Last updated on: September 19, 2025

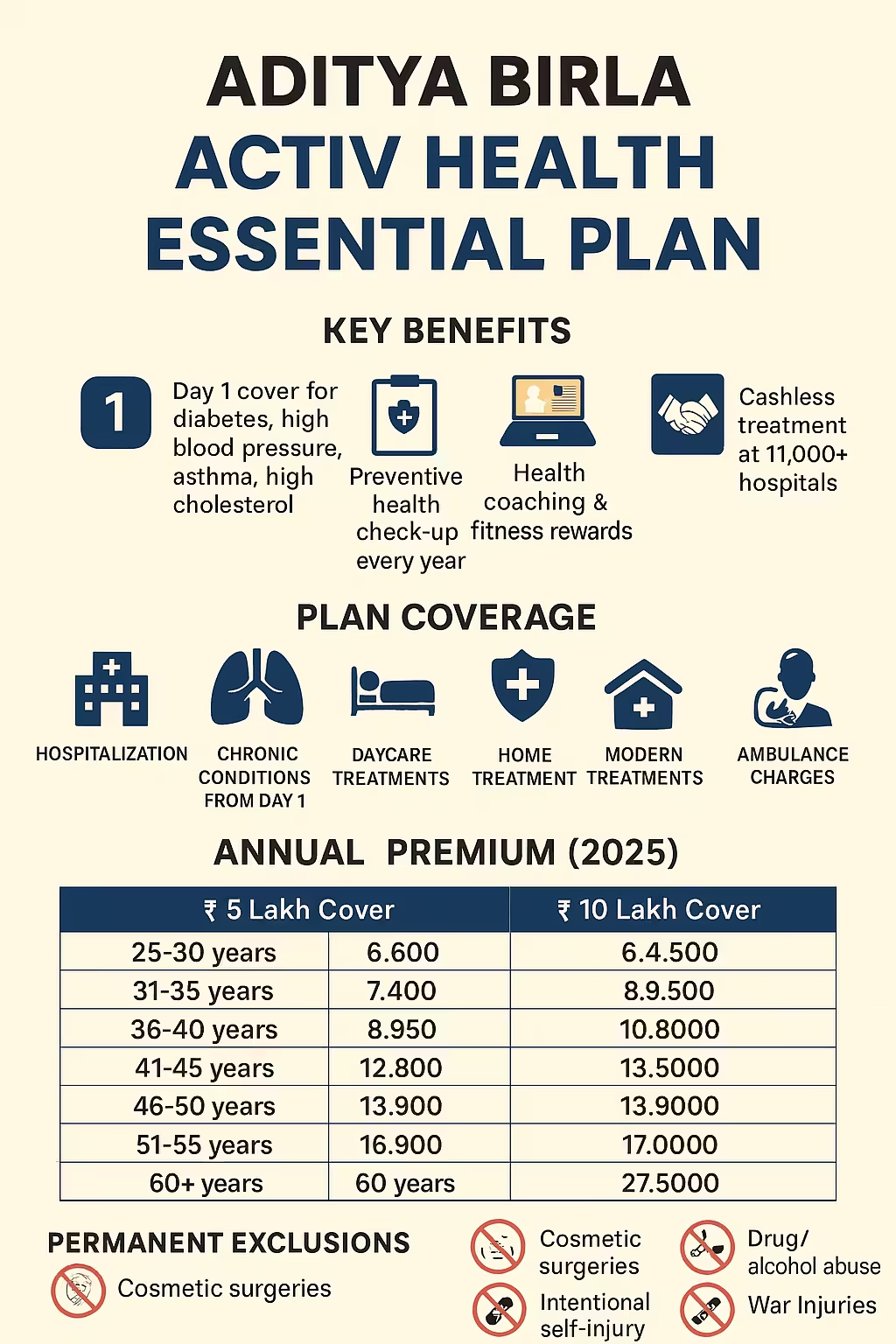

Aditya Birla Activ Health Essential Plan 2025 offers low-cost, high-value coverage with Day 1 chronic care for conditions like diabetes and hypertension. It includes free annual health check-ups, OPD consultations, digital fitness coaching, and up to 50% premium return via HealthReturns. The plan suits Indian families, professionals, and senior citizens who want cashless care, early coverage, and wellness rewards without waiting periods.

With the increasing rate of healthcare expenses in India, most families are seeking health insurance that is pocket-friendly and also loaded with benefits. It is even more important to find a policy that will cover even the treatment following the first day in the case of individuals who suffer lifestyle related illnesses such as diabetes or high blood pressure. The Aditya Birla Activ Health Essential Plan is an intelligent and low-cost alternative that individuals and their families seeking solid health covers without chronic or long-term conditions waiting periods would benefit in 2025.

The policy is intended to ensure that everybody can access health covering on day one of the policy, more so those with preconditions such as diabetes, high blood pressure, asthma, and cholesterol. It has gathered the fundamentals of hospital insurance along with health preventive tools such as check-ups and physical activity incentives.

