Last updated on: September 19, 2025

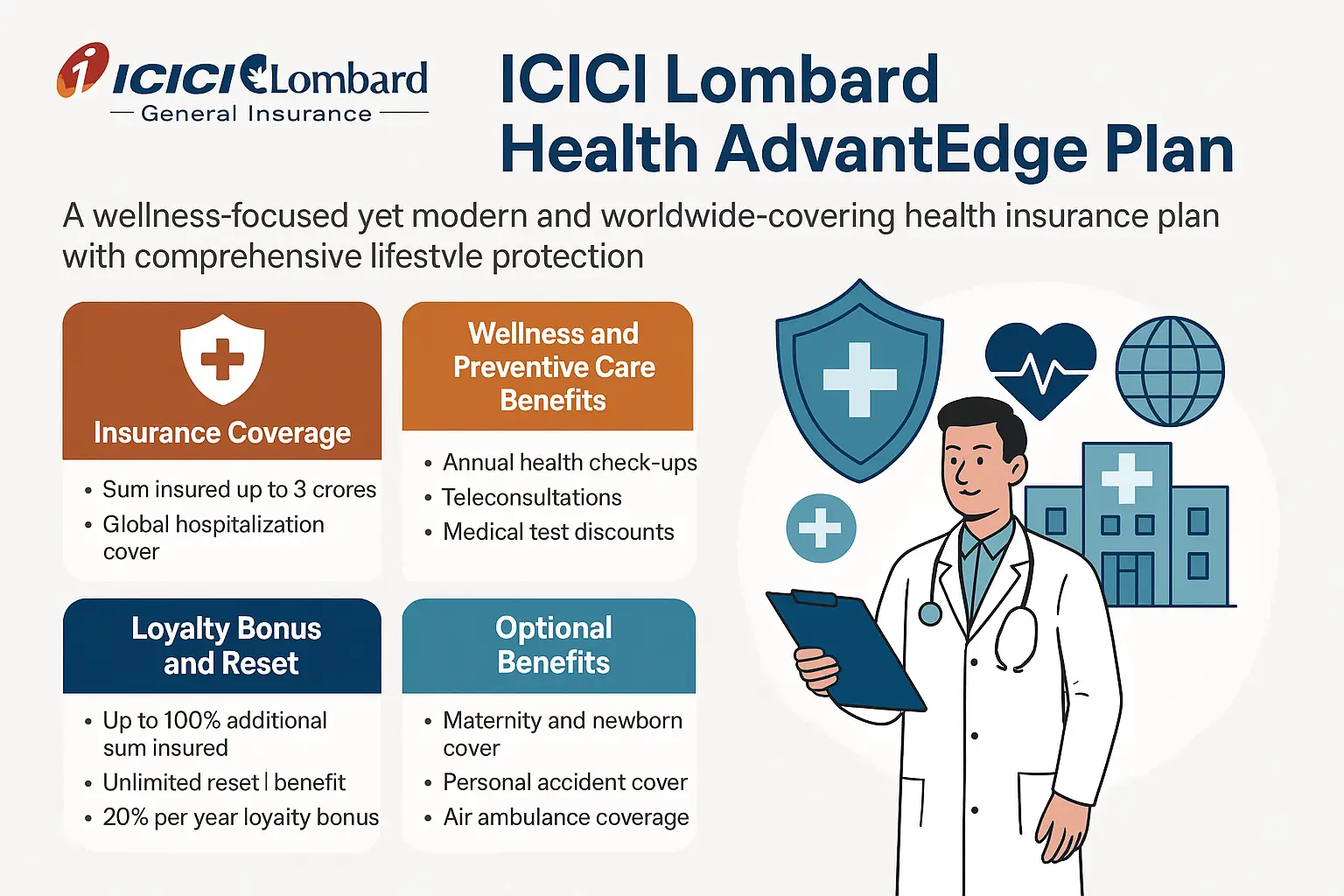

In 2025, healthcare is not only about paying hospital bills. It is about care and prevention, early diagnosis, new therapies and the proper care at the most crucial time possible. This is just what the ICICI Lombard Health AdvantEdge Plan offers. It is not only a health insurance plan. It is an all-out lifestyle protection program established to cater to individuals who desire optimum welfare and wellness of themselves and their families. It is a wellness-focused yet modern and worldwide-covering product that reinvents what full health protection is.

The Apex Plus Plan is covered under the benefit of Health AdvantEdge premium plans of ICICI Lombard. It has extensive cover of five lakh to three crore and covered with features such as hospitalisation, wellness benefits, coverage of modern treatments, teleconsultation, maternity, newborn care, loyalty bonuses and even cover of global hospitalisation in case of high sum insured.

It is designed to meet the needs of working professionals, families with increasing needs, and to the global citizens seeking an Indian coverage with a worldwide flexibility.

| Sum Insured Options | Key Benefits | Notable Features |

|---|---|---|

| 5 to 20 Lakh | Single private room, cashless in India | Reset once per year, domestic cover only |

| 25 to 300 Lakh | No cap on room rent, worldwide hospitalization | Unlimited reset, worldwide emergency and planned cover |

The program comprises a comprehensive wellness program which promotes healthy lifestyle and incentives good behavior. You can accumulate wellness points by being healthy, consuming services with the IL TakeCare app and engaging in preventive care services. They can be spent on medicines, diagnostics, or a visit to a doctor.

Also included:

This is a plan that is characterized with a rich reset benefit. Once you have used your sum insured, when claiming, the sum insured is replaced again to use in future unrelated claims on the same year. It is a no limitation or annual reset feature available on any plan except five lakh and seven point five lakh plan where reset is possible once in a year.

When you go without a claim, Loyalty Bonus will add twenty percent to your sum insured, by the end of the bonus period, it can add one hundred percent. There is no reduction of your bonus unlike some of the policies even in case you make a claim.

You get to customize your plan by going with add-ons:

Case Study Sneha (34 years), marketing manager, Mumbai, acquired maternity and newborn cover to her Apex Plus Plan. By the time her second child was born in 2024 the cost of hospitalization had come up to over one lakh, and not only was it covered under the plan, the baby was given the required vaccinations.

There are a couple of exclusions just like any other plan:

ICICI Lombard provides a standard procedure if you wish to terminate your plan:

Using Fincover, Ramesh from Bengaluru purchased the plan for his family of four. He selected a twenty-lakh sum that was paid for with EMIs and covered by maternity and critical illness add-ons. From quote to policy confirmation, the digital process only took fifteen minutes.

Is worldwide coverage offered by this plan?

Yes, after a two-year waiting period, plans with a sum insured of at least 25 lakh are eligible for worldwide coverage.

How often can I use the reset benefit, and what is it?

For unrelated illnesses, reset enables full sum insured restoration. With the exception of the five and seven point five lakh sum insured options, which are only permitted once a year, it can be used an unlimited number of times for all plans.

Are maternity and newborn costs covered by this plan?

Yes, but only if you choose to add the maternity option. It includes first-year vaccinations, hospitalization of the newborn, and delivery

How does the system of wellness points operate?

Using the IL TakeCare app and maintaining your health earns you points. These can be exchanged for medications, diagnostic tests, and doctor visits.

Are there any sublimits or copayments?

Unless you choose it as an optional discount, there is no need for a copayment. There are no restrictions on certain diseases or room rent.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).