ICICI Lombard Health Booster Plan

Medical bills never announce themselves, they burst in at the most unexpected moment. They barge in when you’re not at all prepared. Although you may have a basic health insurance coverage, you will still find it insufficient in the event of substantial or repeated hospitalizations within a single year. Enter the ICICI Lombard Health Booster Plan—a top-up cover that triggers once the primary limit is reached, leaving your base coverage and your wallet unscathed. Far from a standard health plan, this one acts as your medical safety net. Irrespective of whether you carry a small corporate policy, a modest family plan, or have nothing at all, Health Booster can run in tandem with these coverages—or function on its own—to absorb substantial medical expenses.

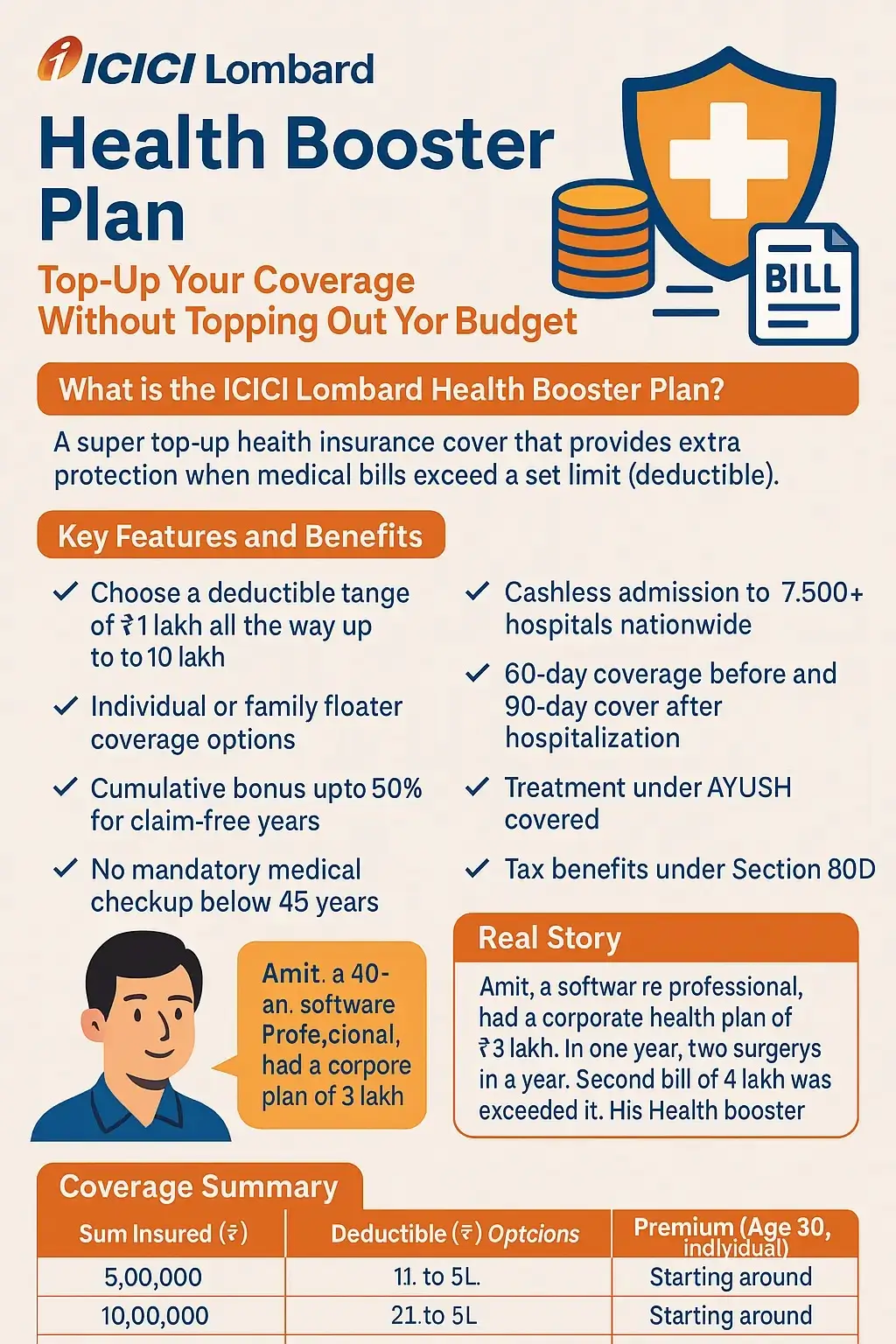

What is the ICICI Lombard Health Booster Plan?

ICICI Lombard’s Health Booster Plan functions as a super top-up health insurance cover. It offers extra financial protection whenever your medical bills surpass a predetermined limit known as the deductible. You can set this limit anywhere from ₹1 lakh to ₹2 lakh and even opt for a higher threshold—whatever option you pick. In contrast with conventional top-up policies, Health Booster does not depend on a single claim. It factors in the yearly sum of medical expenses incurred. Even with several hospital admissions, once the sum of your medical bills surpasses the deductible, the plan starts offering coverage.

Key Features and Benefits

- Choose a deductible range of ₹1 lakh all the way up to ₹10 lakh.

