Last updated on: September 19, 2025

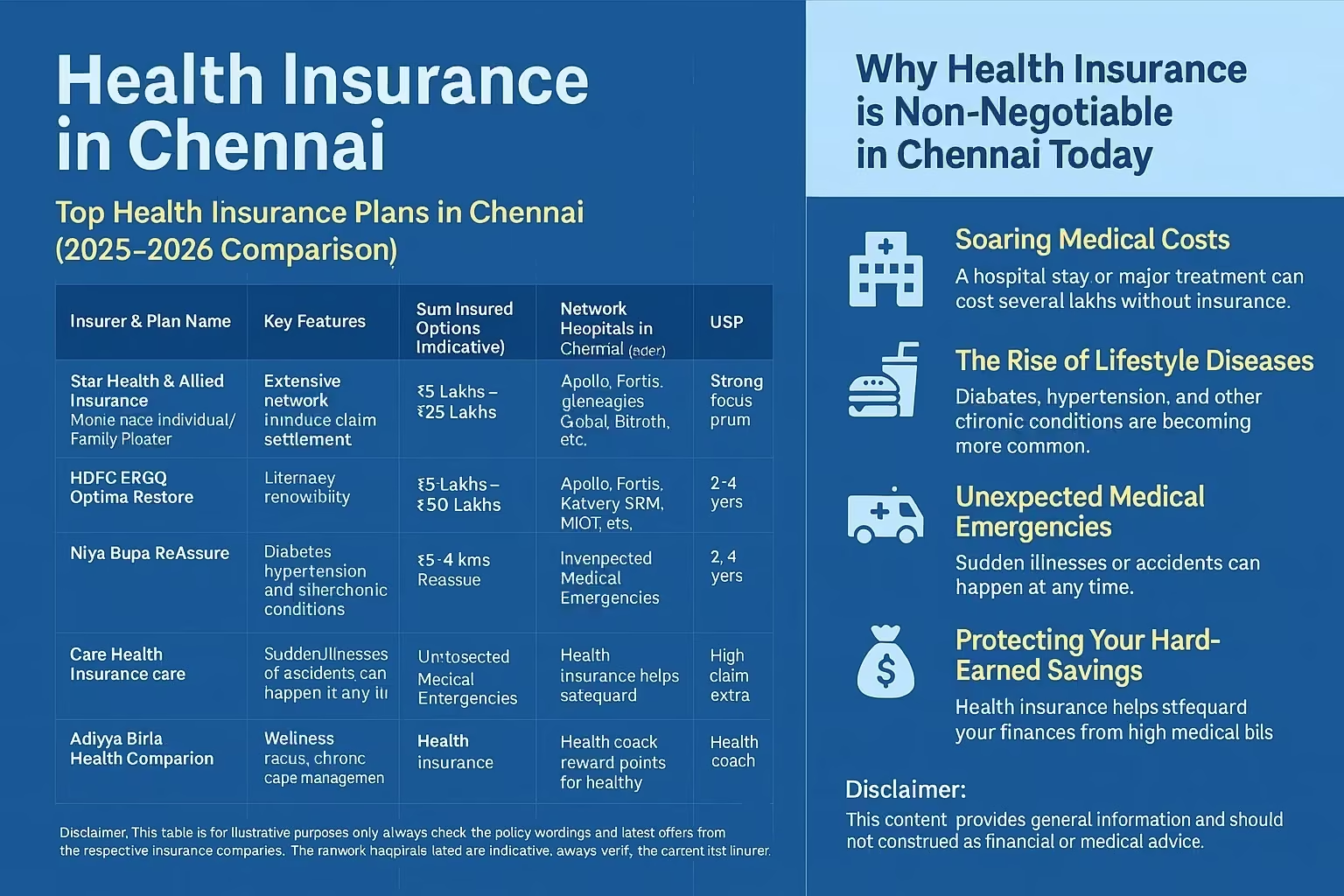

Here’s a comparison of some popular health insurance plans that are well-regarded and widely available in Chennai. Please note: Policy features and premiums can change. Always verify the latest details directly with the insurer.

| Insurer & Plan Name | Key Features | Sum Insured Options (Indicative) | Network Hospitals in Chennai (Indicative) | Waiting Period (PED) | Unique Selling Proposition (USP) |

|---|---|---|---|---|---|

| Star Health & Allied Insurance - MediClassic Individual/Family Floater | Extensive network, in-house claim settlement, automatic restoration. | ₹5 Lakhs - ₹25 Lakhs | Apollo, Fortis, Kauvery, SIMS, MIOT, etc. | 2-4 years | Strong presence in South India, excellent cashless network. |

| HDFC ERGO Optima Restore | Restore benefit, lifetime renewability, good for families. | ₹5 Lakhs - ₹50 Lakhs | Apollo, Fortis, Gleneagles Global, Billroth, etc. | 2-4 years | Automatic restoration of sum insured, wide network. |

