Last updated on: September 19, 2025

Top-up health insurance plans are supplementary policies designed to enhance existing health insurance coverage by providing additional protection against high medical expenses. These plans activate once the base policy’s coverage limit is exhausted, making them a cost-effective option for those seeking higher coverage without purchasing a new policy. Top-up plans typically have a deductible, which is the threshold amount that must be reached before the plan kicks in, offering benefits such as hospitalization, surgery, and emergency care. They are ideal for individuals and families who wish to safeguard against unforeseen medical costs without substantially increasing their insurance premiums. By bridging the gap between basic policy limits and potential healthcare expenses, top-up plans ensure comprehensive financial security in the event of significant medical treatments.

Health insurance plays a very important role in financial planning, especially with the increase in the medical expenses. Regular health insurance policies are limited in the number of coverage provided by the policy and therefore to many it might be insufficient. That is where top-up health insurance policies are applied that provide an extra source of financial security. So, what are the top-up health insurance plans, why they are important and how can you select one of the best suited ones to you?

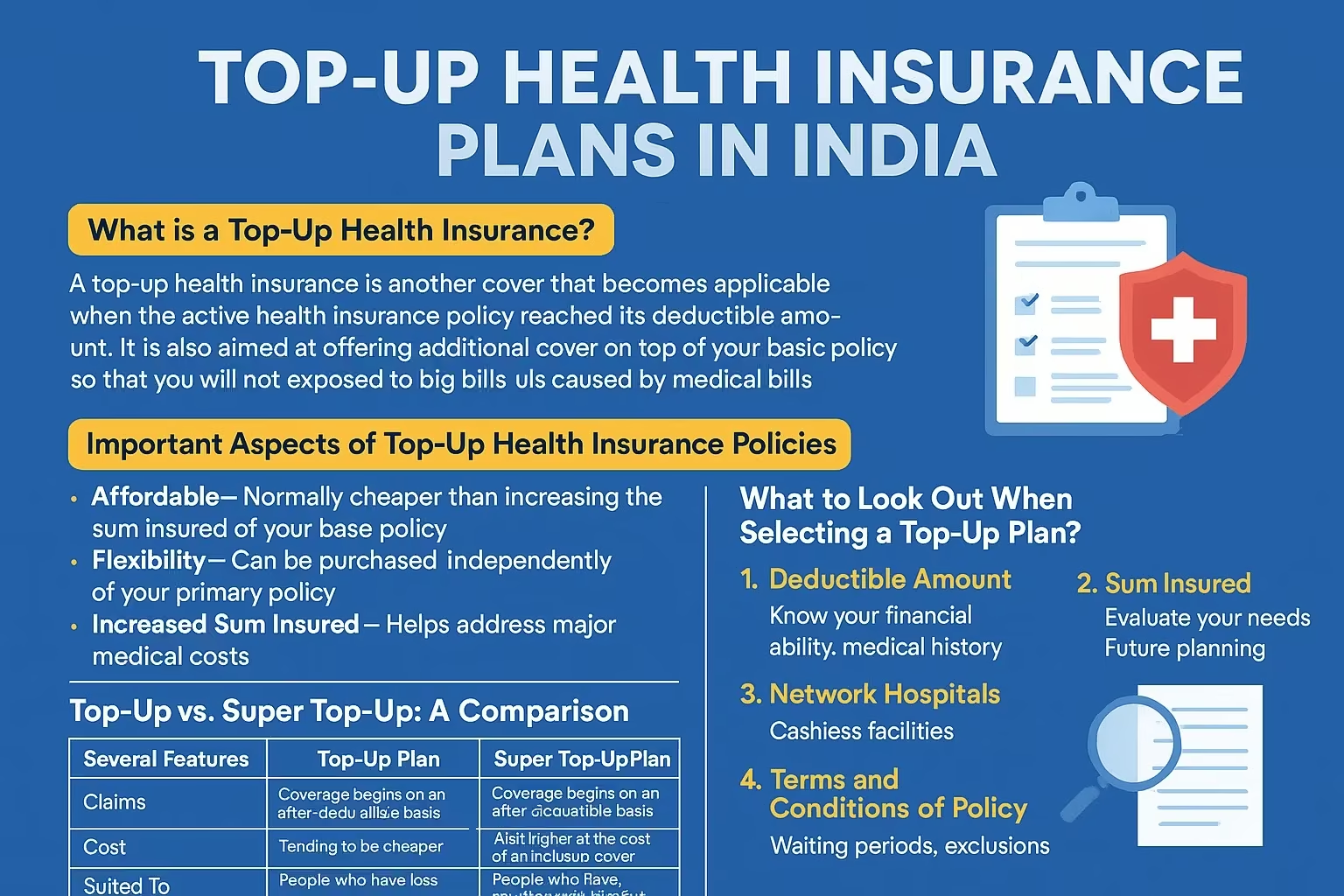

A top-up health insurance is another cover that becomes applicable when the active health insurance policy reached its deductible amount. It is also aimed at offering additional cover on top of your basic policy so that you will not be exposed to big bills caused by medical bills.

Do You Know? A deductible is the cost you are supposed to pay directly at your own expense before the top up plan pays. As an example, suppose that your deductible is INR 3 lakh, then you will be covered through a top-up plan beyond this specified amount.

Consider that you have a primary health cover of INR 5 lakh. If there is a situation of a medical emergency and the hospital bill reaches INR 8 lakh, your base policy will pay the first 5 lakh, and top-up policy might cover the rest of the 3 lakhs, on the condition that the deductible is fixed at that figure.

Pro Tip: It is always good to make sure that the amount of deductible is something that you can afford to pay out of your pocket.

Even though both top-up and super top-up plans serve to cover something extra, they work in different ways as far as claims are concerned.

| Several Features | Top-Up Plan | Super Top-Up Plan |

|---|---|---|

| Claims | Coverage begins on an after-deductible basis per claim | Coverage begins on an after-deductible basis of the total claims in a policy year |