- One can opt for coverage on an individual or a family floater basis.

- Cumulative bonus of 10% for every claim-free year, up to a total of 50%

- There is no mandatory medical checkup for individuals below 45 years of age with a clean medical history.

- Cashless admission to more than 7,500 hospitals nationwide.

- Daycare procedures are covered without any sub-limit.

- 60-day coverage before and 90-day cover after hospitalization

- Coverage for treatment under AYUSH is also provided.

- The sum insured can be reset just once within a policy year.

- In addition, earn tax benefits under Section 80D of the Income Tax Act.

Real story: Amit, a 40-year-old software professional, had a corporate plan of ₹3 lakh. In one year, he had two surgeries. The first bill of ₹2.5 lakh was handled by the corporate plan. The second bill of ₹4 lakh exceeded it. His Health Booster Plan kicked in after the ₹2 lakh deductible, paying ₹2 lakh—and saving him from dipping into his savings.

Coverage Summary

| Sum Insured (₹) | Deductible (₹) Options | Premium (Age 30, Individual) | Waiting Period for Pre-Existing Conditions |

|---|---|---|---|

| 5,00,000 | 1L to 5L | Starting around ₹3,500 | 2 years |

| 10,00,000 | 2L to 5L | Starting around ₹4,500 | 2 years |

| 20,00,000 | 3L to 7L | Starting around ₹5,500 | 2 years |

| 30,00,000 | 5L to 10L | Starting around ₹6,900 | 2 years |

| 50,00,000 | 5L to 10L | Starting around ₹9,400 | 2 years |

How Does the Deductible Work?

The amount you pay out of pocket before your insurance starts is known as your deductible. This is a choice you make at the time of purchase.

For instance:

You select a plan with a ₹10 lakh sum insured and a ₹3 lakh deductible.

- The policy will not cover a hospitalization bill of ₹2 lakh because it is less than the deductible.

- The policy will pay ₹2 lakh if your annual hospital expenses exceed ₹3 lakh, say ₹5 lakh.

Choosing a deductible that corresponds to the coverage of your current policy or the highest amount you are able to pay out of pocket is crucial.

Inclusions

- Costs associated with inpatient hospitalization

- 60-day pre-hospitalization costs

- 90-day post-hospitalization costs

- Daycare treatments (like chemotherapy, dialysis, and cataracts)

- Expenses for organ donors

- AYUSH therapies

- Charges for ambulances (up to specified limits)

- The amount insured gets reset once during a policy year.

- Family floater option with parents, dependent children, spouse, and self

- Bonus accumulation for years without a claim

- Settlement of direct claims at network hospitals

Exclusions

- Any medical costs that fall below the selected deductible

- Illnesses (apart from accidents) acquired during the first 30 days

- Aesthetic or cosmetic procedures

- Costs associated with maternity and childbirth

- Treatment for infertility

- Unless it’s related to an injury, dental and vision

- Treatment for substance or alcohol abuse

- Adventure sports injuries or self-harm

- Pre-existing conditions during the first two years

Waiting Periods

- The first waiting period, excluding unintentional hospitalization, is 30 days from the start of the policy.

- Specific illnesses: a two-year waiting period is applicable to a predetermined list of conditions; pre-existing diseases: covered after two years of continuous coverage

- Reset benefit: Only activated once during a policy year, when the base sum insured has been depleted.

Buying the ICICI Health Booster Plan Through Fincover

Fincover makes it simpler than ever to obtain a top-up policy like Health Booster. Here’s how to do it:

- Go to the Fincover website and select “Health Insurance.”

- Select “Top-Up Health Plans.”

- Choose “Health Booster” after applying the ICICI Lombard filter.

- Provide your information, including your age, city, family size, and the amount insured by your current policy.

- Select the deductible amount in accordance with your affordability or current coverage.

- Choose the amount insured (₹5L to ₹50L) based on your tolerance for risk.

- Examine premium quotes and, if available, include any extra benefits.

- Use a card, net banking, or UPI to safely pay.

- Instantly receive the e-policy via email.

Real user tip: Kavitha, a 36-year-old Bangalore HR executive, purchased a ₹20 lakh Health Booster plan with a ₹3 lakh deductible through Fincover. She needed less than ten minutes. She now has high-value coverage for less money each month than she could have spent for one meal out.

Who Should Consider Health Booster?

- Individuals seeking extra support for their corporate health insurance policy

- Families who wish to add major illness coverage without raising the base premium

- People who want extensive illness protection but can afford modest hospital bills

- Seniors who require a large sum insured with reduced premiums but already have a modest individual policy

FAQ on ICICI Lombard Health Booster Plan

Is it possible to purchase this plan without a base policy?

Indeed. Even without any other insurance, you can purchase Health Booster. However, in the event of a claim, you will be responsible for paying the deductible amount out of pocket.

Is it possible to submit more than one claim in a year under the plan?

Yes, provided that the total number of claims exceeds the deductible. In the event that you use it up, you also receive a one-time reset of the insured amount.

Can I later raise the amount insured?

Yes, subject to underwriting approval, you may request a change in the sum insured at renewal.

Does the annual deductible change?

Indeed. A new deductible limit is set at the beginning of each policy year. Any additional costs incurred over the course of a year are covered.