| Niva Bupa ReAssure | ReAssure benefit (doubles sum insured), Live Healthy rewards. | ₹5 Lakhs - ₹1 Crore | Apollo, Fortis, Kauvery, SRM, etc. | 2-4 years | Industry-first “ReAssure” benefit for extended coverage. |

| Care Health Insurance - Care Plan | High sum insured options, no-claim bonus super. | ₹5 Lakhs - ₹75 Lakhs | Apollo, Billroth, SIMS, Kauvery, Madras Medical Mission, etc. | 2-4 years | High claim settlement ratio, broad coverage options. |

| Bajaj Allianz Health Guard | Robust network, wellness benefits, personal accident cover option. | ₹3 Lakhs - ₹50 Lakhs | Apollo, SRM, MIOT, Vijaya Hospital, etc. | 2-4 years | Strong brand, good for family floaters. |

| ManipalCigna ProHealth Plan | Comprehensive coverage, global network option (add-on). | ₹4.5 Lakhs - ₹1 Crore | Apollo, Fortis, MIOT, Billroth, Kauvery, etc. | 2-4 years | Extensive coverage, wellness programs, high claim settlement. |

| Aditya Birla Health Insurance - Activ Health | Wellness focus, chronic care management program. | ₹2 Lakhs - ₹2 Crore | Apollo, Fortis, Kauvery, Gleneagles Global, etc. | 2-4 years | Health coach, reward points for healthy lifestyle. |

| Max Bupa Health Companion | Extensive cashless network, loyalty additions, comprehensive. | ₹3 Lakhs - ₹1 Crore | Apollo, Fortis, Kauvery, SRM, MIOT, Vijaya Hospital, etc. | 2-4 years | Strong focus on customer service, good for families. |

Disclaimer: This table is for illustrative purposes only. Always check the policy wordings and latest offers from the respective insurance companies. The network hospitals listed are indicative; always verify the current list directly with the insurer.

Chennai, a bustling metropolis and a medical hub, is a city where life moves fast, and so do healthcare costs. From the aroma of filter coffee filling the morning air to the vibrant buzz of T. Nagar, Chennai offers a unique blend of tradition and modernity. However, beneath its charm lies a crucial reality: quality healthcare, while readily available, comes with a significant price tag. This is precisely why having robust health insurance in Chennai is not just a smart choice, but an absolute necessity for every individual and family.

This comprehensive guide is crafted specifically for Chennaiites, in a friendly, human-written Indian local English style. We’ll delve deep into why health insurance is indispensable, what to look for, how to choose the right plan, and answer all your burning questions about securing your health and finances in this dynamic city.

Let’s get real. Life in Chennai is about balancing work, family, and perhaps a weekend trip to Mahabs. Health often takes a backseat until something unexpected happens. Here’s why health insurance is your best mate in such situations:

Chennai boasts some of the best hospitals in India – think Apollo, Fortis, MIOT, Kauvery, SIMS, Gleneagles Global, and many more. While their medical expertise is world-class, the cost of treatment can leave a gaping hole in your savings. A basic hospital stay can run into several thousands, and a major surgery or treatment for a critical illness can easily cross several lakhs. Without insurance, you’re looking at draining your lifetime savings in a heartbeat.

With our busy schedules, sometimes less-than-healthy food choices (who can resist that crispy vada and strong filter coffee?), and sedentary lifestyles, Chennai is seeing a surge in lifestyle diseases. Diabetes, hypertension, heart ailments, and obesity are becoming increasingly common. These chronic conditions require continuous monitoring, expensive medications, and often, repeated hospital visits. A good health insurance policy covers these ongoing expenses, providing much-needed financial relief.

Life is full of surprises, and not always the pleasant kind. A sudden bout of dengue, a slip and fall resulting in a fracture, or an unforeseen cardiac event can strike anyone, anytime. In such scenarios, the last thing you want to worry about is arranging funds. Health insurance ensures you can focus on immediate and quality treatment, without the financial scramble. Imagine rushing to a hospital at 2 AM – knowing your insurance has your back is a huge relief.

Most of us work tirelessly to save for our children’s education, buying a dream home, or a peaceful retirement. A single medical emergency, especially if it’s critical, has the potential to wipe out years of dedicated saving. Health insurance acts as a robust financial shield, protecting your assets and ensuring your long-term goals remain undisturbed.

In India, health insurance premiums are eligible for tax deductions under Section 80D of the Income Tax Act, 1961. This means you can save money on your taxes while investing in your health and financial security. It’s a double benefit!

Disclaimer: This content provides general information and should not be considered financial or medical advice. Always consult with a qualified financial advisor or insurance expert before making purchasing decisions. Policy features, terms, and conditions are subject to change by the respective insurance companies. Refer to the official policy documents for definitive information.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).