Last updated on: September 19, 2025

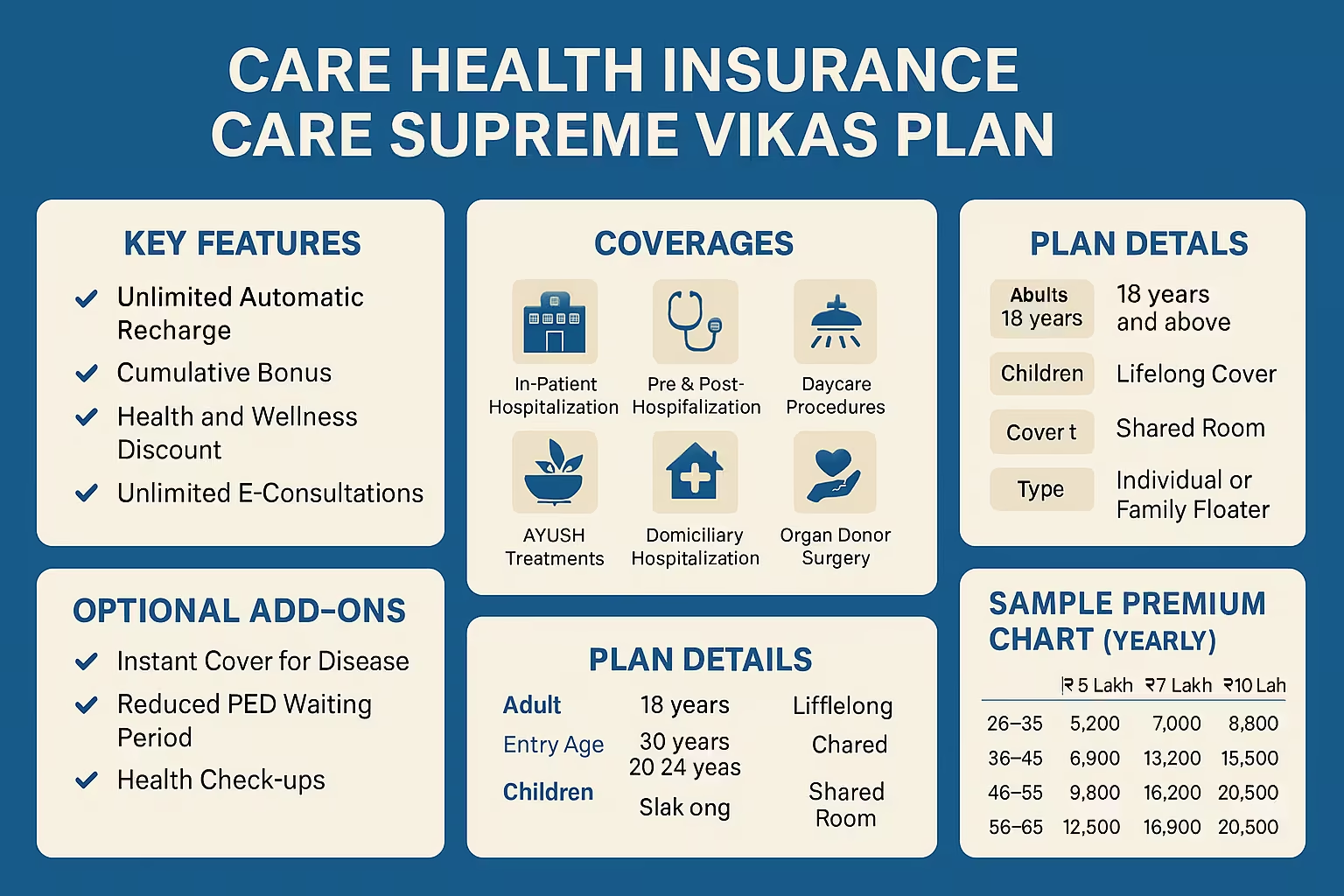

In 2025, rising healthcare costs make affordable coverage essential. The Care Supreme Vikas Health Insurance Plan is built for budget-focused families, young professionals, and anyone seeking solid protection without high premiums. It offers hospitalization cover, AYUSH treatments, cumulative bonus, automatic recharge of sum insured, wellness rewards with up to 30% renewal discounts, unlimited e-consultations, and custom add-ons like reduced waiting periods or mental wellness support.

