Last updated on: September 19, 2025

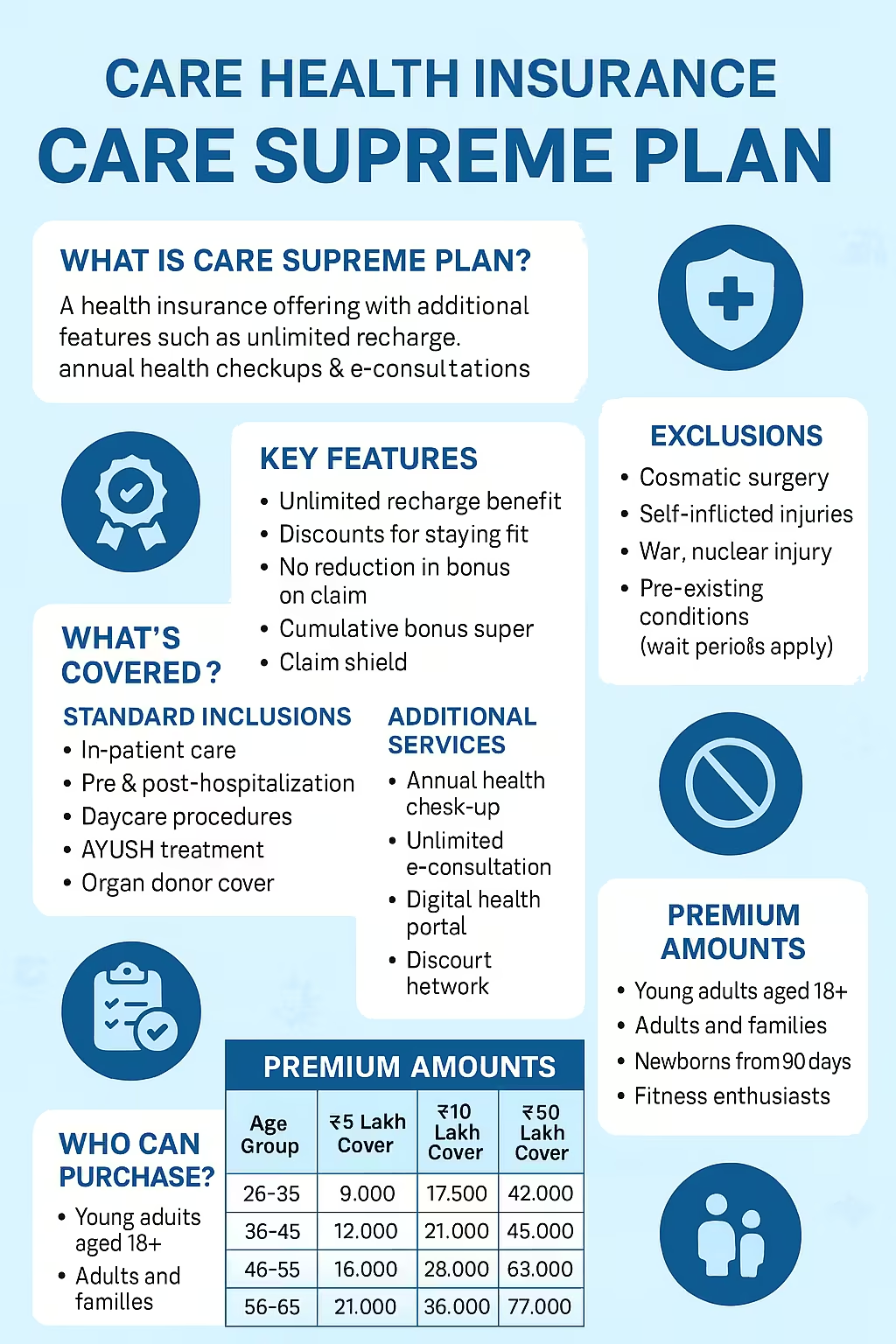

With rising medical costs and lifestyle diseases, families want more comprehensive health cover. The Care Supreme Health Insurance Plan 2025 is designed to meet these needs with high sum insured options, no-claim bonus super benefits, annual health check-ups, unlimited automatic recharge of sum insured, wellness rewards, and coverage for modern treatments like robotic surgeries. It also includes access to over 11,000 cashless hospitals, making it one of the best choices for advanced, family-friendly health insurance.

By 2025, families in India want more advanced healthcare services which are friendlier, exceptionally luxurious, and have supplementary wellness services. Due to a high level of medical inflation, and patients developing more and more lifestyle diseases, it is possible that a standard plan might not suffice. That is where Care Supreme Plan of Care Health Insurance comes in. This plan is not only an applicable plan in terms of coverage but it has also been rewarding healthy lifestyles, taking care of digital wellness and unastronomical value in terms of unlimited recharge with cumulative benefits.

