Last updated on: September 19, 2025

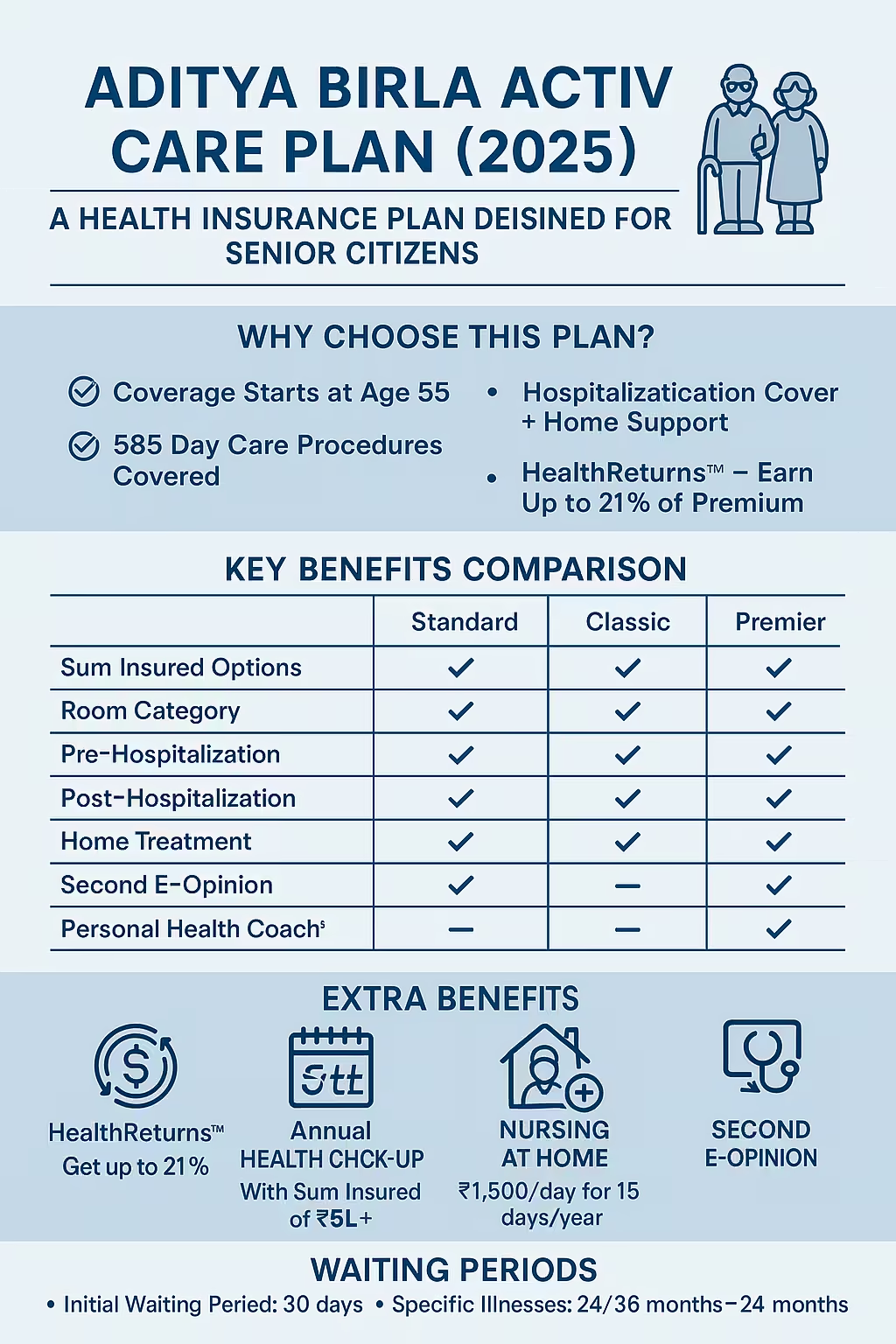

Aditya Birla Activ Care Plan 2025 is designed for senior citizens aged 55–80. It offers hospitalization cover, home treatment, nursing care, health coaching, and HealthReturns™ rewards. With variants like Standard, Classic, and Premier, this plan ensures cashless treatment at 11,000+ hospitals, annual health check-ups, and support for chronic conditions. Ideal for elderly individuals, NRIs securing parental care, and retirees seeking health support with comfort and dignity.