Come 2025, affordable health security becomes essential, not simply optional. A steadily mounting healthcare burden, coupled with growing health risks, has led Indian families to look for policies that merge adequate coverage with affordable premiums. It is precisely here that the Care Supreme Vikas Plan finds its ideal place.

Conceived as an affordable health coverage, it shields insured members from hospital bills, daycare care, and unforeseen emergencies. Concurrently, it offers some clever bells and whistles, such as automatic premium renewal, claim rewards, wellness incentives, and additional benefits. It remains an economical choice that delivers worth for every rupee spent without skimping on necessary coverage.

Care Supreme Vikas is a straightforward health insurance product designed for individuals seeking robust coverage at affordable premiums. The coverage extends to hospital treatments, surgical expenses, AYUSH therapies, and digital health services as well. The plan suits young professionals, small families, and those who stay budget-conscious and are keen on robust coverage and health rewards.

These are the reasons the Care Supreme Vikas Plan distinguishes itself in 2025:

The plan extends coverage to a wide spectrum of medical treatments and hospital expenditures. The benefits you can expect are as follows:

Even though the plan is extensive, it does leave several items uncovered:

The plan offers more than simple basic coverage. Equipped with potent advantages that allow you to cut costs and keep your coverage intact.

Continuous Automatic Recharge: Each time you exhaust your coverage in one claim, the amount automatically reverts so that you can submit another.

Cumulative Bonus: Each year that you go claim-free, your coverage expands by 50%, to a maximum of 100%.

Claim Shield (Add-on) enables you to pay for routinely excluded items such as gloves, bandages, or surgical instruments.

Health & Wellness Discount: A discount of up to 30% on renewal is available to you if you log at least 10,000 steps every day.

Unlimited E-Consultations: Compatible video or voice appointments with general practitioners are offered free of cost.

Discount Network: Enjoy discounts on medicines, diagnostic tests, and doctor consultations at partner hospitals.

One can customise the plan by opting for the below add-ons:

| Parameter | Description |

|---|---|

| Entry Age (Adults) | 18 years and above |

| Entry Age (Children) | 90 days to 24 years |

| Exit Age (Adults) | Lifelong coverage |

| Exit Age (Children) | Till 25 years |

| Cover Type | Individual and Family Floater (up to 2 adults + 2 children) |

| Tenure Options | 1, 2 or 3 years |

| Room Type | Shared room (minimum 4-bed sharing) |

| Medical Checkup | Not required till age 65 |

| Condition | Waiting Time |

|---|---|

| Initial waiting period | 30 days (except accidents) |

| Named diseases (like hernia, piles) | 24 months |

| Pre-existing conditions | 36 months (can be reduced) |

Here is a sample premium table to give you an idea of what you may pay per year:

| Age Group | ₹5 Lakh Cover | ₹7 Lakh Cover | ₹10 Lakh Cover |

|---|---|---|---|

| 26–35 | ₹5,200 | ₹7,000 | ₹8,800 |

| 36–45 | ₹6,900 | ₹9,300 | ₹11,500 |

| 46–55 | ₹9,800 | ₹13,200 | ₹15,800 |

| 56–65 | ₹12,500 | ₹16,900 | ₹20,500 |

Care Supreme Vikas is especially meant for:

May I add my spouse or child to the policy after its start date?

Yes. The plan permits you to extend coverage mid-way under qualifying circumstances such as marriage or childbirth.

Does this plan cover maternity?

No, maternity coverage or protection for newborns is not included in this plan.

Suppose the total sum insured is used up in a single claim?

The policy receives automatic recharge, which replenishes your sum insured for subsequent claims.

Do I have to undergo a medical checkup?

If you’re under 65 years of age and you are healthy, an additional medical examination is not required.

How can I avail the wellness discount?

Count over 10,000 daily steps with your cell phone or fitness tracker. Every logged active day stands to enlarge your renewal discount—up to 30%.

The Care Supreme Vikas Plan emerges as a sturdy choice for 2025, offering affordability, active wellness support, and flexible add-ons. It melds fundamental coverage with contemporary perks such as recharge, digital health services, and activity-based rewards. Belonging to any tier—whether you’re a young professional, a small family, or a senior citizen—you can expect this plan to deliver the control and care you require.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).