Last updated on: September 19, 2025

Many people face the challenge of not having health insurance when they need medical care. This can lead to huge medical bills, stress, and worry about getting proper treatment. Health insurance helps reduce these problems. It ensures that even if someone gets sick or hurt, they won’t have to pay a lot of money on their own. Plus, knowing you’re covered can make you feel safer and less worried about the future. Having health insurance means you can focus on getting better rather than worrying about how to pay for it.

It was a rainy night in Mumbai in early 2025 when Ankit, a 31-year-old marketing manager, rushed his mother to a hospital after a sudden heart attack. Within hours, he had spent over ₹1.8 lakh just for the initial emergency treatment and ICU stay. He thought his company’s group insurance would be enough but was shocked to find it only covered a small part. According to India’s National Health Accounts 2024 report, over 65 percent of health costs are still out-of-pocket. Stories like Ankit’s are common, making one thing clear—health insurance isn’t just extra, it’s essential now.

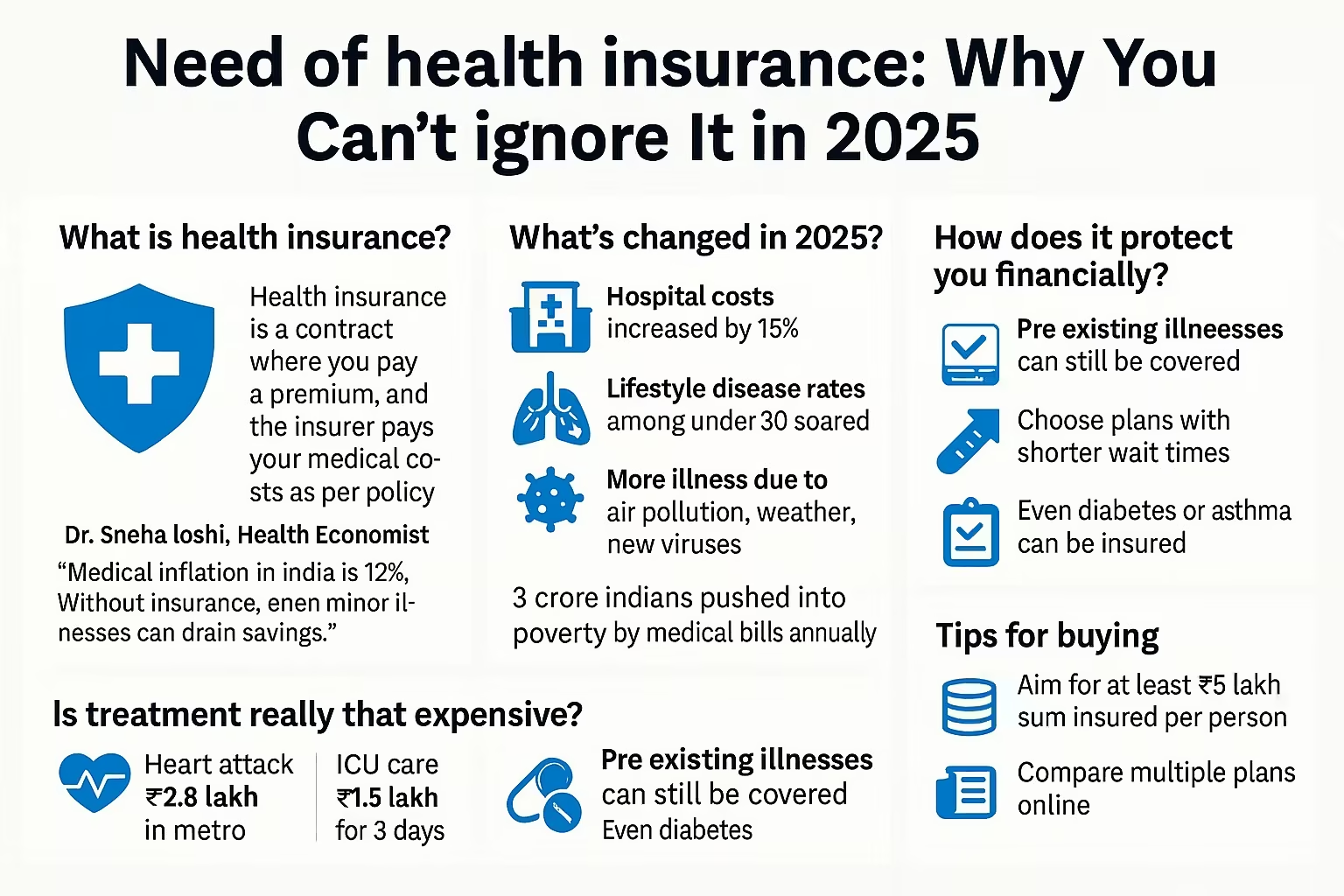

Health insurance is a contract where you pay a premium to an insurance company, and in return, they pay for your medical costs according to policy terms. It covers hospital stays, surgeries, doctor visits, medicines, and sometimes even regular checkups.