Safeguarding our parents’ health is more than just about the bills for hospital care. Having them feel at ease, toward recovery, and in the care of dedicated professionals — just as you would. That is the assurance of the Aditya Birla Activ Care Plan—thoughtfully fashioned for seniors in 2025.

Whether you are looking after elderly parents or preparing for your own medical needs after 55, this plan delivers a total holistic package—including daycare services, at-home treatments, nursing care, cutting-edge digital wellness tools, and incentives for staying active.

Activ Care is an Aditya Birla Health Insurance health plan expressly tailored for individuals age 55 and over. More than just a safety net, it—quite simply—is a lifestyle-oriented solution. From hospitalization support and routine medical check-ups to post-hospital recovery aids, the plan has your needs fully covered.

Presented in three tiers—Standard, Classic, and Premier—the plan affords you the flexibility you need when matching healthcare requirements to your budget.

Traditionally, health insurance only steps in when something goes wrong. However, with Activ Care, you’re also rewarded for doing things right.

Do the Health Assessment, be active at least 13 days a month, and you can earn up to 21% of your premium back. The better you look after your health, the bigger the rewards.

You may employ these rewards to:

This policy offers more than hospitalization coverage alone. It is intended to help your loved ones at every phase—from treatment to recovery, and even in day-to-day lifestyle management.

Among the major features are:

Here is an approximate premium range based on sum insured and plan type. These premiums are indicative and may vary based on health declaration, co-pay, and tenure options.

| Sum Insured | Standard Plan (55-60 yrs) | Classic Plan (55-60 yrs) | Premier Plan (55-60 yrs) |

|---|---|---|---|

| ₹3 Lakhs | ₹11,000 – ₹13,500 | ₹13,000 – ₹16,000 | ₹16,500 – ₹19,000 |

| ₹5 Lakhs | ₹13,500 – ₹16,500 | ₹17,000 – ₹20,000 | ₹21,000 – ₹25,000 |

| ₹10 Lakhs | Not Available | ₹25,000 – ₹30,000 | ₹30,000 – ₹35,000 |

| ₹25 Lakhs | Not Available | Not Available | ₹45,000 – ₹55,000 |

The plan suits the following:

Is this policy meant only for people who already suffer from illnesses?

By no means. Even healthy seniors find it perfectly suited for them. Even so, it delivers excellent support should any illness emerge.

Is it possible to purchase the plan for my parents, who are more than seventy years old?

Yes. Coverage can be taken up till the age of 80.

Do I have to undergo a medical test?

In most cases, it is not required.

Do OPD consultations fall under the policy?

Indeed, discounts are offered through the partner network, and the Classic and Premier variants provide specific coverage.

How might I make use of HealthReturns?

Put it toward your next premium payment, use it to buy medications, or reserve it for unexpected emergencies.

By 2025, the Aditya Birla Activ Care Plan will be recognized as a dependable and all-inclusive health cover for senior citizens. It’s not only about hospitalization costs; it is about comfort, accessibility, recovery, and rewards too. It meets contemporary needs, recognises family obligations, and turns the journey to staying healthy into a rewarding experience.

Be it a working professional looking after aging parents, a senior couple seeking additional independence, or an NRI seeking coverage from overseas, this plan integrates protection, convenience, and digital empowerment into a single noteworthy decision.

How could we improve this article?

Written by Prem Anand, a content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors.

Prem Anand is a seasoned content writer with over 10+ years of experience in the Banking, Financial Services, and Insurance sectors. He has a strong command of industry-specific language and compliance regulations. He specializes in writing insightful blog posts, detailed articles, and content that educates and engages the Indian audience.

The content is prepared by thoroughly researching multiple trustworthy sources such as official websites, financial portals, customer reviews, policy documents and IRDAI guidelines. The goal is to bring accurate and reader-friendly insights.

This content is created to help readers make informed decisions. It aims to simplify complex insurance and finance topics so that you can understand your options clearly and take the right steps with confidence. Every article is written keeping transparency, clarity, and trust in mind.

Based on Google's Helpful Content System, this article emphasizes user value, transparency, and accuracy. It incorporates principles of E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness).