Last updated on: September 19, 2025

Health insurance claims may be rejected for various reasons, often due to administrative errors, policy exclusions, or unmet requirements. Common causes include incorrect or incomplete information on claim forms, which can lead to processing delays or outright denials. Claims may also be rejected if they are filed outside of the allowable time frame set by the insurer. Coverage issues, such as services not included in the policy or treatments deemed medically unnecessary, are frequent rejection factors. Additionally, claims might be denied if prior authorization from the insurer was not obtained or if the policyholder has not met their deductible. Understanding these potential pitfalls can help policyholders navigate the complexities of insurance claims and improve the likelihood of approval.

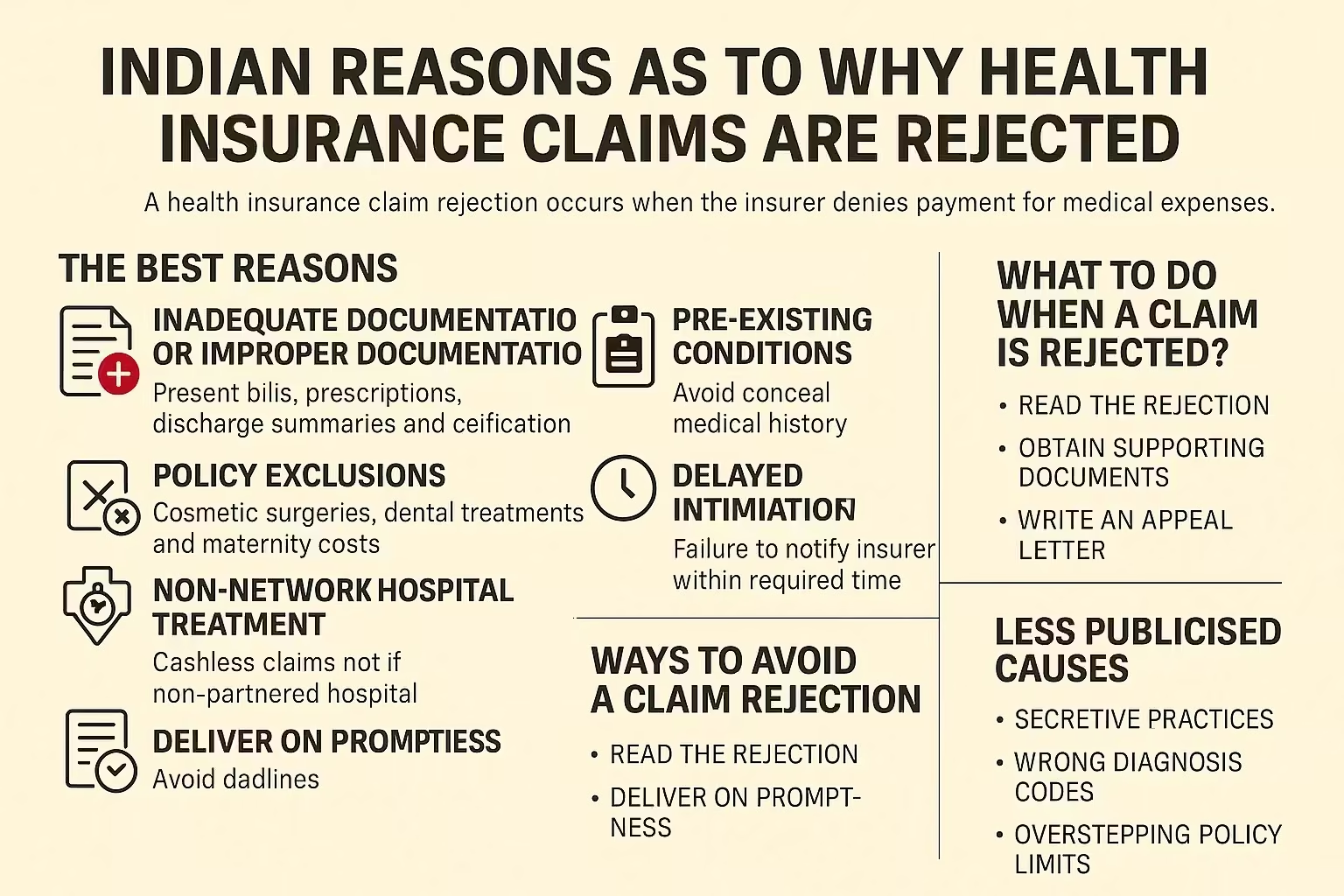

In India, health insurance is extremely vital since it gives essential financial security against medical emergencies. Yet, the process of going through claims may be a complicated one, particularly in case of rejections. The reasons as to why your health insurance claims are rejected may assist you in preventing the traps and make sure that your claims are accepted.

As part of this detailed guide, we have deconstructed the most frequent causes of claim denials, what to do to prevent them, and personal advice of experts on a trouble-free claim process.

The situation where your insurance company refuses to pay or compensate medical expenses received is called a health insurance claim rejection. This normally occurs when your claim does not match with the terms and conditions of your policy.

During the year 2021, the Insurance Regulatory and Development Authority of India (IRDAI) ranked the health insurance claim rejection rate in India as 5 percent to 10 percent. Majority of the rejections are caused by mistakes or negligence that can be avoided.

The failure to submit the required documents as well as the provision of inaccurate information is one of the most popular causes of rejections.

To be avoided:

Every insurance policy has an exclusion when there are certain specified conditions or treatments that are not covered in the plan.

Common Exclusions:

Tip: First, read the wording of your policy to determine what is not covered.

Not mentioning pre-existing issues (e.g. diabetes, hypertension) at the time of buying the policy may result in an outright denial of claims.

Impact: When such conditions are involved, there is a likelihood of an insurer applying a waiting period (2-4 years).

Pro Tip: Never conceal medical history or it might complicate the situation in the future.

