Last updated on: September 19, 2025

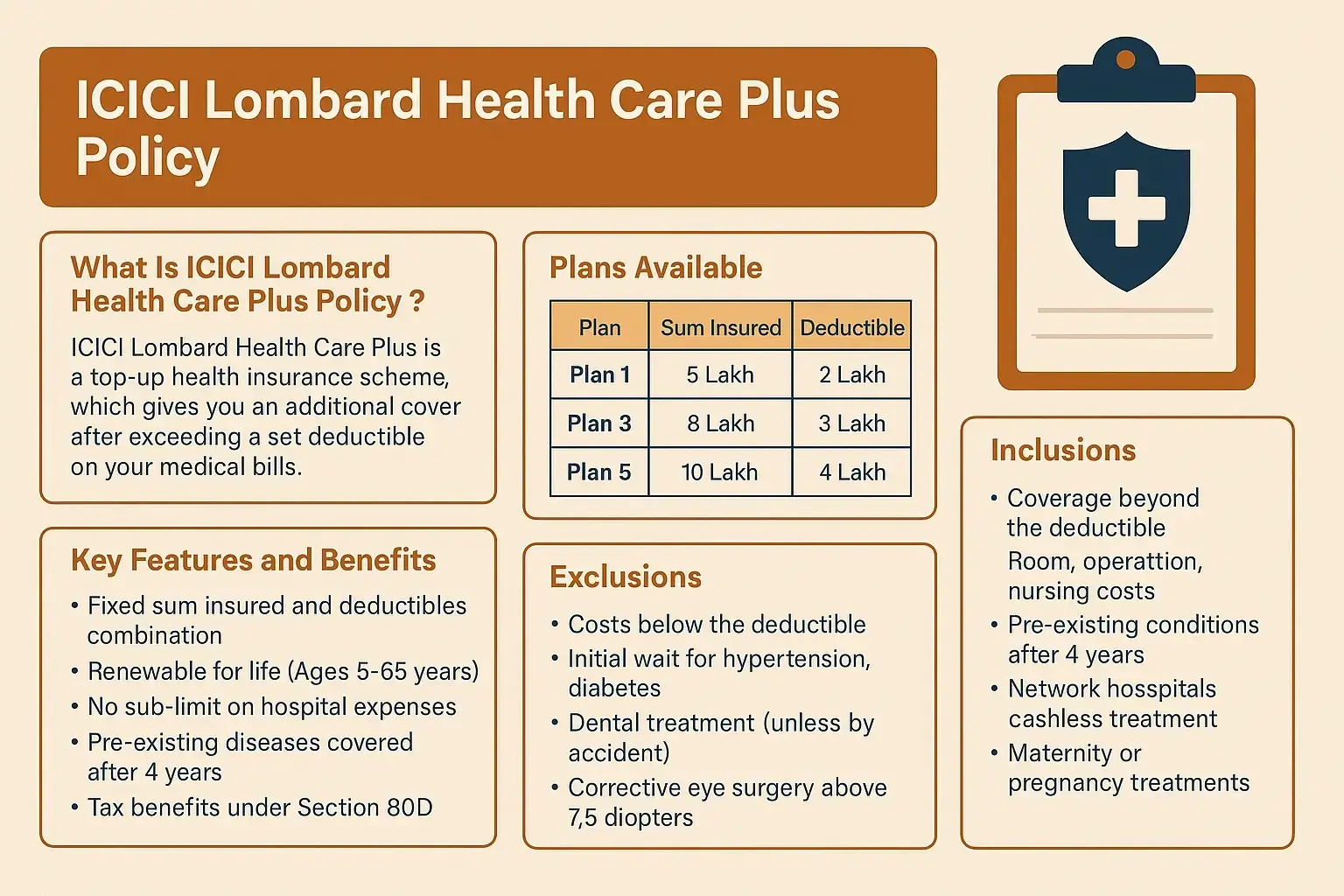

ICICI Lombard Health Care Plus is a top-up health insurance policy designed to cover large medical expenses once a defined deductible is crossed. With sum insured options of ₹5L, ₹8L, and ₹10L, and deductibles starting from ₹2L, this plan offers flexibility for individuals and families. It includes no copayment, no sub-limits on room rent, and covers pre-existing diseases after 4 years. Ideal for people with employer coverage or limited base plans, it helps reduce premium costs while expanding financial protection. The plan is renewable for life and offers tax benefits under Section 80D.

The majority of health insurance takes reasonable care of you, yet occasionally, a single hospital charge can surpass your overall base cover. This is where the ICICI Lombard Health Care Plus Policy comes in.

Health Care Plus is an addition of a safety cushion whether you already have a base plan or not. It comes in when your health costs surge past a particular threshold, known as a deductible. Therefore, after that, this plan takes over the bill instead of you paying the extra out of pocket.

ICICI Lombard Health Care Plus is a top-up health insurance scheme, which gives you an additional cover after exceeding a set deductible on your medical bills. You can purchase it without having a base policy making it flexible to individuals who want to avoid costly hospital expenses.

To illustrate, say you have a base policy of two lakh and your hospital bill amounts to six lakh, base plan will pay two lakh, and Health Care Plus will pay the remaining four lakh, assuming you have a deductible so structured.

It is a very good option to those who are self-employed or elderly citizens, or anyone desiring to have their health cover broadened without making their premiums proportionately bigger.

| Plan Name | Sum Insured | Deductible | Approx. Annual Premium (with GST) | Waiting Period |

|---|---|---|---|---|

| Plan 1 | ₹5 Lakh | ₹2 Lakh | ₹4720 to ₹12744 | 30 to 90 days for general illness, 48 months for pre-existing |

| Plan 3 | ₹8 Lakh | ₹3 Lakh | ₹3245 to ₹8762 | Same as above |

| Plan 5 | ₹10 Lakh | ₹4 Lakh | ₹2360 to ₹6372 | Same as above |

Note: Premium varies depending on the tenure and plan selected. The policy is available for one or two-year durations.

Traditional wellness programs are not mentioned in this plan, but its main strength is cost effectiveness. Your relatively affordable premium can insure you against major hospital bills. It works best with a minimum health insurance scheme or a cover offered by the employer.

Pro Tip: Young career earners who may own a simple corporate health cover solution may combine this plan to receive up to ten lakh of extra cover at a much cheaper premium level than the plain cover policy.

ICICI Lombard enables you to surrender the policy by receiving a pro-rata refund, depending on the tenure of the policy. The product offers a free-15 days look to receive full refund in case of unsatisfaction.

Steps:

Note: Any claims already made or in process will have effects on the refunds.

It is easy, quick, and transparent to purchase a policy under Fincover.

Real Story

Ajay, age 35, software engineer already had a three lakh corporate health policy. He took Health Care Plus Plan 5 with four lakh deductible, 10lakh sum insured, about six thousand a year. Year later, he had to undergo an operation (which cost 6.5 lakh), and his base plan reimbursed three lakh, and the remaining amount was reimbursed by the top-up plan.

It is the limit you are obliged to pay or cover under an alternative plan before this policy becomes active. To illustrate this, in case your deductible is three lakh, this policy will only cover you when your hospital bill is above three lakh.

It is true. The deductible is still there and you will be required to pay that sum immediately out of pocket in the event of a claim.

Yes, they are insured following four years of continuous policy covering ICICI Lombard.

No. The room rent, hospital charges, diagnostic tests, and consultation fee have no sub-limits.

Yes, when every claim is more than the deductible amount. When there are more than one claim made, and none of them surpass the deductible, the policy will not pay.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).