Last updated on: September 19, 2025

In India, health insurance policies increasingly cover dengue fever, a mosquito-borne viral infection prevalent in tropical regions. Given the rising incidence of dengue cases, insurers offer plans that include hospitalization, diagnostic tests, and outpatient expenses incurred during treatment. Many insurers provide specific ‘dengue insurance plans’ with benefits like cashless hospitalization and lump sum payouts upon diagnosis, enabling policyholders to manage healthcare costs effectively. These plans often require no pre-medical tests and cover all age groups, ensuring broader accessibility. However, the extent of coverage can vary significantly between insurers, making it crucial for policyholders to carefully review terms and conditions. Additionally, awareness campaigns and government initiatives aim to enhance understanding and uptake of dengue-related health coverage, ensuring preparedness against financial burdens linked to this endemic disease.

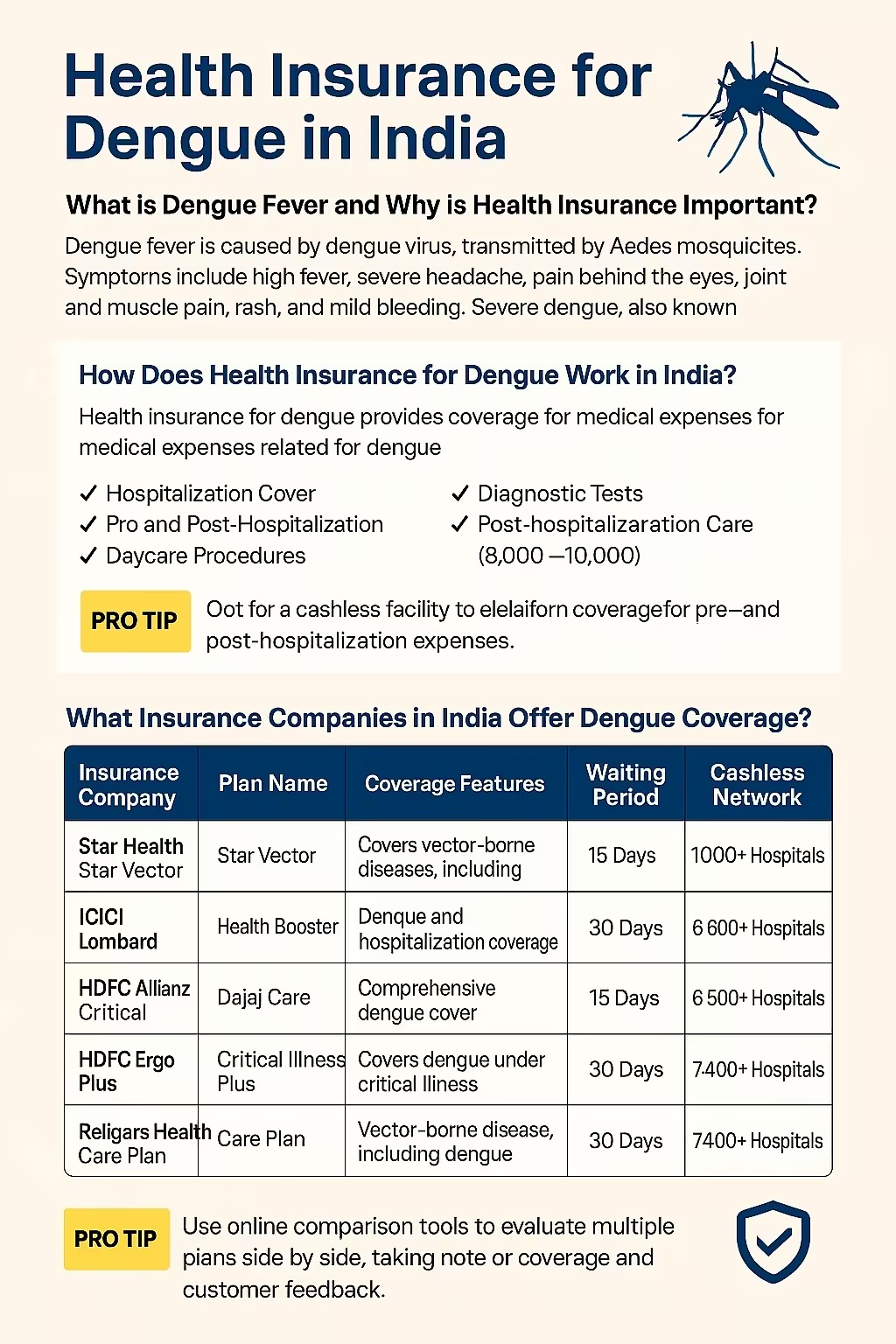

Dengue fever is a mosquito-borne viral infection that has become a significant public health concern in India. Given the rising incidence and the potential financial burden of treatment, having a health insurance plan that covers dengue is crucial. This guide explores all you need to know about health insurance for dengue in India, helping you make an informed decision.

