Yes Bank Credit Cards - Features and Benefits | Fincover®

Yes Bank is one of the full service commercial bank offering a range of banking products to customers and corporate. Yes Bank Credit cards are known for their host of benefits, low annual fee, low interest rates, and a rewarding loyalty program.

Types of Yes Bank Credit Cards

| Card Name | Joining Fee | Rewards |

|---|---|---|

| Yes First Exclusive Credit Card | Rs. 1999 + GST | 24 RP per ₹200 on dining/travel, 12 RP per ₹200 on other transactions |

| Yes First Preferred Credit Card | Rs. 999 + GST | 12 RP per ₹200 on dining, 8 RP per ₹200 on all categories |

| Yes Premia Credit Card | Rs. 999 + GST | 12 RP per ₹200 on dining, 6 RP per ₹200 on all categories |

| Yes Select Credit Card | Rs. 399 + GST | FREE Amazon voucher worth ₹500 on ₹1000 spend in first 30 days |

| Yes Bank Ace Credit Card | Rs. 399 + GST | FREE Amazon voucher worth ₹500 on ₹1000 spend in first 30 days |

Yes First Exclusive Credit Card

Highlights: Chance to earn upto 8000 reward points, Complimentary access to airport lounges and golf program

Fees: For the first year Rs. 1999 + GST fee will be charged which can be reversed upon spending Rs. 40000 within 30 days of card set up date. Renewal fee of Rs. 1999 can be reversed upon spending Rs. 300000 within one year prior to card renewal date

- Airport Lounge Access priviliges – Domestic – 3 per Quarter, International – 6 Per Calender year

- Get waiver of green fee (4 nos) at select golf courses in India

- 1% fuel surcharge waiver

- Attractive interest rate of only 2.99% on revolving credit

- Available for salaried and self-employed

- FREE Amazon voucher worth ₹1500 on spending ₹1500 within first 30 days

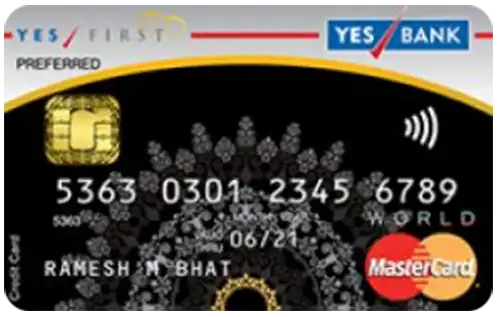

Yes First Preferred Credit Card

Highlights: Medical Emergency cover of Rs. 25 Lakhs, Additional 2x reward points

Fees: Joining fee of Rs. 999+GST, which can be reversed upon spending INR 50000 within 90 days of card set up date, Annual fee of Rs. 999+ GST which can be reversed on a yearly spend of Rs. 2.5 Lakhs and more.

- Contactless Transactions

- 8 reward points on Rs. 200 spent

- Medical emergency cover upto Rs. 25 Lakhs while travelling outside and accident cover of Rs. 1 Crore

- 4 complimentary visits to airport lounges outside India and 2 within India

- Complimentary Golf Program

- FREE Amazon voucher worth ₹1500 on spending ₹1500 within first 30 days

Yes Premia Credit Card

Highlights: Accelerated Rewards, Life Insurance cover of 1 crore, and Movie Discount offers

Fee: Joining fee of Rs. 999+GST, which can be reversed upon spending INR 50000 within 30 days of card issuance, Annual fee of Rs. 999+ GST which can be reversed on a yearly spend of Rs. 2 Lakhs and more.

- 4 Green fee waiver per year

- Life Insurance cover of 1 Crore, Medical insurance cover of 30 lakhs

- 1% Fuel surcharge waiver

- 2 complimentary domestic airport lounge visits and 3 international lounge visits allowed

- Accelerated rewards on selective purchases

- FREE Amazon voucher worth ₹1500 on spending ₹1500 within first 30 days

Yes Select Credit card

Reward Points – Earn 3X/5X Reward Points with your YES Select Credit Card

- 24 Reward Points for every Rs. 200 spent on Travel and dining expenses upto Rs. 5000

- 12 Reward Points on every Rs. 200 on all categories

- Get 6 Yes Rewards Points on Every INR 200 on select categories

- Airmiles 10 reward points = 1 Club Vistara point

Yes Bank Ace Credit Card

Reward Points – Earn 3X/5X Reward Points with your YES Ace Credit Card

- 24 Reward Points for every Rs. 200 spent on online shopping

- 12 Reward Points on every Rs. 200 on offline shopping except on select categories

- Get 6 Yes Rewards Points on Every INR 200 on select categories

- Airmiles 10 reward points = 1 Club Vistara point

- No reward points will be added for fuel transactions, cash withdrawals, and EMI transaction

Yes bank Credit Card Eligibility

General Eligibility:

Age: Between 21 and 60 years

Employment: Salaried or self-employed with a steady source of income

Minimum Income:

- INR 25,000 per month for most cards

- INR 40,000 per month for YES Prosperity Edge Credit Cards

CIBIL Score: 700 or above (a good credit score)

Documents Required to Apply for a Yes bank Credit Card

- Identity proof: PAN Card, Aadhaar Card, Passport, Driving License, etc.

- Address proof: Aadhaar Card, Voter ID, Ration Card, Utility Bills, etc.

- Income proof: Salary slips, bank statements, ITRs, Form 16, etc. (depending on employment type)

- Recent passport-size photograph

How to Apply for Yes Credit Cards?

It is important that you ensure you fulfill the eligibility criteria before applying for Yes bank Credit Cards,

- Click on the apply now link given at the top

- You need to enter some details as requested

- You would need to submit the documents required

- Once done, an application ID will be sent to you to track your application status.

Yes Bank Credit Card FAQs

1. What Yes Bank Credit Card will suit me?

Yes Bank offers a range of credit cards across categories like shopping, travel, lifestyle, and wellness. To find the best fit, identify your spending habits—whether you spend more on travel, dining, shopping, or fuel. Once you understand your spending pattern, you can choose a card aligned with those needs.

2. What is the procedure to report if I lose my Yes Bank Credit Card?

If you lose your credit card, immediately report it to Yes Bank Customer Care:

- YES First / YES Premia: 1800 103 6000

- YES Prosperity: 1800 103 1212

- Calling from outside India: +91 22 5079 5101

3. How can I generate a Yes Bank Credit Card PIN?

You can generate your PIN by:

- Logging into Yes Bank Internet Banking and following the instructions

- Visiting the nearest Yes Bank ATM and using the card services menu

4. What happens when my credit card expires?

Yes Bank usually sends a replacement card before expiry. For Yes Private and Yes Private Prime, there is no reward redemption fee. For other Yes Bank credit cards, a redemption fee of ₹100 may be charged.