The denial of cashless claims may be faced in case the treatment is taken in a non-partnered hospital because it is not a network partner of the insurer.

Failure to notify the insurer in the required time of hospitalization (typically in a range of 24-48 hours) may lead to the rejection of claims.

Insider Tip: Do not forget to notify your insurer on a timely basis, even during an emergency.

| Step | Process Evaluation |

|---|---|

| 1. | IC Verification - Making sure that all the papers are valid and complete |

| 2. | Policy Check - Is the treatment covered in your policy terms? |

| 3. | Medical Necessity - Did the treatment have to be medically necessary? |

| 4. | Fraud Detection - Conduct a check regarding misrepresentation or false claims |

Insider Tip: Stay in touch with your insurer as you go through the claim process to ensure you give clarifications in due time.

Don’t panic. It is possible to challenge a denied claim.

Did You Know? Once enough documents are furnished to support the claims, many of them are granted after an appeal.

Some of them are clear, and some of them are less popular, although very important:

| Factor | The Importance Of |

|---|---|

| Coverage | It should fit your medical needs (e.g. pre-existing conditions, maternity) |

| Network Hospitals | Make sure that your favored hospitals are listed |

| Claim Settlement Ratio | Select insurers having the ratio of >95 % to be more reliable |

| Customer Reviews | Check customer reviews on claim experience |

Where to Check Claim Ratio? Go to the official website of IRDAI or read the annual report of your insurer.

As a result of incomplete documentation, failure to declare pre-existing conditions and policy exclusions.

Yes, you should present the required papers together with a written explanation to your insurers.

Between 15-30 days depending on the insurer and complexity of the given case.

Indeed, false statements may result in cancellation of policy and legal proceedings.

It can only be covered under the circumstances of an accident, or in particular as covered under a dental rider or policy.

There are plans that cover OPD. Look at your policy or enquire with your insurer.

Knowing what causes health insurance claims to be denied is important in case you want to make sure your policy will not fail at the most critical moment. The difference between approval and rejection can be avoided by taking care of common mistakes such as incomplete paperwork, non-disclosures and lack of understanding of your policy.

Stay informed. Stay insured. And be stress-free when it counts the most.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).