Last updated on: September 19, 2025

Imagine a health insurance plan that adapts to your life. One that grows with your family, expands your coverage every year, and even offers unlimited claims. That’s not a dream—it’s exactly what the ICICI Lombard Elevate Plan is designed to deliver.

Elevate is not just another insurance policy. It’s a next-generation plan built for today’s realities and tomorrow’s possibilities. It blends infinite protection with smart tech, custom add-ons, and wellness tools. Whether you’re a first-time buyer or a seasoned policyholder looking for deeper, more dynamic coverage, Elevate could be the right fit.

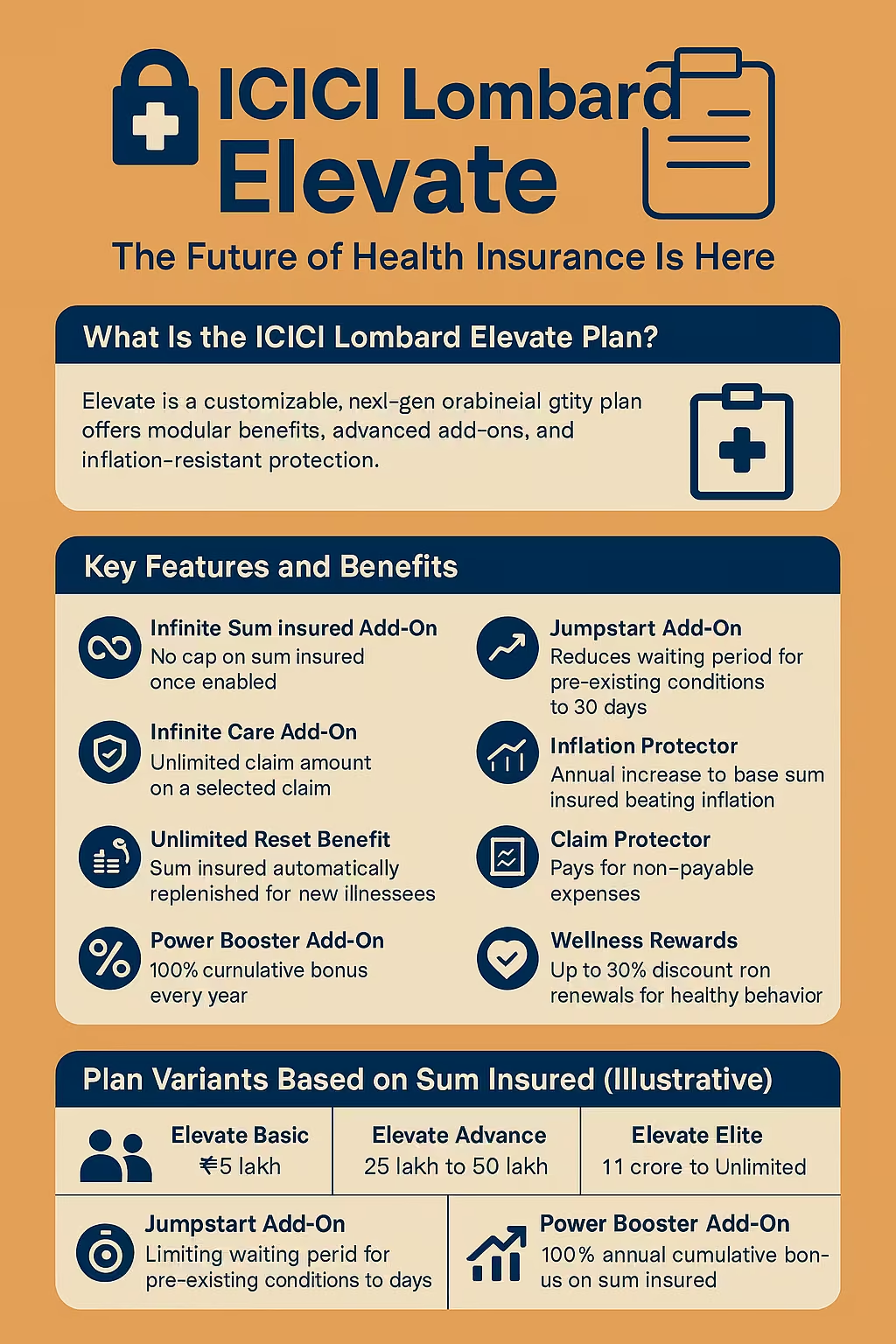

Elevate is a customisable, next-gen health insurance plan that offers modular benefits, advanced add-ons, and inflation-resistant protection. With features like infinite sum insured, reset benefits, OPD coverage, wellness discounts, and one-time unlimited claim protection, it redefines what modern insurance should feel like.

