Last updated on: September 19, 2025

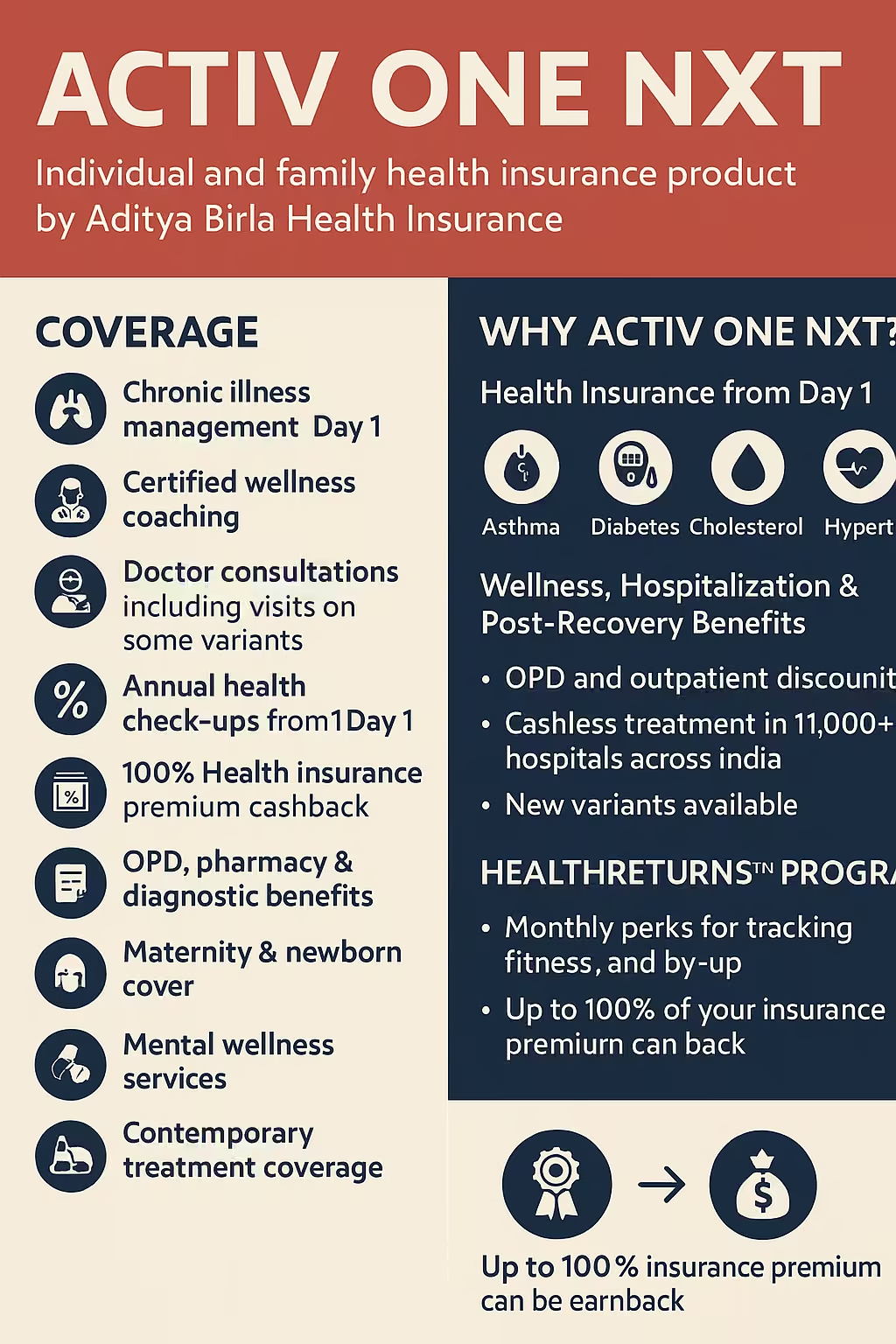

Aditya Birla Activ One NXT Plan 2025 is designed for proactive health management. It offers Day 1 coverage for chronic conditions like diabetes and high BP, unlimited doctor consultations, OPD benefits, mental wellness, and HealthReturns™ rewards for fitness. With plan variants like Value, Prime, and Apex, it fits every budget and lifestyle need. Families, salaried professionals, and fitness-minded individuals can benefit from cashless access at over 11,000 hospitals, tech-enabled wellness coaching, and modern treatment coverage.

