Last updated on: September 19, 2025

With medical expenses climbing ever higher in India, senior citizens end up as one of the most susceptible groups when confronted with health emergencies. Upon retirement, one gradually experiences a constriction of income, while health risks rise. In 2025, Care Health Insurance will back Indian seniors with a customized senior citizen health insurance plan. The plan empowers retirees and elderly persons to face hospital stays, extended care, and medical complications with assurance and financial protection.

This guide will outline every detail of Care Senior Health Insurance—how the policy works, what is covered, its cost, the benefits and exclusions, and who ought to purchase it. It will enable Indian families to make an informed health choice for their parents or themselves.

Care Health Insurance’s Senior Citizen Plan is a specialized health coverage availed by individuals above 61 years of age. The policy provides hospitalization expenses, pre- and post-hospital outlays, annual check-ups, and a range of designated day-care treatments. The plan is specifically designed to manage age-related illnesses such as diabetes, heart disease, arthritis, and cataracts, all while sparing the family from any financial burden.

Care Health Insurance (formerly known as Religare Health Insurance) has devised the plan; the company is highly respected in India for its broad hospital network, outstanding customer support, and prompt claim processing.

As one advances in age, the number of health problems experienced likewise rises. Seniors tend to need routine checkups, diagnostic evaluations, surgical procedures, and emergency medical assistance. Conventional plans may not afford sufficient coverage or could impose multiple restrictions for senior citizens. Here are the reasons that justify having a dedicated senior plan:

Costs for medical treatment escalate after the age of 60.

A heightened likelihood of hospitalization because of chronic disorders

Existing ailments such as BP and diabetes are compensated only after a specified waiting period.

Quick claim approvals for senior citizens

Thus, during an emergency, one need not rely on children or relatives.

The policy provides coverage for virtually every major medical expense that India’s seniors are likely to incur. The insurer will finance expenses from consultation through surgery, up to the sum insured.

In-patient Hospitalization: All costs for the full hospital stay, including room rent, nursing, surgery, and medicinal expenses.

Pre Hospitalization–Up to thirty days; Post Hospitalization–Up to sixty days

Daycare Treatments: More than 500 procedures, including dialysis, chemotherapy, and cataract.

Annual Health Check-up: Every insured person receives a complimentary yearly health assessment.

Ambulance Cover: Cost of conveyance in an ambulance is capped at a predetermined limit per hospital stay.

Alternative Therapies: AYUSH interventions (Ayurveda, Unani, Homeopathy, etc.)

Domiciliary Hospitalization: If the patient receives treatment at home for a period of three days or more.

