Last updated on: September 19, 2025

Aditya Birla Activ Health Platinum – Premiere is a premium health insurance plan designed for individuals who demand top-tier coverage. It offers worldwide hospitalization, cashless claims across India, unlimited sum insured reloads, and 100% premium-back rewards through HealthReturns. The plan also covers OPD, dental consultations, mental wellness, robotic surgeries, and chronic conditions from day one. Built for urban professionals, frequent travelers, and health-conscious families, it ensures peace of mind with modern healthcare support in 2025 and beyond.

If you consider that your health merits more than merely a basic policy, the Aditya Birla Activ Health Platinum – Premiere Plan is just what you need. It goes beyond boat-like insurance: this world-class coverage plan rewards your lifestyle, aids in achieving your health goals, and bolsters you wherever in the world life takes an unexpected detour.

Needless to say, this plan delivers a holistic 360° coverageruning the gamut from inpatient hospitalization and international care to wellness coaching, dental assessments, and mental health support as well.

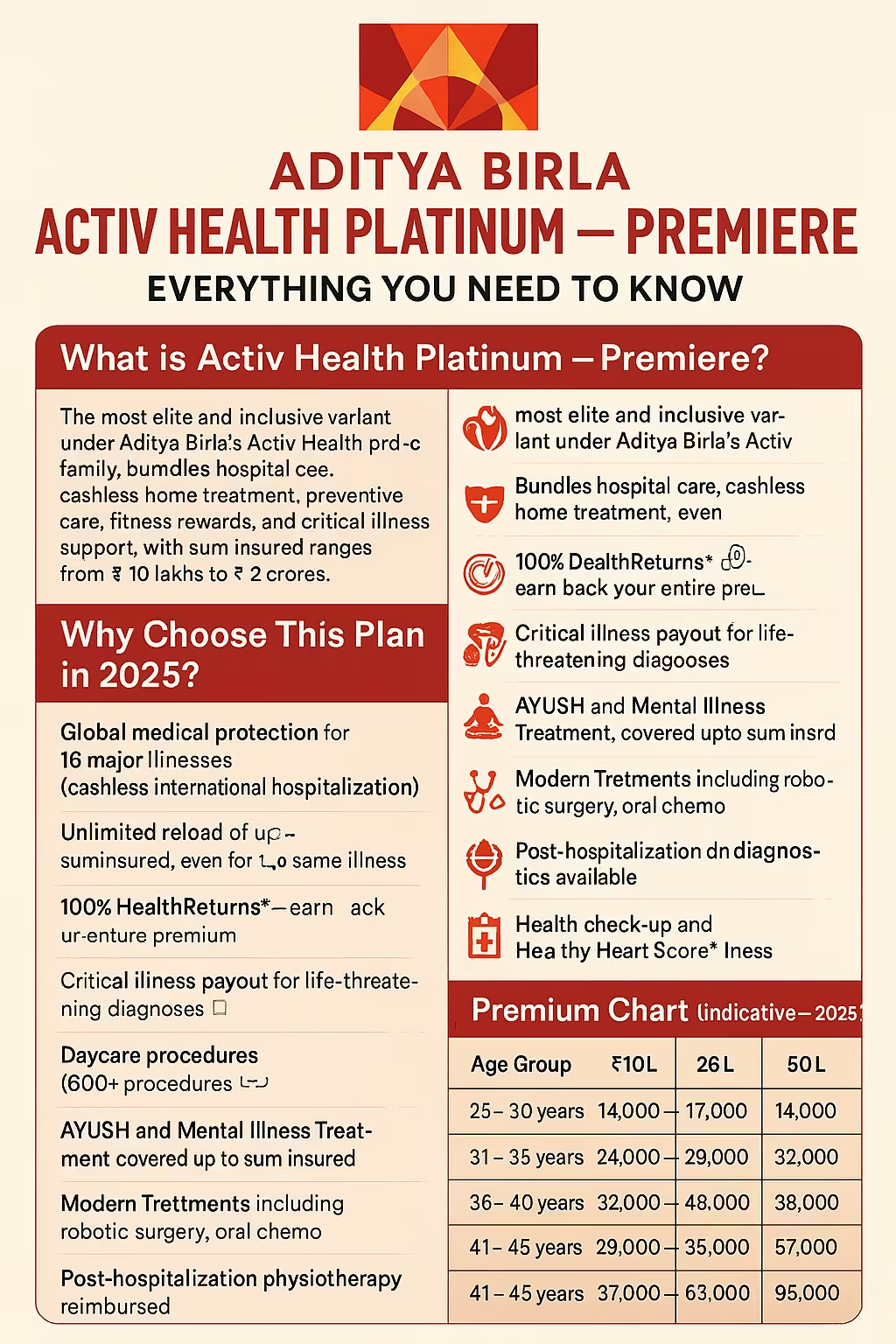

Inside Aditya Birla’s Activ Health product family, Platinum – Premiere stands out as their supremest and most comprehensive health insurance option in 2025. Designed for individuals and families who value extensive healthcare coverage in India and overseas, the policy wraps together hospitalization, cashless home treatment, preventive care, fitness incentives, and critical illness protection into a single dynamic coverage.

Granting a sum-insured scale of ₹10 lakhs to ₹2 crores, this plan perfectly suits high-net-worth individuals, urban families, and global professionals who will not compromise on their health.

The Platinum Premiere Plan offers one of the widest spectrums of coverages available in the industry today. This is what it covers:

Yet, for a policy that spans such a wide spectrum, some exclusions are still in place, as is customary for all insurance policies.

