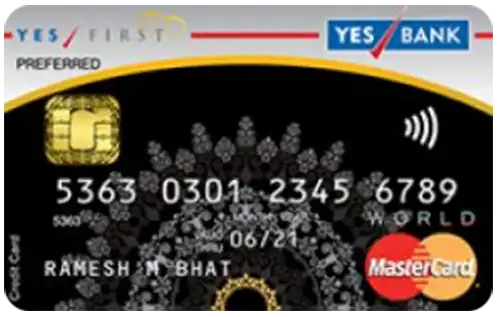

YES First Preferred Credit Card

Enter the world of rewarding experiences with the YES First Preferred Credit Card. This feature-rich card is guaranteed to elevate your lifestyle

Features and Benefits of YES First Preferred Credit Card

- Accelerated Rewards: Enjoy bonus reward points on joining, renewal, and reaching spending milestones. Additional 2X Reward Points Gain 16 reward points on every ₹200 spent on travel and dining, up to ₹3,000 per statement cycle. Additionally, earn 8 reward points on all other categories.

- Travel Privileges: Access complimentary domestic and international airport lounges with Priority Pass membership. 4 complimentary airport lounge visits per calendar year and 2 complimentary lounge visits per quarter in India

- Complimentary Golf Services: 1 golf lesson every calendar month and 4 additional sessions with green fee waiver at select golf courses in India

- Insurance Coverage: Credit Shield cover of 8 Lac, Lost Card liability cover of 8 Lac

Quick Loan

Get a loan upto the credit card limit to fulfil immediate loan requirements

Express Loan

Get a pre-approved loan at an attractive interest rate on your YES BANK Credit Card

YES First Preferred Credit Card – Fees, Charges & Eligibility

Fees and Charges

| Fee/Charge | Amount |

|---|---|

| Annual Fee (1st Year) | ₹999 + taxes (waived on spending ₹50,000 within 90 days) |

| Annual Fee (Renewal) | ₹999 + taxes (waived on spending ₹2.5 lakh in the previous year) |

| Interest Rate | 3.80% per month (45.6% annually) on revolving credit & cash advances |

| Cash Advance Fee | 2.5% of the withdrawn amount (minimum ₹300) |

| Over Limit Fee | 2.5% of the over-limit amount (minimum ₹500) |

| Foreign Currency Markup | 3.5% |

| Late Payment Fee | Based on outstanding balance (starting from ₹150) |

| Add-on Card Fee | Free (up to 3 cards) |

| Duplicate Statement Fee | ₹100 per statement |

Eligibility Criteria

| Criteria | Details |

|---|---|

| Age | 21 to 60 years |

| Occupation | Salaried or Self-employed |

| Minimum Income (Salaried) | ₹2 lakh net salary per month |

| Minimum Income (Self-employed) | ITR of at least ₹24 lakh OR FD of ₹3 lakh with YES Bank |

Documents Required

| Document Type | Examples |

|---|---|

| Identity Proof | PAN Card (mandatory) |

| Address Proof | Passport, Utility Bill, Ration Card, Driving License, etc. |

| Income Proof | Salary Slip / Form 16 / ITR (as applicable) |

| Photograph | Recent passport-size color photograph |

How to Apply for YES First Preferred Credit Card?

- Click the Apply button under the YES First Preferred Credit Card section.

- Fill out the online application and upload the required documents.

- Once submitted, you’ll receive an acknowledgement number.

- Track your application status online anytime.

FAQ – YES First Preferred Credit Card

Q: What are reward points worth?

A: Reward points can be redeemed for a wide range of products, gift vouchers, and travel services via the YES Bank rewards platform. Conversion rates may vary by option.

Q: How do I access airport lounges?

A: The card offers complimentary Priority Pass Membership enabling access to select domestic and international lounges.

Q: What travel insurance is included?

A: The card provides overseas medical cover and air accident insurance. Refer to the card’s terms for specific limits and conditions.

Q: Is there a foreign currency markup fee?

A: Yes, a 3.5% foreign currency markup applies to all international transactions.

Q: How do I apply for the YES First Preferred Credit Card?

A: Apply directly through the YES Bank Website or via trusted partners like Fincover for easy processing.