Organ Donor Expenses: Expenditures connected to the treatment of the donor

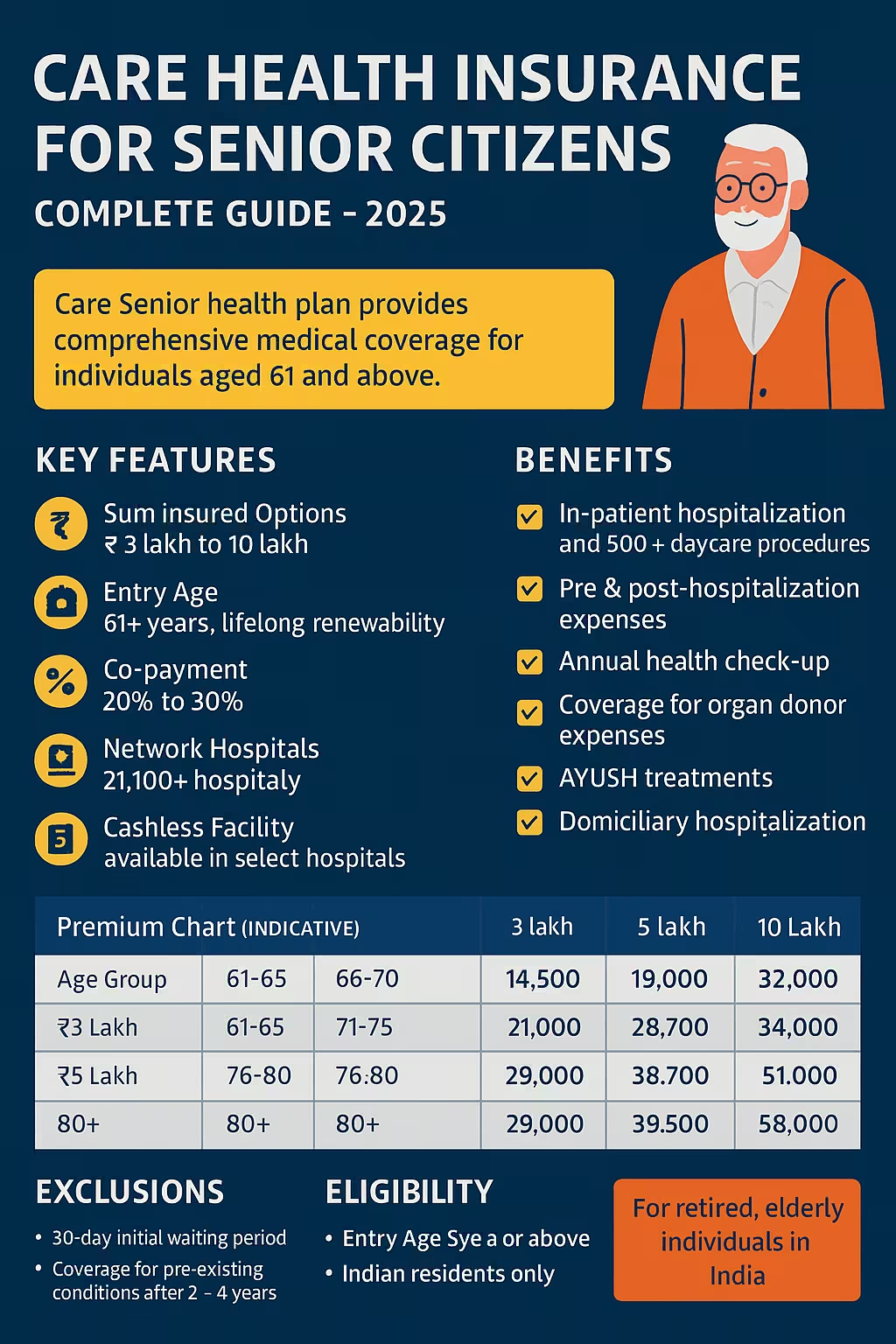

| Feature | Description |

|---|---|

| Sum Insured Options | ₹3 Lakh to ₹10 Lakh |

| Entry Age | 61 years to lifelong renewability |

| Network Hospitals | 21,100+ across India |

| Cashless Facility | Available in major hospitals |

| Co-payment Clause | 20% – 30% for all claims (depends on age) |

| Pre-existing Diseases | Covered after 2–4 years waiting period |

| Free Health Check-up | Once per policy year |

| Tax Benefits | Available under Section 80D |

| Domiciliary Coverage | Yes, as per medical advice |

Step 1 – Pick Your Plan

Opt for a sum assured in line with the medical histories of both you and your parents. You may opt for additional benefits such as the no-claim bonus or raise the room-rent allowance.

Step 2 – Send the Proposal

Kindly submit your KYC, age-proof documents, and the medical declaration. At times, a medical examination may be necessary.

Step 3 – Policy Issuance

After approval, the policy is issued in a span of 24–48 hours. The e-policy is forwarded to your email immediately.

Step 4 – While in Hospital

When confined to a network hospital, avail the cashless service. Else, settle the bill first and submit the claim later.

Step 5 – Claim Settlement

Upload online all bills, discharge summary, and other related documents. The claim is generally settled within seven to ten working days.

Much like any other insurance, this plan is subject to certain exclusions and restrictions.

Waiting Periods:

Permanent Exclusions:

The policy has been designed for:

Eligibility Criteria:

Age: 61 years or above

The maximum age limit does not apply.

Eligible only for Indian Residents

| Age Group | ₹3 Lakh Cover | ₹5 Lakh Cover | ₹10 Lakh Cover |

|---|---|---|---|

| 61–65 | ₹14,500 | ₹19,000 | ₹32,000 |

| 66–70 | ₹17,800 | ₹24,500 | ₹38,000 |

| 71–75 | ₹21,000 | ₹28,700 | ₹44,000 |

| 76–80 | ₹25,500 | ₹33,900 | ₹51,000 |

| 80+ | ₹29,000 | ₹39,500 | ₹58,000 |

Note: Premium may vary based on city, health condition, and optional add-ons.

| Feature | Care Senior Plan | Regular Plan (Adults) | Travel Insurance |

|---|---|---|---|

| Entry Age | 61+ years only | 18–60 years | No age bar |

| Waiting for Pre-Existing | 2–4 years | 1–3 years | Not Covered |

| Co-payment Clause | Yes (mandatory) | Optional | NA |

| Cashless Hospitals | Yes (select) | Yes | No |

| Annual Check-up | Included | May be optional | No |

| AYUSH Coverage | Yes | Yes | No |

Mrs. Lakshmi Iyer, 68 years, Chennai

Renewal: One can renew for the entire life of the policy irrespective of age.

Portability: Procedures can be carried out under IRDAI rules to move from another insurer to Care.

Bonus: Claim-free years entitle you to a no-claim bonus capped at 50% every annum.

Add-ons: You can opt for optional covers such as room rent waiver and no co-payment.

Does this policy extend coverage for my pre-existing diabetes and BP?

Yes, you need to serve a waiting period of 2–4 years, depending on which plan version you choose.

Do I have to undergo a health check before purchasing?

Generally, the answer is yes. For seniors, a minimal health examination must be undertaken before the policy is issued.

Is it permitted to pay the premium through EMI?

Yet, options for premium payments—whether monthly, quarterly, or half-yearly—are provided.

Is it possible to purchase this plan for my parents who are above 75?

Yes. Care extends coverage to 80+ years and sets no upper age limit.

Will it reimburse surgeries such as cataract or knee replacement?

Yes, though any cover will be subject to a 2–4 year waiting period, depending on the procedure involved.

By 2025, Care Health Insurance for Senior Citizens stands out as among the most thoughtfully crafted offerings in India’s health insurance landscape. Whether your parents grapple with diabetes, arthritis, or age-related surgeries, the plan will lessen your stress and ensure their medical security.

To Indian families, this policy serves not simply as a financial instrument; rather, it provides them with the serenity they need in their golden years.

Take the step today. Easily compare, purchase, and renew Care Senior Plans on fincover.com and grant your parents the care they deserve.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).