This plan is ideal for:

| Age Group | ₹10L Sum Insured | ₹25L Sum Insured | ₹50L Sum Insured | ₹1 Cr Sum Insured |

|---|---|---|---|---|

| 25 – 30 years | ₹14,000 – ₹17,000 | ₹24,000 – ₹29,000 | ₹32,000 – ₹38,000 | ₹44,000 – ₹52,000 |

| 31 – 35 years | ₹15,500 – ₹18,500 | ₹26,000 – ₹31,000 | ₹35,000 – ₹41,000 | ₹48,000 – ₹56,000 |

| 36 – 40 years | ₹17,000 – ₹20,000 | ₹28,000 – ₹34,000 | ₹38,000 – ₹45,000 | ₹52,000 – ₹60,000 |

| 41 – 45 years | ₹19,000 – ₹23,000 | ₹31,000 – ₹38,000 | ₹42,000 – ₹49,000 | ₹57,000 – ₹65,000 |

| 46 – 50 years | ₹22,000 – ₹26,500 | ₹35,000 – ₹43,000 | ₹47,000 – ₹56,000 | ₹63,000 – ₹72,000 |

| 51 – 55 years | ₹25,000 – ₹29,500 | ₹39,000 – ₹48,000 | ₹53,000 – ₹62,000 | ₹70,000 – ₹80,000 |

| 56 – 60 years | ₹28,000 – ₹33,500 | ₹43,000 – ₹52,000 | ₹58,000 – ₹68,000 | ₹77,000 – ₹88,000 |

Yes. Upon diagnosis of one of the 16 specified illnesses, you can avail hospitalization abroadup to ₹3 Cr or ₹6 Cr, depending on the variant you choose.

Yes. Both hospitalization for mental health conditions and dental consultations/investigations carried out at our partner facilities are covered.

No. The Super Reload is uncapped, and it can even be utilized for the same illness.

You can secure a No Claim Bonusan additional 50% coverage every year that can rise to 100% in totalwhile still earning HealthReturns™.

Yes. The policy benefits cover OPD expenses and physiotherapy sessions undertaken after hospital discharge.

Aditya Birla Activ Health Platinum – Premiere Plan goes beyond being a mere health policyit puts together a comprehensive healthcare ecosystem. It bolsters your wellness, absorbs hefty out-of-pocket expenses, and adjusts to your changing needs. Be it incentivising your healthy habits or guaranteeing access to world-class medical care, the plan stands true to its role as a genuine health partner.

For those who refuse to compromisethe plan delivers value, vision, and versatility in a single premium bundle.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).