Are you a health-conscious business person, plus, some people may have a modern urban family? Then you should consider the Care Supreme plan (They have add-ons that are light-years beyond a simple health cover).

So how does the plan work, and what does it cover and who is it best suited to, and how much does it cost and why is it a top choice in 2025?

The Care Supreme Plan is an all-purpose health insurance coverage which offers in patient care, pre-hospitalization, post-hospitalization, day-care procedures, home care, and AYUSH / treatment. The difference comes with its additional features such as unlimited automatic recharge; annual health checkups; bonus rewards of healthy habits; e-consultations and lockable super bonus cover.

In other words, it is a plan that has been designed to do more than protecting when one is ill, it is a plan to also support wellness.

That is why thousands are catching up with Care Supreme in 2025:

If you are looking to have health insurance that goes with you before, during, and after an illness, then Care Supreme might be your option.

These are some of the outstanding features, which make Care Supreme better than regular plans:

Automatic Recharge with no limit: In case your sum insured is exhausted, it can automatically be charged. This does not have a restriction and you are able to use this even on either related or unrelated sicknesses.

Cumulative Bonus: With every claim free year, you receive 50 percent cumulative bonus on your sum insured. This can reach 100 percent as a whole and will not decrease even when you claim.

Cumulative Bonus Super (Optional): There is an option of an accelerated bonus, which is 100 per cent of sum insured every claim-free year up to the maximum of 500 per cent.

Claim Shield: 68 non payable items in case of hospitalization are compensated.

Air Ambulance: Covered up to a sum of 5 lakh in a year.

The Care Supreme Plan has both the standard and extended benefits which ensure that you remain financially stable in case of a medical incident. Let us have a look at what is covered:

There are boundaries in every plan. Things not covered by Care Supreme are:

The working details of the plan: Step-by-step.

Step 1: Select your Coverage

You may choose among a large number of sum insured starting at 5 lakhs to 1 crore.

Step 2: Decide the Tenure

Select a one year, two years and three years policy. You are offered discounts on multiyear payments.

Step 3: Premium Payment According to the Zone of the City

Depending on your city of residence you can either be in Zone 1 (Delhi NCR, Mumbai Metro, Gujarat) or Zone 2 (rest of India).

Step 4: Enjoy Benefits

As soon as policy becomes effective, you may use such benefits as e-consultation, check-ups, discounts, etc.

Step 5: Lodge a Claim

The care has a cashless network of hospitals within which one is hospitalised or one is refunded. You will be assisted at all levels by the Care team.

| Age Group | ₹5 Lakh Cover | ₹10 Lakh Cover | ₹25 Lakh Cover | ₹50 Lakh Cover |

|---|---|---|---|---|

| 26–35 | ₹9,000 | ₹17,500 | ₹24,000 | ₹42,000 |

| 36–45 | ₹12,000 | ₹21,000 | ₹29,000 | ₹50,000 |

| 46–55 | ₹16,000 | ₹29,000 | ₹38,000 | ₹63,000 |

| 56–65 | ₹21,000 | ₹36,000 | ₹48,000 | ₹77,000 |

| Condition | Waiting Period |

|---|---|

| Initial Waiting | 30 days (except for accidents) |

| Named Illnesses | 24 months |

| Pre-existing Conditions | 48 months (modifiable with rider) |

The Care Supreme Plan also gives you a chance to customize your coverage with the following add-ons:

There is a lot of people to whom Care Supreme plan can be suitable:

Self, spouse, livein partner, same-resex partner, son, daughter, parents, inlaws, grandparents.

Health insurance in the year 2025 does not concern merely hospital bills. Care Supreme is advertising proactive, proactive health with:

The Care Supreme Plan encompasses a very strong yet versatile health insurance product that does not only cover but also rewards you of being healthy. It is optimal to the families and individuals that would like to have the entire control on their healthcare path without any fiscal anxiety.

Irrespective of whether you want a basic plan with comprehensive cover or an added wellness enhancement, in Care Supreme you get both.

Is it possible to buy additional perks after getting the product?

Yes, you are also allowed to add riders in renewal.

Does it cover maternity and new born care?

Not, on this plan. In the case of maternity, look at specialist Care plans.

Am I going to enjoy tax benefits?

Yes, as per the Exemption of Section 80D of the Income Tax Act.

What is the process of renewal?

You will have email and SMS alerts. Online renewal is easy.

Am I able to transfer a policy?

Yes, it is permissible to transfer it on the basis of IRDAI rules.

Indian health insurance practitioners, medical researchers, and web-based authors are the ones who have created this handbook so that the Indian families can get down to point when talking of the Care Supreme Plan. We examined 2025 product operations, claim experiences, and example of usages to ensure that it assists the NRIs, professionals, and travellers. It does not matter you belong to the category of young adults, parent, corporate individual or a senior citizen, as you read on this article will encourage you to make an informed decision about global health coverage confidently.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).