By the year 2025, health insurance will be about more than just emergency hospital costs, it is about taking charge of health, customized wellness, and resilience that lasts over time. It is with these contemporary needs that the Aditya Birla Activ One NXT is constructed. It does not only protect you when you are ill, it accompanies you when you are healthy and reminds you of the need to make a better lifestyle and reward your efforts.

It can be used by busy young professionals, family heads who want the whole family to have protection, and individuals with chronic conditions who can find customised support. Activ One NXT is all about being ahead of illness and owning your health process; whether it is OPD visits or chronic illness management, starting Day 1.

Activ One NXT is the brand flagship product of Aditya Birla Health Insurance as an individual and family health insurance product. Activ One NXT initiates its promise on Day 1 unlike conventional policies where, a policy holder has to wait until something goes wrong even with chronic diseases such as diabetes, high blood pressure, and asthma.

It is accompanied by a great package of wellness, hospitalization, and post-recovery benefits. It comes in different versions in terms of plan (such as Value, Prime, and Apex) and can be availed by the first-time health insurance purchasers as well as those individuals who are renewing their cover.

Activ One NXT thinks that the health insurance ought to recompense you in case you take satisfactory decisions. This is where the HealthReturns 10 comes in.

Under this program:

These returns may be utilized to:

It is the environment in which insurance is not the next day, it is your healthy habit.

Activ One NXT cares about unexpected and expected healthcare needs based on personalization.

And here is a sample of what it covers:

| Age Band | ₹5 Lakh Cover | ₹10 Lakh Cover | ₹20 Lakh Cover |

|---|---|---|---|

| 25 – 30 years | ₹6,000 – ₹7,500 | ₹9,000 – ₹11,000 | ₹13,000 – ₹16,500 |

| 31 – 35 years | ₹6,800 – ₹8,600 | ₹10,200 – ₹12,500 | ₹14,500 – ₹18,000 |

| 36 – 40 years | ₹8,200 – ₹9,500 | ₹12,200 – ₹14,500 | ₹17,500 – ₹21,000 |

| 41 – 45 years | ₹9,800 – ₹11,500 | ₹14,800 – ₹17,800 | ₹21,500 – ₹26,000 |

| 46 – 50 years | ₹12,000 – ₹14,200 | ₹17,500 – ₹20,800 | ₹25,000 – ₹30,500 |

| 51 – 55 years | ₹14,500 – ₹17,000 | ₹21,200 – ₹24,800 | ₹30,500 – ₹36,000 |

| 56 – 60 years | ₹16,800 – ₹19,500 | ₹24,500 – ₹28,500 | ₹35,000 – ₹42,000 |

| 60+ years | ₹20,000 – ₹24,000 | ₹29,000 – ₹34,500 | ₹40,000 – ₹48,500 |

Will Activ One NXT work with diabetes or high BP?

Yes. Chronic illnesses such as diabetes, hypertension, and cholesterol are covered on day 1.

Is there a restriction to room rent or selection of hospital?

No restriction in Apex of room rents. The other variants also have indulgent limits.

Does OPD come under it?

Yes. Prime and Apex versions have a defined OPD reimbursements. There are also discounts.

But what happens when I do not make a claim?

You have No Claim Bonus (your coverage gets increased) and you can get HealthReturns.

Will this plan be sold online?

Yes. The process is fast, electronic and completely online.

It is an age when our health is being influenced as much by our habits as it is by the accidents, and Activ One NXT by Aditya Birla Health Insurance Company is the type of insurance that comes to suit the age. It does not only pay when we become sick but also instructs, coaches and recompenses us when we are not sick.

You are in your 20s or in your 40s, or even reaching your retirement age, this plan is a long-term friend to your health, to the safety of your family and your financial security. In 2025, insurance is not reactive anymore. Activ One NXT is proactive, smart and personal.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).