new cases of spinal cord injuries are reported every year in India, many of which result in paralysis.

Several insurance companies in India offer plans that can cover paralysis. While there might not be specific policies labeled exclusively for paralysis, certain critical illness and disability insurance plans include paralysis as part of their coverage. Here are some notable companies and their offerings:

| Insurance Company | Policy Name | Coverage Highlights | Eligibility | Premium Range (Approx) |

|---|---|---|---|---|

| HDFC Ergo | Critical Illness Plan | Covers 15 critical illnesses including paralysis | Age 5 to 65 years | ₹2,000 - ₹5,000/year |

| Star Health | Star Criticare Plus | Provides lump sum on diagnosis of paralysis | Age 18 to 65 years | ₹3,500 - ₹7,500/year |

| ICICI Lombard | Complete Health Plan | Coverage for hospitalization and post-hospital care | Age 6 to 65 years | ₹4,000 - ₹9,000/year |

| Max Bupa | Health Companion | Comprehensive cover including rehabilitation | Age 18 to 65 years | ₹3,000 - ₹6,000/year |

| Bajaj Allianz | Health Guard | Wide coverage including pre-existing conditions | Age 3 months to 65 years | ₹3,200 - ₹8,000/year |

It’s crucial to compare different policies not just on the basis of premium but also on coverage specifics such as pre-existing condition clauses, waiting period, and the network of hospitals.

Choosing the right plan involves assessing your medical needs, financial situation, and understanding the terms of the policy. Here’s how to navigate this process:

Assess Coverage Needs: Determine the extent of coverage needed for hospitalization, medication, and therapy. Consider future needs like long-term rehabilitation.

Understand Policy Terms: Look into the waiting period, exclusions, and the claim process. Some policies might have a waiting period before paralysis is covered.

Evaluate Network Hospitals: Ensure that the insurance company has a good hospital network, including hospitals that specialize in treating paralysis.

Consider Premium vs. Benefits: A lower premium might mean less coverage. Balance the premium amount against the benefits offered.

Consult an Insurance Advisor: An advisor can provide insights into the best plans based on individual needs and financial constraints.

Pro Tip:

Always read the fine print of insurance documents. Be aware of terms like ‘sub-limits’ and ‘co-payments’ which can affect the total payout.

Understanding the key features of paralysis coverage helps in making an informed decision. Here are some critical aspects to consider:

According to a report by the National Health Portal of India, the average cost of stroke treatment leading to paralysis can range from ₹50,000 to ₹5,00,000, depending on the severity and treatment protocol.

Filing a claim can be a complex process, but understanding the steps involved can simplify it:

Expert Insights:

Keep a digital copy of all your documents. This makes it easier to submit them quickly and prevents loss of physical documents.

Yes, there are government schemes in India that support paralysis patients. These schemes aim to provide financial aid and affordable healthcare to individuals with disabilities, including paralysis.

Ayushman Bharat Pradhan Mantri Jan Arogya Yojana (PM-JAY): This scheme provides health coverage up to ₹5 lakh per family per year for secondary and tertiary care hospitalization. It covers pre-existing diseases, including paralysis.

Rashtriya Arogya Nidhi: Offers financial assistance to patients living below the poverty line and suffering from major life-threatening diseases, including paralysis.

National Trust Schemes: Various schemes under the National Trust cater to the welfare of persons with disabilities, focusing on healthcare, rehabilitation, and livelihood.

Employee State Insurance Scheme (ESIS): Provides medical benefits for employees earning a salary of up to ₹21,000 per month. Includes coverage for paralysis treatments.

Pro Tip:

Always check the eligibility criteria and required documentation for government schemes. These can vary widely and affect your ability to access benefits.

Paralysis patients in India face several challenges when it comes to accessing health insurance. Understanding these challenges can help in navigating the insurance landscape better.

Expert Insights:

It’s advisable to consult with an insurance advisor who specializes in healthcare to get tailored advice and better understand policy nuances.

Maximizing insurance benefits requires strategic planning and understanding the policy thoroughly. Here are some tips:

Pro Tip:

Maintain a detailed record of all communications with your insurer. This will help resolve disputes and clarify claims quickly.

Navigating health insurance options for paralysis patients in India requires careful consideration of the available policies, understanding terms, and being proactive in managing healthcare needs. By selecting the right insurance plan and leveraging government schemes, paralysis patients can significantly reduce their financial burden while ensuring access to necessary medical care and rehabilitation services. Regularly reviewing and updating insurance plans to match changing health needs will further aid in maximizing benefits.

What are the eligibility criteria for paralysis insurance in India?

Eligibility criteria generally include age limits, pre-existing health conditions, and sometimes a medical examination.

How can paralysis insurance coverage be enhanced?

Coverage can be enhanced by opting for add-ons or riders in your policy, such as critical illness riders.

Are there any tax benefits for purchasing paralysis insurance?

Yes, premiums paid for health insurance are eligible for tax deductions under Section 80D of the Income Tax Act.

Can family members be included in paralysis insurance coverage?

Family members can often be included in a family floater plan, but specific coverage for paralysis might depend on individual assessments.

How does one appeal a rejected insurance claim?

To appeal, review the rejection letter, gather additional documentation, and submit a formal appeal to the insurance company, possibly with legal assistance if needed.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).