Last updated on: September 19, 2025

When selecting a health insurance plan for existing heart conditions, many people struggle with exclusions, long waiting periods, or high premiums. The Care Heart Health Insurance Plan 2025 is specially designed for people who have had heart surgery or are dealing with cardiac conditions. It accepts applicants with heart surgeries within the last 7 years, offers shorter waiting periods for pre-existing conditions, and provides tailored benefits like annual cardiac check-ups, automatic recharge of sum insured, and access to over 11,000 cashless hospitals. This makes it one of the most reliable plans for anyone looking for focused heart care coverage.

The Care Heart Plan is a unique health insurance package to individuals with already existing heart conditions or those who have had heart operations. It is meant to cater to the medical requirements of people who are recovering due to heart issues or having a prolonged heart disease.

At Care Heart, one can receive heart-related treatments; however, unlike normal health insurance plan, the center is specialized. It provides cover on in-patient treatment, frequent visits to the doctor, and recovery costs after an operation. In case you have undergone a heart surgery within the past 7 years or you are facing heart diseases, this plan has been specifically designed in your favour.

It provides you with a network of cashless hospitals, an annual heart health check-up and value added benefits that cater to you during and after treatment.

Cases of heart related diseases have become one of the leading causes of hospitalisation in India. Heart operations and the after-care procedures may amount in lakhs of rupees. The regular health insurance plans either exclude or introduce long waits when it comes to pre-existing conditions in the heart.

That is why such a heart-related program as Care Heart matters a lot.

The Care Heart plan has a number of benefits inbuilt. It provides extensive varieties of hospital services and physician assistance that is customized to heart care.

| Feature | Description |

|---|---|

| Sum Insured Options | ₹3 Lakh to ₹10 Lakh |

| Eligibility | People who had heart surgery within last 7 years |

| Pre and Post Hospitalisation | 30 days before and 60 days after |

| Annual Check-Up | Free yearly heart health check-up |

| No Claim Bonus | 10% increase in sum insured each year (up to 50%) |

| Cashless Treatment | Available in 11,000+ hospitals across India |

| Daycare & OPD | Covered for listed procedures |

| AYUSH Cover | Full sum insured for approved alternative treatments |

| Recharge Benefit | Automatic refill of sum insured once per policy year |

| Entry Age | 18 to 65 years |

| Policy Tenure | 1, 2, or 3 years |

Step 1. Select Your Sum Insured

You can choose between 3L, 5L, 7L or 10L depending on the state of your health and your budget.

Step 2. Fill Proposal Form

Inform whether or not you had undergone heart surgery in the past 7 years. Disclose the history of any previous heart problems.

Step 3: Medical screening

The medical reports can be necessary in terms of age or type of surgery.

Step 4: Premium

Choose single, or instalment payments. There is a discount on 2 or 3 years policy.

Step 5: Approval of policy

Obtain confirmation in 2 to 5 days after underwriting.

Step 6: Put Your Plan to Use

Make a cashless treatment appointment with the Care app or helpline. Apply to get reimbursed in case of emergency after treatment.

The plan is specially designed to people recovering of:

Such conditions are also excluded in the Care Heart Plan or have waiting periods just like in any insurance.

The plan is tailored towards patients with heart complications or individuals who have undergone heart surgery.

