Last updated on: September 19, 2025

Being the cultural centre and an expanding industrial powerhouse in Gujarat, Vadodara is home to major healthcare establishments such as Sterling Hospital, Bhailal Amin General Hospital and Sunshine Global Hospital. As health services improve, the price of treatment goes up. With this, people living in Vadodara are now becoming more dependent on health insurance for protection against increasing health bills and unplanned emergencies.

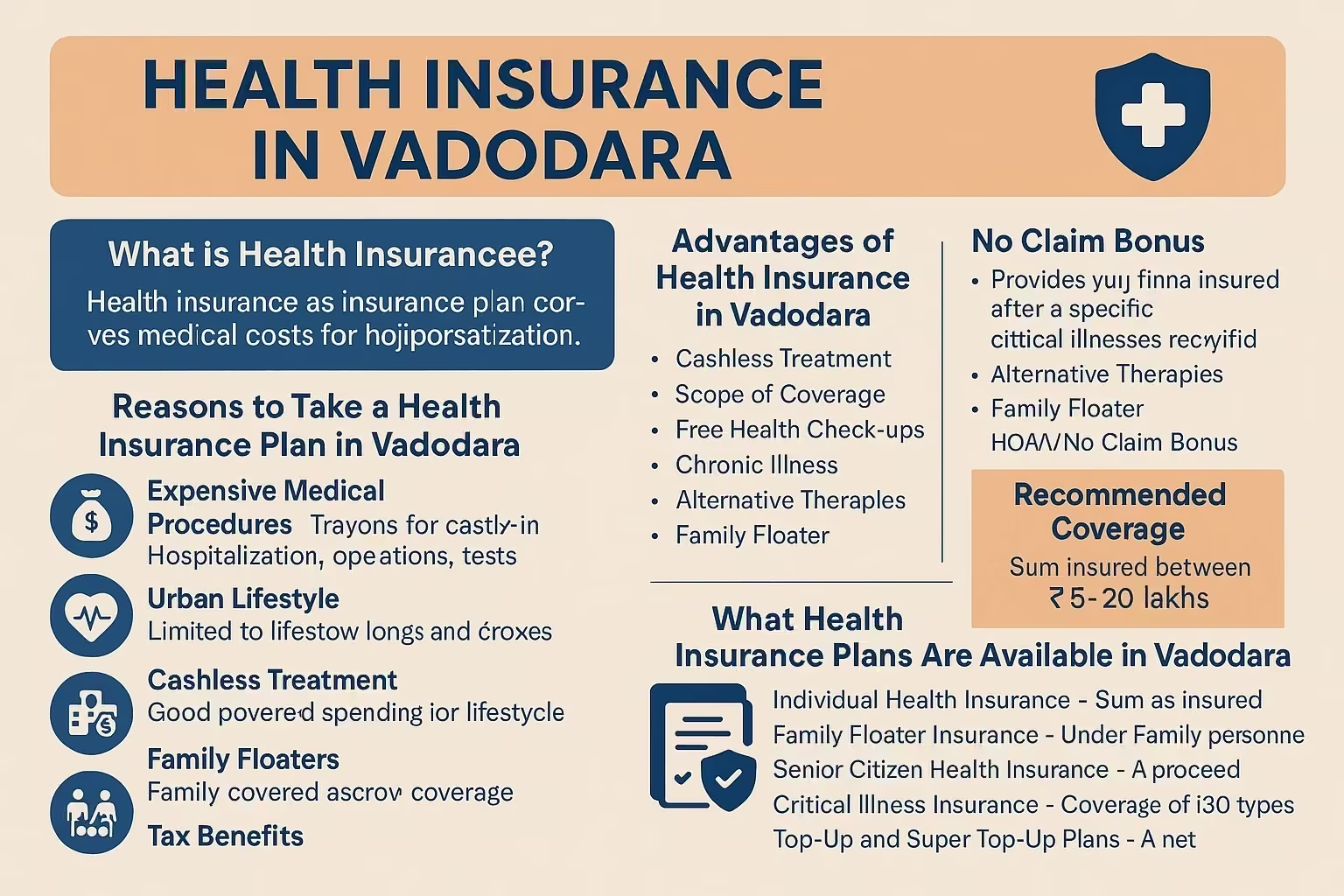

An insurance plan is a contract in which the insurer promises to cover medical costs agreed on by the parties. This type of coverage regularly covers hospital visits, operations, test procedures and care after treatment concludes. Since health care costs keep going up, health insurance is now something people need rather than an extra comfort.

Did you know

Now, many insurers cover day-care treatments, consultations in outpatient departments (OPDs) and procedures like robotic surgeries which are growing in Vadodara’s leading hospitals.

Local Insight

Choose a health insurance plan that has Sterling Hospital, Bhailal Amin General Hospital and Sunshine Global Hospital as network hospitals so you can enjoy cashless treatment in Vadodara.

Individuals are recommended to have a sum insured between ₹5 to ₹10 lakhs. When buying a family floater plan, coverage of ₹10 to ₹15 lakhs is normally appropriate. If you are a senior or you have a serious illness history, choose a health insurance plan with ₹20 lakhs or more coverage and add critical illness riders.

Did you Know

A few insurers offer special wellness programs which come with fitness-related bonuses, discounts and easy access to doctors over the phone, making your health insurance plan more beneficial.

Expert Advice

Always keep paper and electronic copies of your health insurance documents and ID on hand to avoid problems in case of an emergency.

Should I get health insurance if I live in Vadodara?

Yes. As medical treatments become more expensive and more people suffer from lifestyle illnesses, health insurance helps protect your finances.

Is it possible to buy insurance for healthcare online in Vadodara?

Absolutely. Many websites make it easy for you to review and buy health insurance plans online.

Do hospitals in Vadodara offer cashless treatments?

Yes. A number of top hospitals in Vadodara are part of insurance plans that allow you to be treated without paying cash upfront.

What happens if I go to a hospital that isn’t part of my health plan’s network?

Here, you can get reimbursed by sending your bills and documents to your insurance company after getting treated.

Is it possible to buy health insurance for my parents in Vadodara?

Yes. There are various health insurance plans designed for the elderly which many insurers offer to your parents.

Is it possible to get coverage for Ayurveda or Homeopathy treatment?

Yes. Many comprehensive health plans cover AYUSH treatments which consist of Ayurveda, Yoga, Unani, Siddha and Homeopathy.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).