Expert Insight: Dr. Sneha Joshi, Health Economist, says: “With rising medical inflation over 12 percent yearly in India, even small illnesses can drain savings. Health insurance absorbs this shock.”

Many believe they’re healthy and young—so why rush? But 2025 presents new reasons:

Everyone. But especially:

Tip: Don’t wait for marriage or children to buy. Young buyers get better deals and fewer exclusions.

Yes. A simple appendix surgery can cost ₹70,000 to ₹1.5 lakh in a metro city. ICU care for three days? Over ₹1 lakh. Cancer can require ₹5 lakh plus in a few months.

Here’s a comparison table of average treatment costs in 2025:

| Treatment | Metro Hospital | Tier 2 City | Without Insurance Paid by Family |

|---|---|---|---|

| Heart Attack | ₹2.8 lakh | ₹1.7 lakh | 100 percent upfront |

| Covid or Flu ICU | ₹1.5 lakh | ₹75,000 | 100 percent upfront |

| Gall Bladder Surgery | ₹90,000 | ₹55,000 | 100 percent upfront |

Depending on your plan, insurance can cover:

Expert Advice: Always check the ‘Sum Insured’ and what room category is covered to avoid payment surprises.

Even with insurance, some expenses may not be covered. These are called out-of-pocket expenses, such as:

To minimize, choose:

“Medical bills aren’t predictable. Even a short hospital stay can surprise you,” says Priyanka Mehra, financial planner.

Many people think they can’t get insurance if they already have an illness. But it’s possible. Insurers now offer:

How to improve your coverage:

It’s hard but not impossible to insure the elderly. In 2025:

Features for seniors:

“Buying early is best. But late is better than never,” shares Ramesh Khanna, insurance advisor.

Shopping for insurance can be confusing. Focus on:

“Check claim settlement history. Companies with claims paid above 90 percent are preferable,” suggests insurance expert Neha Raj.

| Feature | Individual Plan | Family Floater |

|---|---|---|

| Covers | 1 person | Multiple family members |

| Sum Insured | Fixed per person | Shared among all members |

| Cost | Higher for many individuals | Cheaper for young small families |

You need at least ₹5 lakh cover per person in cities. For families, pick ₹10 lakh to ₹15 lakh, or choose a base cover plus super top up plan.

Steps to calculate:

“Even Rs 1 crore health insurance is affordable if you take super top up plans,” says Rahul Suri, founder of a health startup.

Yes. Many 2025 policies now include:

Absolutely. Under Section 80D of the Income Tax Act:

This reduces your overall taxable income.

“Tax savings are a bonus, but don’t buy just for that. Focus on real medical risks,” cautions C.A. Pravin Agrawal.

After the Covid pandemic, most insurers have started covering:

Some even include home care benefits for less severe cases.

The fastest and most accurate way is to use online health insurance comparison sites. Fincover.com lets you:

Benefits of applying online:

“Digital buying gives more transparency and helps avoid agent bias,” says digital insurance trainer Sunil Pandey.

Thanks to new portability rules, you can:

Just avoid gaps in coverage during the switch.

In 2025, about 90 percent of big hospitals offer cashless claim facilities.

Here’s how it works:

If you use a non network hospital, pay the bill yourself. Then:

“Always keep copies and records. Digital apps can store all your documents safely,” recommends Aditya Shetty, health claims consultant.

Claims may be delayed or denied if:

To avoid:

Some think insurance is just for old age. But:

“Healthy does not mean invincible. Early coverage builds a safety net,” shares Dr. Ashok Nair, family physician.

Group plans offered by companies are helpful but limited. Drawbacks:

Having a personal plan ensures:

No. Most policies do NOT cover:

Always check policy wordings and compare add ons for special needs.

Beyond paperwork and premiums, health insurance in 2025 is confidence. It lets families focus on recovery, not bills, when emergencies happen.

Longer life expectancy, pollution, unpredictable disease outbreaks, and growing medical costs all make it a necessity, not a luxury.

“Financial safety and health go hand in hand today. Start small—but start now,” urges Gayathri Viswanath, a public health policy analyst.

If you don’t have a health plan:

If you already have one:

Don’t wait for a crisis to realize it’s too late. Health insurance in 2025 is a basic household need. Taking action today can help you stay secure through whatever the future brings.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).