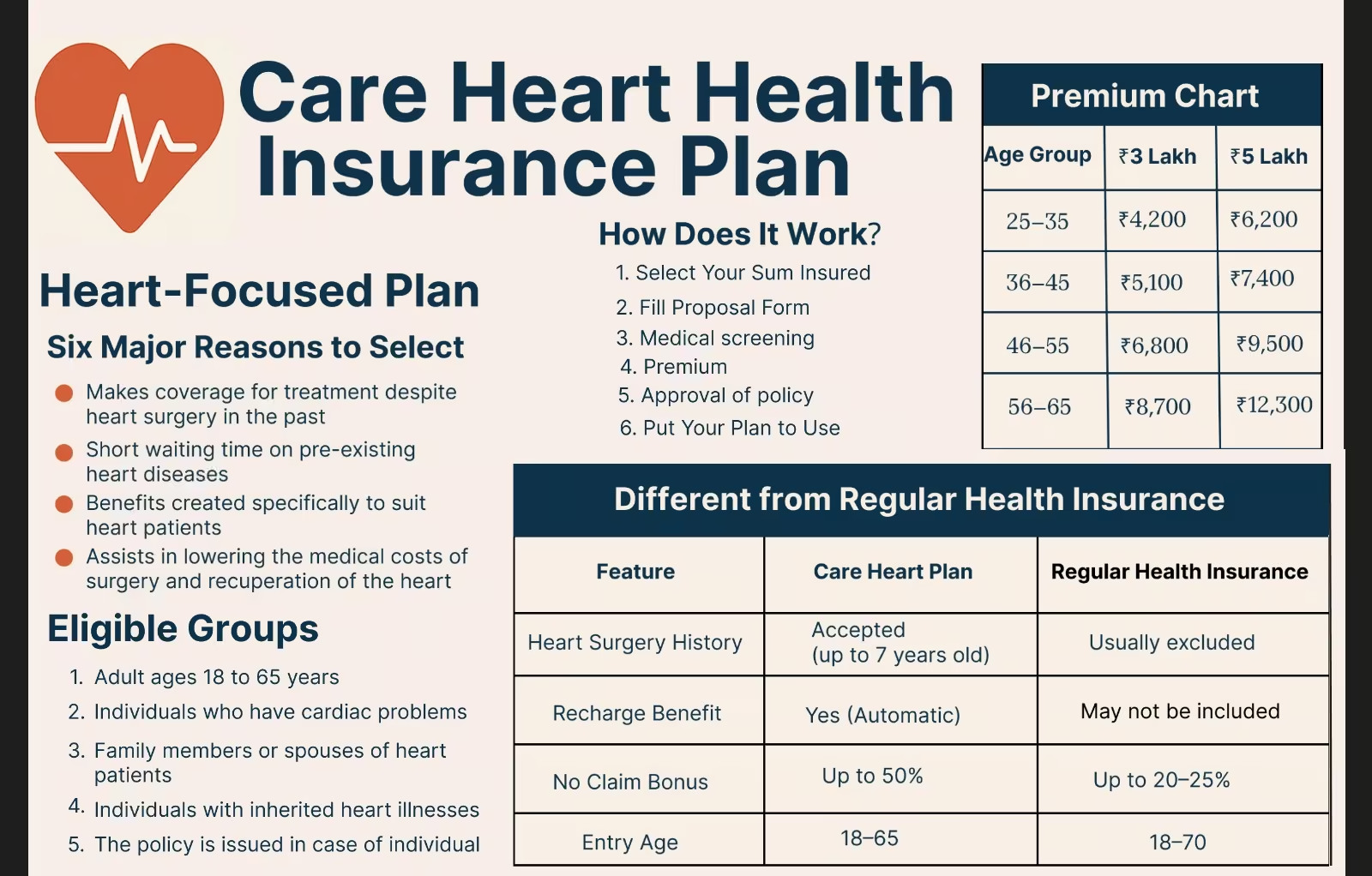

Below is an approximate yearly premium (without GST) for different age groups and sum insured values.

| Age Group | ₹3 Lakh | ₹5 Lakh | ₹7 Lakh | ₹10 Lakh |

|---|---|---|---|---|

| 25–35 | ₹4,200 | ₹6,200 | ₹7,800 | ₹9,500 |

| 36–45 | ₹5,100 | ₹7,400 | ₹9,100 | ₹11,200 |

| 46–55 | ₹6,800 | ₹9,500 | ₹11,800 | ₹14,200 |

| 56–65 | ₹8,700 | ₹12,300 | ₹15,000 | ₹18,500 |

Note: Actual premium may vary based on medical history and city of residence.

| Feature | Care Heart Plan | Regular Health Insurance |

|---|---|---|

| Heart Surgery History | Accepted (up to 7 years old) | Usually excluded |

| Pre-existing Cardiac Cover | Yes | Limited or after 2–4 years |

| Recharge Benefit | Yes (Automatic) | May not be included |

| Cardiac Check-Up | Free annual check-up | Not offered |

| Specialised Cardiac Claims Team | Yes | No |

| No Claim Bonus | Up to 50% | Up to 20–25% |

| Entry Age | 18–65 | 18–70 |

Name: Mr. Rajan Kapoor, 58, Pune

Type of Policy: Care Heart Individual - 5 Lakh

History: 4 years ago he underwent a bypass surgery

Complication: Chest pain and needed stenting

Claim: Hospitalisation without cash of 3.8 lakh

Benefits Used:

Renewal: Selected 2-year plan at reduced premium

Through Care Heart policy, tax savings can be availed under Section 80D:

1. Is it possible to purchase it in case I had heart surgery 6 years ago?

Yes, these are the plans of the people who had surgery within last 7 years.

2. Does this plan have a cashless facility?

Yes, Care Health Insurance is accepted in more than 11000 hospitals in India.

3. Is it OPD and daycare?

It includes daycare. The basic plan does not include OPD.

4. What happens when my sum insured gets exhausted?

The automatic recharge is the one which replenishes your sum insured at the end of each year.

5. Is it possible to renew the plan on a lifetime basis?

Yes, the policy can be renewed on life basis.

In 2025, the Care Heart Plan is an essential item that people with a past of cardiac disease will need. It provides a sense of tranquility to you and your family because of its special care towards heart, low waiting period and regular check-ups.

The plan will prevent financial jolt in case of emergency caused by heart problems and will aid a quicker recovery. This policy suits you, whether you have a particular job or are retired, or a care-giver to a person with heart problems.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).