Dengue fever is caused by the dengue virus, transmitted by the Aedes mosquitoes. Symptoms include high fever, severe headache, pain behind the eyes, joint and muscle pain, rash, and mild bleeding. Severe dengue, also known as dengue hemorrhagic fever, can be life-threatening and requires hospitalization.

Health insurance plays a vital role in managing the financial impact of dengue treatment, which can include hospitalization, medications, diagnostic tests, and follow-up consultations. Without insurance, these costs can be substantial.

Did You Know?

According to the World Health Organization, India reports tens of thousands of dengue cases each year, with significant outbreaks occurring in urban and semi-urban areas.

Health insurance for dengue functions similarly to other health insurance plans, providing coverage for medical expenses related to dengue treatment. Several Indian insurance companies offer plans that specifically target vector-borne diseases like dengue.

Pro Tip:

Opt for a health insurance plan that offers a cashless facility. This allows you to focus on recovery without worrying about upfront payments.

Several insurance companies in India offer plans that cover dengue. Here’s a comparison of some popular plans:

| Insurance Company | Plan Name | Coverage Features | Waiting Period | Cashless Network |

|---|---|---|---|---|

| Star Health | Star Vector Care | Covers vector-borne diseases, including dengue | 15 Days | 10,000+ Hospitals |

| ICICI Lombard | Health Booster | Dengue and hospitalization coverage | 30 Days | 6,500+ Hospitals |

| Bajaj Allianz | Dengue Care | Comprehensive dengue cover | 15 Days | 6,500+ Hospitals |

| HDFC Ergo | Critical Illness Plus | Covers dengue under critical illness | 30 Days | 10,000+ Hospitals |

| Religare Health | Care Plan | Vector-borne disease cover, including dengue | 30 Days | 7,400+ Hospitals |

Expert Insights:

Insurance experts suggest opting for a plan with a shorter waiting period and a vast cashless network to ensure hassle-free treatment.

Treatment costs for dengue can vary significantly depending on the severity of the disease and the healthcare provider. Here’s a breakdown of potential costs:

Pro Tip:

Always check if your insurance plan offers coverage for both pre and post-hospitalization expenses, as these can add up quickly.

Most health insurance plans in India have a waiting period of 15 to 30 days for dengue coverage. It’s essential to verify this with your insurer before purchasing a plan.

Some insurance plans may cover home treatment expenses if prescribed by a doctor, but this varies by insurer. Always check the policy details.

Choosing the right health insurance plan for dengue involves considering several factors to ensure comprehensive coverage and peace of mind.

Pro Tip:

Use online comparison tools to evaluate multiple plans side by side, taking note of coverage details and customer feedback.

Understanding the exclusions in dengue health insurance plans is crucial to avoid unexpected surprises during the claim process. Common exclusions may include:

Expert Insights:

Insurance advisors recommend thoroughly reading the policy document to understand the exclusions and avoid claim denials.

Yes, premiums paid for health insurance, including dengue coverage, are eligible for tax deductions under Section 80D of the Income Tax Act.

While having a pre-existing condition may affect your eligibility or premium rates, many insurers still offer coverage after a specified waiting period.

Filing a claim for dengue health insurance requires understanding the steps and documentation needed to ensure a smooth process.

Pro Tip:

Keep multiple copies of all documents and maintain a record of all communications with your insurer for future reference.

Claim processing time can vary but generally takes 15 to 30 days. Ensure all documents are submitted promptly to avoid delays.

If your claim is rejected, review the reason provided by the insurer. You can appeal the decision if you believe it is unjustified, providing additional documentation for review.

Health insurance for dengue in India is a necessity given the prevalence of the disease and the potential financial burden of treatment. By understanding the available options, coverage details, and claim processes, you can select the best plan to safeguard your health and finances.

What is the average premium for dengue health insurance in India?

The average premium for dengue health insurance in India can range from ₹1,500 to ₹5,000 annually, depending on the insurer and coverage scope.

Can I add dengue coverage to my existing health insurance policy?

Some insurers offer add-on covers for dengue, which can be added to your existing health insurance policy for an additional premium.

Is there a specific season when dengue cases are more prevalent in India?

Dengue cases in India typically surge during the monsoon season, from June to September, due to favorable breeding conditions for mosquitoes.

Are there any government health schemes in India that cover dengue treatment?

Some state governments in India offer health schemes that cover vector-borne diseases like dengue. It’s advisable to check with local health authorities for available options.

Can I purchase dengue health insurance for my entire family under a single plan?

Yes, many insurers offer family floater plans that cover multiple family members under a single policy, providing coverage for dengue and other illnesses.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).