Built for families, individuals, and long-term care planners, Elevate allows you to go beyond traditional limitations. You can reduce waiting periods, protect against rising healthcare costs, and even digitise your outpatient treatments.

Did You Know?

Elevate is among the first health plans in India to offer both “infinite claims” and “infinite coverage” under dedicated add-ons. That means you can literally go beyond limits—something unheard of in most plans.

Combine Infinite Sum Insured with Claim Protector and you create a zero-worry hospital experience. You don’t have to monitor limits, read fine print, or get stuck with hidden costs.

| Plan Name | Sum Insured Options | Reset Benefit | Add-On Availability | Unique Feature |

|---|---|---|---|---|

| Elevate Basic | ₹5 lakh to ₹20 lakh | One-time reset | Claim Protector, Jumpstart | Best for small families or individuals |

| Elevate Advance | ₹25 lakh to ₹50 lakh | Unlimited reset | Infinite Care, BeFit, Wellness | Higher base cover, optional OPD |

| Elevate Elite | ₹1 crore to Unlimited | Unlimited reset | Infinite Sum Insured, Power Booster | Designed for families and long-term care seekers |

Add-On Infinite Care

Pays unlimited on one claim selected, and the cover can be used during the first two policy years. Assists when a large event such as a surgical procedure or an injury occurs early in the policy.

Infinite Sum Insured Add-On

Eliminates maximum limit on your sum insured. Claims in excess of your base amount will nevertheless be paid.

Power Add-On Booster

An annual boost of 100 per cent on your sum insured, regardless of whether you make a claim or not.

BeFit OPD Add-On

Cashless coverages of OPD treatments such as consultations, diagnostics, physiotherapy, and minor procedures are done through the app.

Jumpstart Add-On

Limits the waiting period of declared pre-existing conditions ( such as diabetes or hypertension) to a mere 30 days only in certain circumstances.

Claim Protector

There are other items on the claim that would otherwise be paid out of pocket such as gloves, disinfectants, PPE kits.

Inflation Protector

Automatically increases your base sum insured to counter the cost inflation of healthcare year on year.

Expert Insight

By combining the Jumpstart and Power Booster on top of each other, you not only decrease your exposure during the early policy years, but you also increase your protection with each passing year. It is a tactical decision when you are in your 40s or when you have lifestyle-related risks.

Fincover makes it simpler to purchase Elevate. It is 100 percent digital, quick and customisable.

Steps:

Real Story

Vineet is a 38-year-old Hyderabad-based IT manager who opted to have Elevate Advance with a cover of 25 lakh and the additional Infinite Sum Insured and BeFit. He is now enjoying teleconsultation via the IL app, saved 2000 last year towards OPD expenses and feels relaxed that any serious hospitalisation will not affect his savings.

Is Elevate superior to an ordinary health plan?

Of course, particularly when you need superior protection, optional OPD, increasing cover, and flexibility. Elevate provides you with greater control than historical policies.

Am I allowed to take Elevate even when I have another plan?

Yes. Elevate may be your main or second plan. It is also convenient with both new and experienced policyholders.

How can one compare Infinite Sum Insured and Infinite Care?

All the claims are covered by Infinite Sum Insured. Infinite Care entitles you with unlimited coverage of one claim of your choice during the first two years.

Is the cost of premiums increasing when I get all add-ons?

Yes, but they are still economical considering that one would need to purchase several policies in each need. You will pay more but you will receive exponentially more benefits.

Is it possible to port to Elevate?

Yes. Portability is offered on an underwritten basis and when a customer transfers to Elevate, the waiting period benefits can be transferred.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).