The following are the major reasons why Activ Health Essential plan will be an excellent decision in 2025:

In case you have asthma, high blood pressure, cholesterol, or diabetes (type 1 and 2), your need will be covered since the first day of your treatment according to this plan. Fereign there is 24 month wait, no exclusion on these diseases.

That is, the Chronic Management Program will automatically upgrade you to in case you manage to develop such a condition later but you did not have it in time.

Find the app with fitness and diet coaches who can give personal advice. These comprise workout schedules, nutritional graphs and health monitoring.

Since the introduction of the policy, you will be able to receive a free health check-up annually. It entails regular tests such as blood sugar, ECG, lipid profile among others.

Being active, completing workouts, or taking a certain number of steps will help you receive rewards as much as 50 percent of your premium. This premium can be paid at the premiums or can be used to purchase medicines.

Depending on the fitness activities you do such as walking and exercising, you are allowed to effect HealthReturns 0 at the end of every month. The healthier you are, the more money you get. One can use these rewards on:

Highest amount that can be earned: 50 per cent of your annual premium

You do not have to wait before you receive a preventive health check-up even in the first year of coming on board. They are the tests:

As soon as you are thrown an answer of any of the conditions listed as chronic:

| Age Band | ₹5 Lakh Cover | ₹10 Lakh Cover |

|---|---|---|

| 25 – 30 years | ₹6,000 – ₹7,500 | ₹9,500 – ₹11,000 |

| 31 – 35 years | ₹6,800 – ₹8,600 | ₹10,800 – ₹12,500 |

| 36 – 40 years | ₹8,200 – ₹9,500 | ₹12,000 – ₹13,900 |

| 41 – 45 years | ₹9,400 – ₹11,200 | ₹13,500 – ₹15,800 |

| 46 – 50 years | ₹11,500 – ₹13,700 | ₹15,800 – ₹18,200 |

| 51 – 55 years | ₹13,900 – ₹16,000 | ₹18,200 – ₹20,700 |

| 56 – 60 years | ₹15,500 – ₹17,800 | ₹20,700 – ₹23,500 |

| 60+ years | ₹17,900 – ₹21,200 | ₹23,500 – ₹27,000 |

Here’s what you get when you buy the Activ Health Essential plan:

| Coverage Type | Details |

|---|---|

| Hospitalization Cover | Covers medical expenses for more than 24-hour hospital stays |

| Chronic Conditions from Day 1 | Asthma, BP, Cholesterol, Diabetes (Type 1 & 2) |

| Daycare Treatments | All day-care procedures covered |

| Pre & Post Hospitalisation | 30 days before and 60 days after hospitalisation |

| Cashless Home Treatment | Available for listed diseases (e.g., chemotherapy, dialysis) |

| Modern Treatments | Laser, robotic, advanced procedures covered as per limits |

| Ambulance Charges | Included for emergency transfers to hospital |

| Doctor Consultation & Diagnostics | Covered up to ₹4,350 annually |

| Preventive Health Check-ups | Annual check-ups from day 1 |

| Fitness Coaching | App-based expert consultations on health and nutrition |

Activ Health Essential like any kind of insurance plan, has certain exclusions:

To find the entire list of exclusions refer to policy wording.

The following is the procedure of applying to the plan:

Step 1- choose your sum insured.

Choose between 10 Lakh or 5 Lakh according to your need.

Step 2: choose Policy Tenure

There is the option of 1, 2 or 3 years.

Step 3: complete Proposal Form

Provide health and KYC information. Many samples up to the age of 55 are not subject to tests.

Step 4: Online Pay or pay via Agent

Either have the policy issued electronically or through the assistance of a certified advisor.

Step 5: Download E- Card

The recipient can use this card in 11,000+ cashless network hospitals.

It is a policy that will fit well with a large number of individuals in 2025:

1. Is this plan just about individuals with chronic conditions?

No, this is a plan of everyone. However, it is going to offer special Day 1 coverage to those individuals who already have some chronic conditions.

2. Is it possible to purchase the plan on behalf of the parents?

Yes. It is possible to purchase such a plan to your parents, even when their ages are more than 60. There is Day 1 of chronic diseases.

3. Should I perform a medical test?

Most people do not require this before age 55. Then it is up to your health declaration.

4. Is this plan able to give me OPD consultations?

Yes. The consultations and diagnostics up to 4350/year will be reimbursed.

5. What is HealthReturns program?

With this program, you will be rewarded on being an active and healthy human being. You will be reimbursed by getting back up to 50 percent of your premium.

6. Do I have the opportunity to take the plan online?

Yes. To have it issued on-line, you can go to the site of the insurer or consult an agent.

Activ Health Essential Plan is the plan of the Aditya Birla Health Insurance Company that is 2025-ready and has a different way of looking at health insurance. This plan will provide you with not only hospital protection but with the help of Day 1 coverage of the most popular chronic diseases, zero waiting list, fitness incentives, and digital health tools to remain fit and healthy.

It is cheap, convenient and serves individuals with lifestyle diseases or who wish to have collocation between fitness and insurance to get one simple plan. Regardless of whether you are a young professional, parent, or a retired couple, this plan provides a correctly balanced support, savings, and security.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).