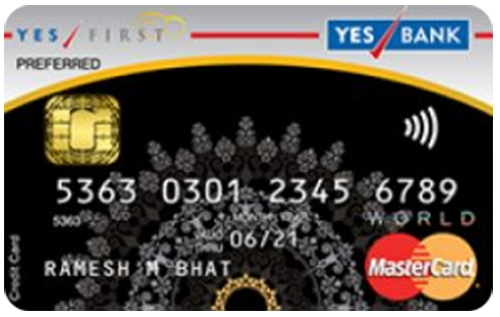

YES First Preferred Credit Card

Enter the world of rewarding experiences with the YES First Preferred Credit Card. This feature-rich card is guaranteed to elevate your lifestyle

YES First Preferred Credit Card

- travel

- fuel

- Rewards

Fee

Joining Fee –Rs. 999 + GST

Annual Fee – Rs. 999 + GST

- Accelerated Rewards:Enjoy bonus reward points on joining, renewal, and reaching spending milestones. Additional 2X Reward Points Gain 16 reward points on every ₹200 spent on travel and dining, up to ₹3,000 per statement cycle. Additionally, earn 8 reward points on all other categories.

- Travel Privileges:Access complimentary domestic and international airport lounges with Priority Pass membership. 4 complimentary airport lounge visits per calendar year and 2 complimentary lounge visits per quarter in India

- Complimentary Golf Services:1 golf lesson every calendar month and 4 additional sessions with green fee waiver at select golf courses in India

- Insurance Coverage: Credit Shield cover of 8 Lac, Lost Card liability cover of 8 Lac

Quick Loan

Get a loan upto the credit card limit to fulfil immediate loan requirements

Express Loan

Get a pre-approved loan at an attractive interest rate on your YES BANK Credit Card

| Fee/Charge | Amount |

| Annual Fee (First Year) | ₹999 + taxes (waived on spending ₹50,000 within 90 days) |

| Annual Fee (Renewal) | ₹999 + taxes (waived on spending ₹2.5 lakh within the previous year) |

| Interest Rate | 3.80% per month (45.6% annually) on revolving credit, cash advances, and overdue amounts |

| Cash Advance Fee | 2.5% of the advance amount (minimum ₹300) |

| Over Limit Fee | 2.5% of the over-limit amount (minimum ₹500) |

| Foreign Currency Markup | 1.75% |

| Late Payment Fee | Fee varies depending on outstanding balance (starts from ₹150) |

| Add-on Card Fee | Free (up to 3 cards) |

| Foreign Conversion | 3.5% |

| Duplicate Statement Fee | Rs. 100 per statement |

Criteria | Details |

Age | 21 to 60 years |

Occupation | Salaried or Self-employed |

Minimum Income (Salaried) | ₹2 lakh net salary per month |

Minimum Income (Self-employed) | ITR of at least ₹24 lakh OR Fixed Deposit with YES Bank of ₹3 lakh or above |

| Document | Description |

| Identity Proof | PAN Card |

| Address Proof | Passport/Utility Bill/Ration Card/Driving License etc. |

| Income Proof | Salary Slip/Form 16/ITR documents (as applicable) |

| Photograph | Recent passport-sized color photograph |

Click on the apply button below the card

- Complete the online application and attach necessary documents required

- Once, we receive the application, you will be provided an acknowledgement number

- Track the status of your credit card application

Obtain the gateway to travel bliss

Make your travel more lively with YES First Preferred Credit Card)with its series of discounts on hotels, bookings, and rewards.

What are reward points worth?

A: You can redeem your reward points for a variety of products, services, and experiences through the YES Bank rewards program. The conversion rate may vary depending on the redemption option.

Q: How do I access airport lounges?

A: You will receive a complimentary Priority Pass membership with your card. This membership allows you to access participating lounges worldwide.

Q: What travel insurance is included?

A: The YES First Preferred Credit Card offers overseas medical cover and air accident cover. Refer to the policy document for specific details and coverage limits.

Q: Is there a foreign currency markup fee?

A: Yes, a preferential foreign currency markup of 3.5% applies to all international transactions.

Q: How do I apply for the YES First Preferred Credit Card?

A: You can apply for the card online through the YES Bank website or through Fincover