| Cost | Tending to be cheaper | A bit higher at the cost of an inclusive cover |

| Suited To | People who have less anticipated claims | People who have multiple or recurring claims |

Expert Insight: You might be planning to have more than one hospitalization or an ongoing treatment, and then a super top-up might provide stronger financial backup.

Did You Know? The super top-up plans are becoming attractive because they allow covering the accumulated costs; hence, the families favor this option.

Pro Tip: Never overlook the fine print of the policy document because such a document contains the terms and conditions.

Professional Tip: In case you are using employer-provided health insurance, a top-up plan may be secure insuring against any foreseen healthcare cost.

Top-up health insurance plan is one that covers a single claim that is more than the amount of the deductible whereas super top-up plan takes into account the sum of all the claims in a policy year that are more than the amount of deductible.

Top-up plans are low cost due to the fact that the policy holder has to first pay a deductible amount before the plan is eligible to cover the other expenses unlike regular plans that cover the expense at the first rupee.

Step 1: Research and Compare

Step 2: Base Policy Review

Step 3: Application Process

Step 4: Medical Examination

Step 5: Receive Policy Document

🧾 Pro Tip: Keep your policy documents handy and review them periodically.

Yes, but it is advisable to have a base policy.

Yes, after the waiting period as per insurer.

What are the tax advantages of a top-up medical policy? Section 80D allows deduction of ₹25,000 (individual) and ₹50,000 (senior citizens).

Can I change my top-up plan to super top-up? Yes, but check for premium and term changes.

How long does it take for a top-up plan to become active? Usually 15 to 30 days depending on the insurer.

Are there limits on the number of claims? No, but the deductible applies on each claim.

Top-up health insurance covers provide a convenient way of improving your medical cover without putting a strain on your pocket. They can be a great addition to the policy that you currently have and give you the comfort against medical bills that can be unexpected. With the help of the insight into the peculiarities of these plans, you can make right decisions and safeguard your financial health.

The plan won’t pay. Covered by base policy or paid out-of-pocket.

Yes, but each will have a separate deductible.

Yes, some top-up plans may include co-payment terms.

Yes, subject to insurer’s terms and IRDAI rules.

Yes, such as specific illnesses, treatments, and procedures. Always read the policy document.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).